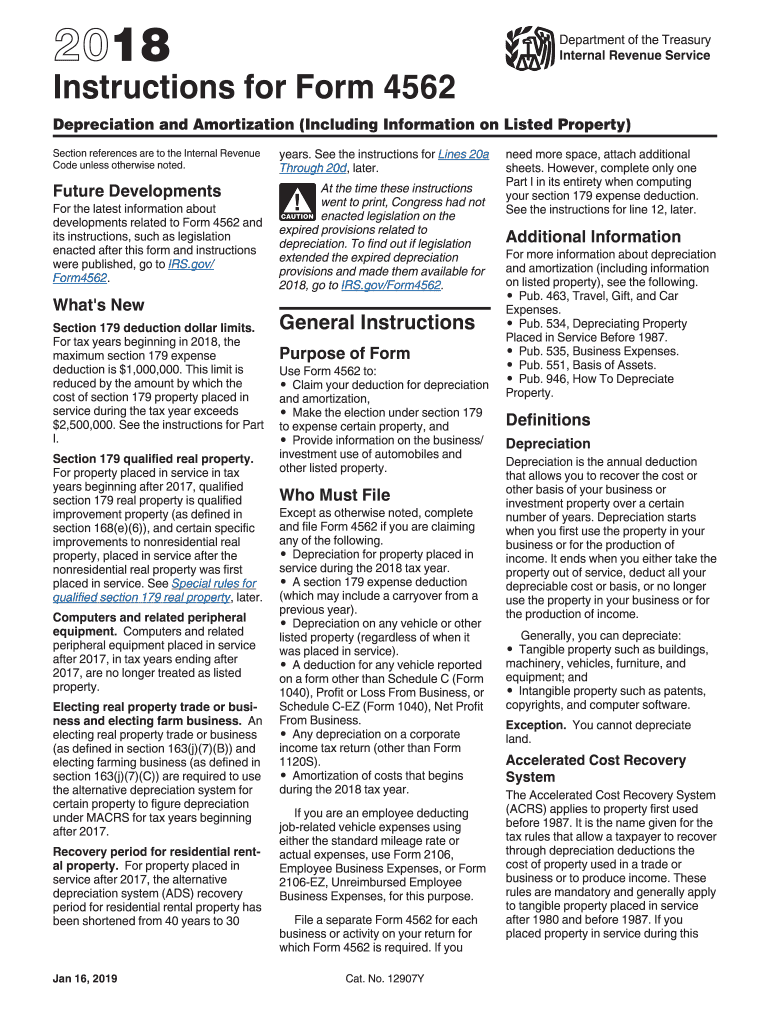

Form 4562 Instructions 2018

What is the Form 4562 Instructions

The Form 4562 Instructions provide guidance on how to report depreciation and amortization for tax purposes. This form is crucial for businesses that want to claim deductions for the depreciation of property and assets. It outlines the necessary information to include, such as the type of property, the date it was placed in service, and the method of depreciation being used. Understanding these instructions ensures compliance with IRS regulations and helps maximize potential tax benefits.

Steps to complete the Form 4562 Instructions

Completing the Form 4562 requires careful attention to detail. Start by gathering all relevant information about your assets, including purchase dates, costs, and any prior depreciation. Follow these steps:

- Begin with Part I to report the current year's depreciation.

- Fill out Part II for the election of the Section 179 deduction, if applicable.

- Complete Part III to detail the MACRS (Modified Accelerated Cost Recovery System) depreciation.

- Review Parts IV and V for any additional information related to listed property and amortization.

Ensure all calculations are accurate and that you have included all necessary attachments, such as supporting documentation for your claims.

How to obtain the Form 4562 Instructions

The Form 4562 Instructions can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to download the most current version to ensure compliance with the latest tax laws. Additionally, tax professionals can provide guidance and access to these instructions as part of their services.

Legal use of the Form 4562 Instructions

Using the Form 4562 Instructions legally involves adhering to IRS guidelines for reporting depreciation and amortization. It is important to use the correct version of the form for the tax year being filed. Misreporting or using outdated forms can lead to penalties. Always ensure that the information provided is accurate and that all required fields are completed to avoid issues during tax processing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4562 typically align with the overall tax return deadlines. For most businesses, the deadline is April fifteenth of the year following the tax year being reported. If filing for an extension, be aware that the form must still be submitted by the extended deadline. Keeping track of these dates is crucial to avoid late filing penalties.

Examples of using the Form 4562 Instructions

Examples of using the Form 4562 Instructions include scenarios where a business purchases new equipment or property. For instance, if a company buys a vehicle for business use, it can use the form to claim depreciation. Another example is when a business invests in improvements to existing property, allowing them to recover costs over time. Each of these situations requires careful documentation and adherence to the instructions to ensure proper tax treatment.

Quick guide on how to complete 2018 instructions for form 4562 instructions for form 4562 depreciation and amortization including information on listed

Discover the simplest method to complete and endorse your Form 4562 Instructions

Are you still spending time organizing your official documents on paper instead of online? airSlate SignNow offers a superior approach to complete and endorse your Form 4562 Instructions and comparable forms for public services. Our intelligent eSignature solution equips you with everything necessary to manage paperwork efficiently and according to official standards - comprehensive PDF editing, handling, safeguarding, endorsing, and sharing tools all available in an easy-to-use interface.

Only a few steps are needed to finish completing and endorsing your Form 4562 Instructions:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to enter in your Form 4562 Instructions.

- Move through the fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the sections with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is important or Conceal sections that are no longer relevant.

- Click on Sign to create a legally upheld eSignature using any method you prefer.

- Add the Date next to your signature and conclude your task with the Done button.

Store your completed Form 4562 Instructions in the Documents directory within your profile, download it, or transfer it to your desired cloud storage. Our service also offers versatile form sharing. There's no need to print your templates when you need to submit them to the appropriate public office - do it through email, fax, or by requesting a USPS “snail mail” delivery from your account. Test it today!

Create this form in 5 minutes or less

Find and fill out the correct 2018 instructions for form 4562 instructions for form 4562 depreciation and amortization including information on listed

Create this form in 5 minutes!

How to create an eSignature for the 2018 instructions for form 4562 instructions for form 4562 depreciation and amortization including information on listed

How to generate an eSignature for the 2018 Instructions For Form 4562 Instructions For Form 4562 Depreciation And Amortization Including Information On Listed in the online mode

How to create an electronic signature for your 2018 Instructions For Form 4562 Instructions For Form 4562 Depreciation And Amortization Including Information On Listed in Chrome

How to make an electronic signature for putting it on the 2018 Instructions For Form 4562 Instructions For Form 4562 Depreciation And Amortization Including Information On Listed in Gmail

How to create an electronic signature for the 2018 Instructions For Form 4562 Instructions For Form 4562 Depreciation And Amortization Including Information On Listed straight from your mobile device

How to make an electronic signature for the 2018 Instructions For Form 4562 Instructions For Form 4562 Depreciation And Amortization Including Information On Listed on iOS devices

How to generate an eSignature for the 2018 Instructions For Form 4562 Instructions For Form 4562 Depreciation And Amortization Including Information On Listed on Android

People also ask

-

What are the key features of the airSlate SignNow platform related to 2017instructions 4562?

airSlate SignNow offers robust features that simplify the eSigning process as outlined in the 2017instructions 4562. Users can easily create, send, and track documents for signature, making it a comprehensive solution for businesses. Additionally, the platform ensures compliance with relevant regulations, enhancing document security.

-

How does airSlate SignNow support integrations with other tools in regard to 2017instructions 4562?

Integrating with various business applications, airSlate SignNow aligns seamlessly with the processes described in 2017instructions 4562. The platform supports connections to CRM systems, cloud storage, and productivity tools, allowing for a cohesive workflow. This integration capability enables users to manage documents efficiently and in compliance.

-

What are the costs associated with using airSlate SignNow for 2017instructions 4562?

The pricing for airSlate SignNow is competitive and designed to deliver value for businesses needing to comply with 2017instructions 4562. Offering various plans, users can choose the one that best fits their needs without overspending on features they won't use. The platform also provides a free trial, enabling prospective customers to explore before committing financially.

-

Are there any benefits to using airSlate SignNow specifically for 2017instructions 4562?

Using airSlate SignNow for 2017instructions 4562 offers several advantages, including signNowly reduced turnaround times for document signing. Businesses can enhance their efficiency by eliminating traditional paperwork and leveraging electronic signatures. This transition not only streamlines operations but also ensures compliance with legal standards.

-

Can I create custom templates in airSlate SignNow for my 2017instructions 4562 documents?

Yes, airSlate SignNow allows users to create custom templates tailored to their unique 2017instructions 4562 requirements. This feature streamlines the preparation process, enabling users to generate consistent and compliant documents quickly. Custom templates save time and ensure that all necessary fields are included for smooth execution.

-

Is training available for new users to understand 2017instructions 4562 within the airSlate SignNow platform?

Absolutely, airSlate SignNow provides extensive training resources and support for new users navigating the context of 2017instructions 4562. From webinars to detailed documentation, users can access a wealth of information to enhance their understanding and maximize the platform's capabilities. This support empowers businesses to adapt quickly and efficiently.

-

How secure is the airSlate SignNow platform for documents related to 2017instructions 4562?

Security is a top priority for airSlate SignNow, particularly regarding documents governed by 2017instructions 4562. The platform utilizes top-of-the-line encryption and complies with legal standards for electronic signatures. Moreover, detailed audit trails ensure that all actions taken on documents are recorded, providing transparency and reliability.

Get more for Form 4562 Instructions

- Exercise chart printable exercise chart to create a weekly exercise plan form

- Rdf reasons form

- Bravo wellness appeals form primeviewplanscom

- Motor expired form

- Type group form

- K 210 underpayment of individual estimated tax rev 7 23 if you are an individual taxpayer including farmer or fisher use this form

- City of harrisonburg special event application form

- Superannuation salary sacrifice agreement template form

Find out other Form 4562 Instructions

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement