Expenses Paid for a Dependent Child Born in , Enter that Child&amp Tax Ny Form

What is the Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny

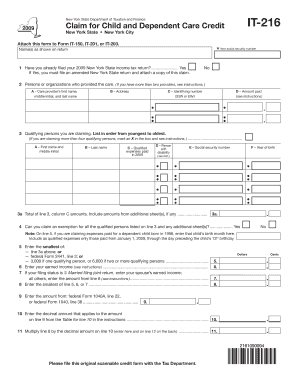

The form titled "Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny" is designed for taxpayers in New York who wish to report specific expenses related to a dependent child. This form helps parents or guardians claim eligible expenses that may affect their tax liability. Understanding this form is crucial for accurately filing taxes and ensuring that all allowable deductions are utilized. The expenses reported can include medical costs, childcare, and education-related fees, which can significantly impact the overall tax calculation.

How to use the Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny

Using the "Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny" form involves gathering all relevant documentation regarding the expenses incurred for the dependent child. Taxpayers should compile receipts, invoices, and any other proof of payment. Once the necessary information is collected, the form can be filled out by entering the total expenses in the designated sections. It is important to ensure that all figures are accurate to avoid potential issues with the tax authorities.

Steps to complete the Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny

Completing the "Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny" form involves several key steps:

- Gather all relevant documentation, including receipts and invoices for expenses related to the dependent child.

- Fill out the form with accurate information, ensuring that all expenses are correctly reported.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate method, whether online, by mail, or in person, as per the guidelines provided by the tax authority.

Key elements of the Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny

Key elements of the "Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny" form include:

- Identification of the dependent child, including their date of birth.

- A detailed breakdown of the expenses incurred for the child.

- Categories of eligible expenses, such as medical, educational, and childcare costs.

- Signature and date to certify the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines regarding the reporting of expenses for dependent children. Taxpayers should refer to the IRS publications that outline what qualifies as deductible expenses. It is essential to ensure that all reported expenses meet the IRS criteria to avoid penalties or audits. Familiarity with these guidelines can help taxpayers maximize their deductions and ensure compliance with federal tax laws.

Eligibility Criteria

To utilize the "Expenses Paid For A Dependent Child Born In , Enter That Child Tax Ny" form, taxpayers must meet certain eligibility criteria. The child must be a qualifying dependent as defined by the IRS, which typically includes children under the age of 19 or full-time students under the age of 24. Additionally, the expenses claimed must be directly related to the care and support of the dependent child. Taxpayers should verify their eligibility before completing the form to ensure compliance and accuracy in their tax filings.

Quick guide on how to complete expenses paid for a dependent child born in enter that childampamp tax ny

Execute [SKS] seamlessly on any device

Digital document management has become prevalent among enterprises and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Oversee [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal status as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Expenses Paid For A Dependent Child Born In , Enter That Child&amp Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the expenses paid for a dependent child born in enter that childampamp tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the tax benefits for Expenses Paid For A Dependent Child Born In , Enter That Child&amp Tax Ny?

Tax benefits for Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny include potential deductions and credits that can signNowly reduce your tax liability. These benefits help you account for healthcare and education expenses related to your dependent child, making your financial planning easier. Consult with a tax professional to maximize these benefits, as regulations may vary.

-

How can airSlate SignNow help with managing Expenses Paid For A Dependent Child Born In , Enter That Child&amp Tax Ny?

airSlate SignNow offers a streamlined solution for documenting and eSigning important paperwork related to Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny. With electronic signatures, you can quickly finalize documents required for tax submissions or reimbursements, saving time and ensuring accuracy. This simplifies your financial processes and helps you stay organized.

-

What features does airSlate SignNow provide for tracking expenses?

airSlate SignNow includes powerful features like document templates and automated workflows that make it easy to track expenses. You can create custom forms specifically for Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny, helping you gather all necessary information in one place. This ensures you have all documentation ready when it's time to file taxes or claim reimbursements.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore all its features before committing. This is a great opportunity to test how the platform can help you manage Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny. Sign up today to see firsthand how easy it is to handle your document needs.

-

Can I integrate airSlate SignNow with other financial tools?

Absolutely! airSlate SignNow provides seamless integration with various financial and accounting software, making it easier to manage Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny. Popular integrations include QuickBooks and Xero, which help to streamline your financial management and keep all documents in sync.

-

How does airSlate SignNow ensure document security?

airSlate SignNow prioritizes document security with bank-level encryption and secure cloud storage. This is especially important for sensitive information related to Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny. You can trust that your documents are safe and only accessible to authorized users.

-

What if I need help while using airSlate SignNow?

airSlate SignNow provides excellent customer support to assist you with any inquiries. Whether you have questions about managing Expenses Paid For A Dependent Child Born In , Enter That Child& Tax Ny or need technical assistance, their support team is readily available via chat, email, or phone. You won't be alone as you navigate the platform.

Get more for Expenses Paid For A Dependent Child Born In , Enter That Child&amp Tax Ny

- Letterhead user specs portland state university pdx form

- Board and commission candidate profile form city of ocean springs ci ocean springs ms

- Schedule c form 1040 internal revenue service

- Disclaimer letter of non responsibility form

- Budamp39s frozen semen contract von marc rottweilers form

- Page 1 of 2 form 1 answer sheets packing tnpsc

- Ropssa form

- Facilitator evaluation form 44660769

Find out other Expenses Paid For A Dependent Child Born In , Enter That Child&amp Tax Ny

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim