I II a Cashing State of Israel Bonds Form

What is the I II A Cashing State Of Israel Bonds

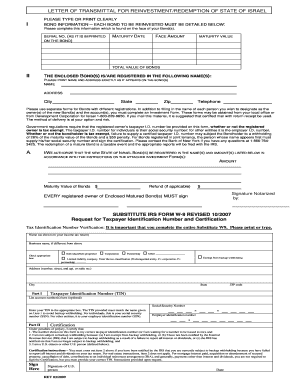

The I II A Cashing State Of Israel Bonds is a specific form used to redeem or cash in bonds issued by the State of Israel. These bonds are often purchased as investments and can be cashed at various financial institutions. Understanding the purpose and function of this form is essential for investors looking to access their funds. The form outlines the necessary information required to process the cashing of the bonds and ensures that the transaction complies with applicable regulations.

How to use the I II A Cashing State Of Israel Bonds

Using the I II A Cashing State Of Israel Bonds involves several steps. First, gather all necessary documentation, including the bonds you wish to cash and identification. Next, fill out the form accurately, providing all required information such as your name, address, and bond details. After completing the form, submit it to the designated financial institution or authority that handles these transactions. It is crucial to ensure that all information is correct to avoid delays in processing.

Steps to complete the I II A Cashing State Of Israel Bonds

Completing the I II A Cashing State Of Israel Bonds requires careful attention to detail. Follow these steps:

- Collect your Israel bonds and any relevant identification documents.

- Obtain the I II A form from a financial institution or authorized source.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form along with your bonds to the appropriate institution.

Key elements of the I II A Cashing State Of Israel Bonds

The key elements of the I II A Cashing State Of Israel Bonds include the bondholder's personal information, bond serial numbers, and the amount being cashed. Additionally, the form may require signatures to authorize the transaction. Understanding these elements is vital for ensuring that the cashing process goes smoothly and that all necessary information is provided.

Required Documents

To successfully cash the I II A Cashing State Of Israel Bonds, certain documents are required. These typically include:

- The original Israel bonds being cashed.

- A valid government-issued photo ID, such as a driver's license or passport.

- Any additional documentation that may be requested by the financial institution, such as proof of address.

Legal use of the I II A Cashing State Of Israel Bonds

The legal use of the I II A Cashing State Of Israel Bonds is governed by regulations pertaining to financial transactions and securities. Bondholders must ensure that they comply with all applicable laws when cashing their bonds. This includes providing accurate information on the form and submitting it to authorized institutions. Failure to adhere to these legal requirements may result in penalties or delays in processing the cashing request.

Quick guide on how to complete i ii a cashing state of israel bonds

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among enterprises and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed forms, as you can obtain the correct documentation and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign [SKS] and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to I II A Cashing State Of Israel Bonds

Create this form in 5 minutes!

How to create an eSignature for the i ii a cashing state of israel bonds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can I sell my Israel Bonds?

Israel bonds are not tradeable and must be held to maturity. By buying an Israel Bond, you are making a direct investment in the State of Israel. Your investment benefits the State of Israel.

-

Are donations to Israel tax deductible in the US?

Under the U.S.-Israel income tax treaty, a contribution to an Israeli charitable organization is deductible if and to the extent the contribution would have been treated as a charitable contribution if the organization had been created or organized under U.S. law.

-

Is there an income tax treaty between US and Israel?

Protecting against double taxation Over 74 countries have an Income Tax Treaty with the United States, and Israel is no exception. The U.S.-Israeli Tax Treaty* is from 1995, and it has long since needed an update.

-

What happens when an Israel bond matures?

The bond includes a commitment from the Israeli government to pay the loan back, plus an agreed rate of interest while using your money – known as the bond coupon or yield. Your loan amount (bond price) is returned to you when the bond matures after a fixed period of time: anywhere from a few weeks to 50 years.

-

Are Israel Bonds tax deductible in the USA?

A: The value of your donated Israel bond may be tax deductible to the extent permitted by law. Consult your tax advisor for details. Israel Bonds cannot provide tax advice.

-

Are Israeli pensions taxable in the US?

Employer Contributions and U.S. Taxes While the pension contributions made by your employer are taxed in Israel, they are also considered taxable income in the U.S. during the year they are made.

-

How do I cash an Israeli bond in the US?

To redeem a matured Israel bond in certificate form registered in your name, submit the following: A signed letter of instruction to Computershare, Israel's fiscal agent explaining your intent to redeem. The physical certificate (make a copy of your physical certificate for your personal records) W-9 Form:

-

Are Israeli bonds taxable in the USA?

Purchasing Israel Bonds through your JRB retirement account means that you do not pay taxes on income from the investment until you withdraw the funds in retirement when you are likely to be in a lower tax bracket.

Get more for I II A Cashing State Of Israel Bonds

- Leadership and teaching in a new era september 1 uwstout form

- Best skin ever application instructions best skins ever form

- Mailing list order form aadsm

- Zoning map amendment application ranchomirageca form

- Samford university library library samford form

- Tempus gallery albums order form for tempus gp albums

- Sleep products safety council safety hangtag order form sleepproducts

- Form 592 resident and nonresident withholding statement

Find out other I II A Cashing State Of Israel Bonds

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast