How to Claim Farm Wineries and Vineyards Tax Credit Form 2013

What is the How To Claim Farm Wineries And Vineyards Tax Credit Form

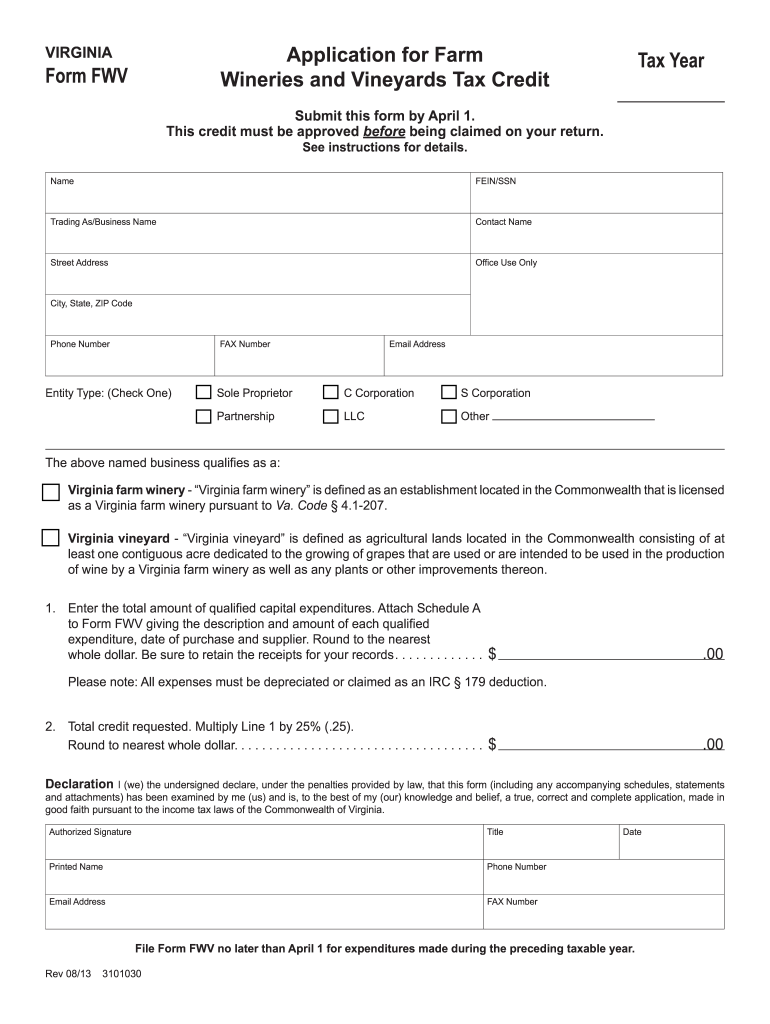

The How To Claim Farm Wineries And Vineyards Tax Credit Form is a specific tax form designed for farmers and vineyard owners in the United States to claim tax credits related to their agricultural activities. This form allows eligible taxpayers to report their income and expenses associated with operating a winery or vineyard, ensuring they receive the appropriate tax benefits. Understanding this form is crucial for maximizing potential tax savings and complying with IRS regulations.

How to use the How To Claim Farm Wineries And Vineyards Tax Credit Form

Using the How To Claim Farm Wineries And Vineyards Tax Credit Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax records. Next, fill out the form carefully, providing detailed information about your winery or vineyard operations. After completing the form, review it for accuracy before signing and submitting it to the IRS. Utilizing a digital solution can streamline this process, making it easier to complete and eSign the form securely.

Steps to complete the How To Claim Farm Wineries And Vineyards Tax Credit Form

Completing the How To Claim Farm Wineries And Vineyards Tax Credit Form involves a systematic approach. Follow these steps:

- Gather all relevant financial documents, including income and expense records.

- Access the form online or obtain a physical copy.

- Fill in your personal and business information accurately.

- Detail your income from winery or vineyard operations.

- List all eligible expenses to maximize your tax credit.

- Review the form for any errors or omissions.

- Sign the form electronically or by hand, then submit it to the IRS.

Eligibility Criteria

To qualify for the benefits associated with the How To Claim Farm Wineries And Vineyards Tax Credit Form, certain eligibility criteria must be met. Generally, the applicant must be actively engaged in farming or vineyard operations, generating income from these activities. Additionally, the winery or vineyard must meet specific production thresholds and adhere to state regulations governing agricultural practices. It is essential to review these criteria thoroughly to ensure compliance and eligibility for the tax credit.

Required Documents

When completing the How To Claim Farm Wineries And Vineyards Tax Credit Form, several documents are required to substantiate your claims. These include:

- Income statements reflecting revenue generated from winery or vineyard sales.

- Expense receipts for operational costs, such as equipment, labor, and materials.

- Tax returns from previous years to provide context for your current financial situation.

- Any relevant licenses or permits required for operating a winery or vineyard in your state.

Form Submission Methods

The How To Claim Farm Wineries And Vineyards Tax Credit Form can be submitted through various methods, ensuring flexibility for taxpayers. Options include:

- Online submission through the IRS e-filing system, which allows for quick processing.

- Mailing a physical copy of the completed form to the designated IRS address.

- In-person submission at local IRS offices, providing an opportunity for immediate assistance.

Quick guide on how to complete how to claim farm wineries and vineyards tax credit 2013 form

Your assistance manual on how to prepare your How To Claim Farm Wineries And Vineyards Tax Credit Form

If you’re wondering how to finalize and submit your How To Claim Farm Wineries And Vineyards Tax Credit Form, here are several concise guidelines to simplify the tax submission process.

To get started, simply create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document platform that allows you to modify, generate, and finalize your tax forms with ease. With its editor, you can alternate between text, checkboxes, and electronic signatures while having the ability to revise responses as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and easy sharing options.

Follow the steps below to finish your How To Claim Farm Wineries And Vineyards Tax Credit Form in just a few minutes:

- Set up your account and begin working on PDFs in no time.

- Utilize our directory to locate any IRS tax document; peruse through various versions and schedules.

- Click Get form to access your How To Claim Farm Wineries And Vineyards Tax Credit Form in our editor.

- Complete the necessary fillable sections with your information (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-recognized eSignature (if required).

- Examine your document and rectify any inaccuracies.

- Save modifications, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can increase errors on returns and prolong refunds. Certainly, before e-filing your taxes, review the IRS website for filing guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct how to claim farm wineries and vineyards tax credit 2013 form

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

I haven't filled the tax forms for 2011, 2012, and 2013 and Glacier Tax Preparation only allows me to do so for 2014. I entered the USA in 2011. How can I file those now?

I don't think you can file taxes for 2011 and 2012 this year.But as you did not have any income in those two years. It is fine even if you dont file taxes.Study how to file taxes, how to determine residency status and which forms you should submit when you are in F1 VisaF1(CPT, OPT), J1, M1 Visa tax returns filing : All information IRS wants you to know - Grad Schools BlogThough I am not expert in tax laws, I figured this from my case and few other friends.

-

I can't figure out if I should claim 1 dependent or 2 dependents on my W-4 tax form. When and how do you make changes to your W-4 tax form after having children?

OK, first off I’m going to say *IGNORE* the instructions on the updated W-4 form. It’s not worth anything. And yes, I’ve seen and followed the directions, which are wildly inaccurate and misleading.Here’s how exemptions and the W-4 work.As of last year, per the Tax Cuts and Job Act, you can NO LONGER, claim yourself as a dependent/exemption. You can, if you are married, no longer claim your spouse as a dependent/exemption.IF you have minor children (Age 19 and under) you *MAY* claim one exemption per child. IF you have a child, enrolled ‘full time in school’ who is age 24 or under, and that schooling is College, Trade School, Vo-Tech, etc and NOT primary education (IE High School education, GED classes, etc) you may claim an exemption for them.So simple example. Jack and Jane Darling are married. They have one child born June 1st.From January to June, Jack and Jane can *ONLY* claim ZERO EXEMPTIONS on their W-4. From June 1st, when the child is born, on wards, they can each claim ONE Exemption on their W-4.Hopefully that helps and simplifies it down. And yes, I’m a tax preparer as well. I spent all of last year warning various clients and I’m doing the same this year, along with explaining how many you can *legally* claim on your W-4.

Create this form in 5 minutes!

How to create an eSignature for the how to claim farm wineries and vineyards tax credit 2013 form

How to make an electronic signature for your How To Claim Farm Wineries And Vineyards Tax Credit 2013 Form online

How to create an eSignature for the How To Claim Farm Wineries And Vineyards Tax Credit 2013 Form in Google Chrome

How to create an eSignature for putting it on the How To Claim Farm Wineries And Vineyards Tax Credit 2013 Form in Gmail

How to make an electronic signature for the How To Claim Farm Wineries And Vineyards Tax Credit 2013 Form straight from your smartphone

How to generate an electronic signature for the How To Claim Farm Wineries And Vineyards Tax Credit 2013 Form on iOS devices

How to generate an electronic signature for the How To Claim Farm Wineries And Vineyards Tax Credit 2013 Form on Android

People also ask

-

What is the Farm Wineries and Vineyards Tax Credit Form?

The Farm Wineries and Vineyards Tax Credit Form is a document that allows eligible wineries and vineyards to claim tax credits for certain expenses incurred in farming operations. Knowing how to claim the Farm Wineries and Vineyards Tax Credit Form can signNowly reduce tax burdens and support business growth in the agricultural sector.

-

How can airSlate SignNow help me with the Farm Wineries and Vineyards Tax Credit Form?

airSlate SignNow streamlines the process of completing and signing the Farm Wineries and Vineyards Tax Credit Form. With our easy-to-use platform, you can quickly fill out the form, eSign it, and send it securely to the relevant authorities, ensuring a hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the tax credit form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions allow you to efficiently manage the Farm Wineries and Vineyards Tax Credit Form without breaking the bank, with the flexibility to choose a plan that suits your requirements.

-

What features does airSlate SignNow offer for managing tax credit forms?

airSlate SignNow provides a range of features including customizable templates, automated workflows, and secure eSigning capabilities. These features make it easier to handle the Farm Wineries and Vineyards Tax Credit Form, ensuring accuracy and compliance while saving you time and effort.

-

Can I integrate airSlate SignNow with other software for tax credit management?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, including accounting and document management systems. This integration enhances your ability to manage the Farm Wineries and Vineyards Tax Credit Form and keep all your financial records organized.

-

How secure is my information when using airSlate SignNow for tax forms?

Security is a top priority at airSlate SignNow. When you use our platform to manage the Farm Wineries and Vineyards Tax Credit Form, your data is protected with encryption and secure storage, ensuring that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for tax credit forms?

Using airSlate SignNow for your Farm Wineries and Vineyards Tax Credit Form offers numerous benefits, including improved efficiency, reduced processing time, and enhanced accuracy. Our platform simplifies the entire document management process, allowing you to focus more on your business operations.

Get more for How To Claim Farm Wineries And Vineyards Tax Credit Form

Find out other How To Claim Farm Wineries And Vineyards Tax Credit Form

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement