MI GR 1040NR Form 2022

What is the MI GR 1040NR Form

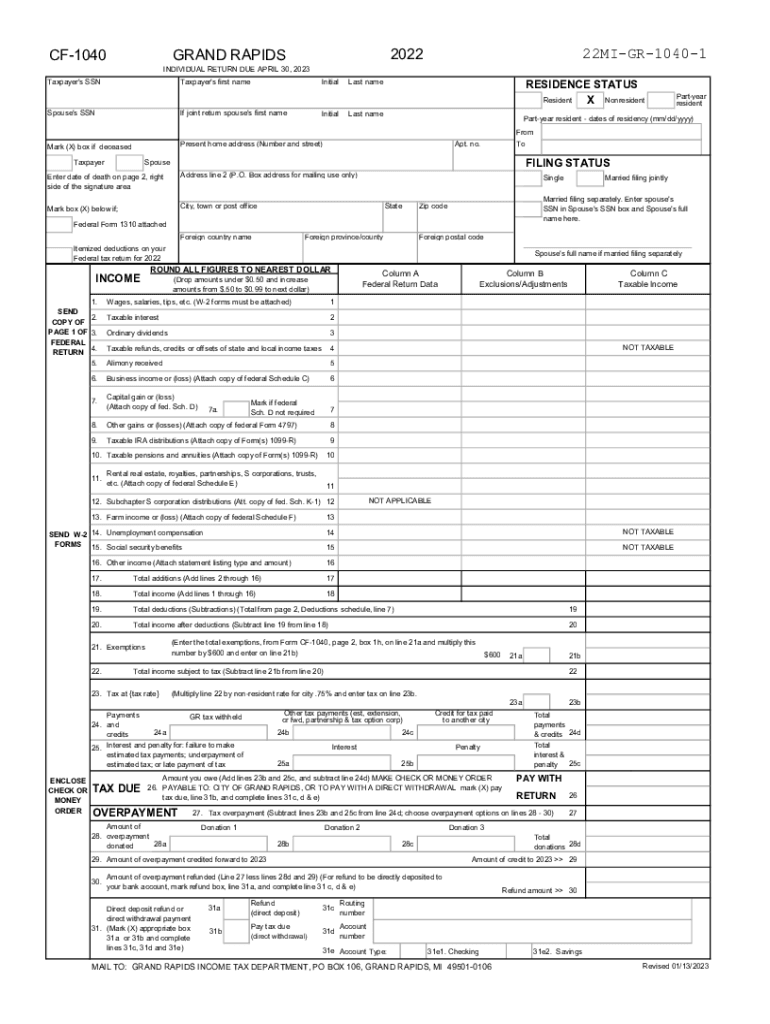

The MI GR 1040NR Form is a state tax return specifically designed for non-residents who earn income in Grand Rapids, Michigan. This form allows individuals who do not reside in Michigan but have taxable income sourced from the state to report their earnings accurately. Understanding the purpose of this form is essential for compliance with state tax laws and ensuring that all income is reported correctly.

How to use the MI GR 1040NR Form

Using the MI GR 1040NR Form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by providing personal information, income details, and applicable deductions. After completing the form, review it for accuracy before submitting it to the Michigan Department of Treasury. Utilizing digital tools can streamline this process, making it easier to fill out and sign the form electronically.

Steps to complete the MI GR 1040NR Form

Completing the MI GR 1040NR Form requires careful attention to detail. Follow these steps:

- Gather all income documents, including any federal tax forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income earned in Michigan and any applicable deductions.

- Calculate your tax liability based on the income reported.

- Sign and date the form, ensuring all information is accurate.

By following these steps, you can ensure that your Grand Rapids tax return is completed correctly and submitted on time.

Legal use of the MI GR 1040NR Form

The MI GR 1040NR Form is legally binding when completed and submitted according to Michigan state tax regulations. To ensure its validity, the form must be signed by the taxpayer, and all information must be truthful and accurate. Non-compliance with the filing requirements can result in penalties, making it crucial to adhere to the legal guidelines associated with this form.

Filing Deadlines / Important Dates

Filing deadlines for the MI GR 1040NR Form typically align with federal tax deadlines. Generally, the form must be submitted by April fifteenth of the following year after the tax year ends. It is important to stay informed about any changes to these deadlines, as extensions may be available under specific circumstances. Marking these dates on your calendar can help ensure timely submission.

Required Documents

To complete the MI GR 1040NR Form, certain documents are required. These include:

- W-2 forms from employers for income earned in Michigan.

- 1099 forms for any freelance or contract work.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother filing process and help ensure that all income is accurately reported.

Quick guide on how to complete mi gr 1040nr form

Effortlessly prepare MI GR 1040NR Form on any device

The management of documents online has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage MI GR 1040NR Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Edit and eSign MI GR 1040NR Form with ease

- Find MI GR 1040NR Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you would like to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign MI GR 1040NR Form to ensure effective communication at any stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi gr 1040nr form

Create this form in 5 minutes!

How to create an eSignature for the mi gr 1040nr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with my grand rapids tax return?

airSlate SignNow is a powerful eSigning solution that simplifies the process of sending and signing documents. With airSlate SignNow, you can easily manage your grand rapids tax return files, ensuring they are signed quickly and securely, leading to timely submissions.

-

How much does airSlate SignNow cost for handling grand rapids tax returns?

The pricing for airSlate SignNow is designed to be cost-effective, with various plans catering to different needs. Whether you need a single user or a team solution for your grand rapids tax return processes, there are options available to fit your budget.

-

What features does airSlate SignNow offer for managing grand rapids tax returns?

AirSlate SignNow offers a range of features specifically aimed at streamlining document management. For your grand rapids tax return, you can benefit from templates, custom workflows, and secure eSigning options that enhance efficiency and reduce errors.

-

Can airSlate SignNow integrate with other software for my grand rapids tax return?

Yes, airSlate SignNow seamlessly integrates with various software platforms, including CRM and accounting tools. This allows you to streamline your processes related to your grand rapids tax return by connecting the software you already use.

-

Is airSlate SignNow compliant with the regulations for grand rapids tax returns?

Absolutely! airSlate SignNow complies with industry standards and regulations, ensuring that your grand rapids tax return documents are handled securely. You can rest assured that your data protection and privacy needs are met.

-

How does airSlate SignNow improve the efficiency of my grand rapids tax return preparation?

By using airSlate SignNow, you can streamline the document signing process, reducing the time spent on administrative tasks. This efficiency helps you focus more on preparing your grand rapids tax return accurately and promptly.

-

What support options are available for airSlate SignNow users handling grand rapids tax returns?

AirSlate SignNow offers a variety of support options, including live chat, email support, and an extensive knowledge base. If you have any questions or need assistance with your grand rapids tax return, reliable support is just a click away.

Get more for MI GR 1040NR Form

- Medical technologist skills checklist form

- Solicitud de transmisin de vehculos pdf form

- Concussion symptoms checklist form

- Personalized card meaning form

- Big o tires credit card form

- Understanding stem and leaf plots worksheet 1 answer key form

- Work experience form portland state university pdx

- New hire worksheet form

Find out other MI GR 1040NR Form

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe