Illinois Form 4562 2011

What is the Illinois Form 4562

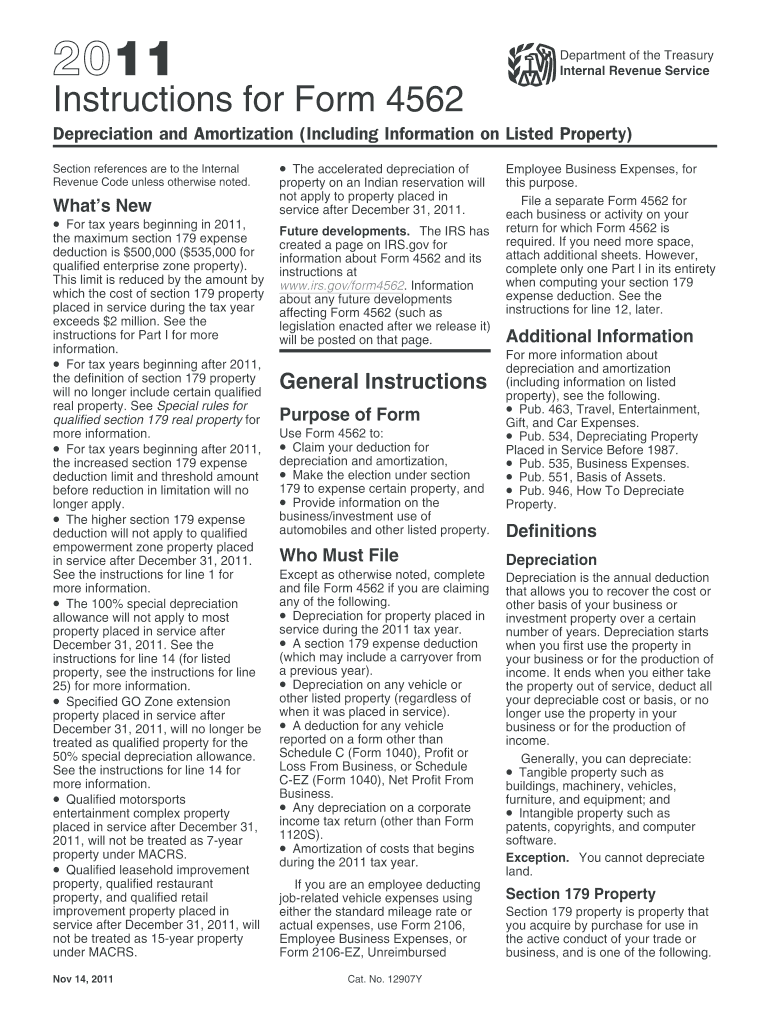

The Illinois Form 4562 is a tax form used by businesses and individuals to report depreciation and amortization for assets. This form is essential for taxpayers who wish to claim deductions for the depreciation of their property, which can significantly impact their overall tax liability. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance with state regulations.

How to use the Illinois Form 4562

Using the Illinois Form 4562 involves several steps to ensure accurate reporting. Taxpayers must first gather all necessary information regarding the assets they wish to depreciate. This includes the purchase date, cost, and type of asset. Once this information is collected, the taxpayer can fill out the form by entering the relevant details in the designated sections. It is important to follow the instructions carefully to ensure all calculations are correct, as errors can lead to delays or penalties.

Steps to complete the Illinois Form 4562

Completing the Illinois Form 4562 requires attention to detail. Here are the key steps:

- Gather all necessary documentation related to the assets.

- Fill in the taxpayer's information at the top of the form.

- List each asset separately, providing details such as acquisition date and cost.

- Calculate the depreciation for each asset using the appropriate method.

- Review the form for accuracy before submission.

Legal use of the Illinois Form 4562

The Illinois Form 4562 must be used in accordance with state tax laws. Proper completion and submission of this form ensure that taxpayers can legally claim depreciation deductions. It is essential to adhere to the guidelines set forth by the Illinois Department of Revenue to avoid potential legal issues. Additionally, maintaining accurate records of all transactions related to the assets is vital for compliance and future reference.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Form 4562 are typically aligned with the overall state tax filing deadlines. Taxpayers should be aware of these dates to ensure timely submission. Generally, the form must be filed by the due date of the Illinois income tax return. It is advisable to check for any updates or changes to deadlines each tax year to remain compliant.

Required Documents

To complete the Illinois Form 4562, certain documents are required. Taxpayers should have:

- Purchase invoices or receipts for the assets.

- Previous tax returns that may include prior depreciation claims.

- Any supporting documentation that verifies the asset details.

Having these documents ready will facilitate a smoother filing process and help ensure the accuracy of the information provided.

Examples of using the Illinois Form 4562

Examples of using the Illinois Form 4562 include situations where businesses purchase new equipment or vehicles. For instance, a small business that buys a delivery van can use this form to report the depreciation over its useful life. Similarly, a company that invests in machinery for manufacturing can also claim depreciation on that asset using the Illinois Form 4562. These deductions can lead to significant tax savings, making it a valuable tool for taxpayers.

Quick guide on how to complete illinois 2011 form 4562

Effortlessly Prepare Illinois Form 4562 on Any Device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without any hassle. Manage Illinois Form 4562 on any device using airSlate SignNow’s Android or iOS applications and enhance your document-driven processes today.

How to Alter and Electronically Sign Illinois Form 4562 with Ease

- Obtain Illinois Form 4562 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of missing or lost documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Illinois Form 4562 to guarantee flawless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois 2011 form 4562

Create this form in 5 minutes!

How to create an eSignature for the illinois 2011 form 4562

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Illinois Form 4562 and how can airSlate SignNow help?

Illinois Form 4562 is a tax form used for reporting depreciation and amortization. With airSlate SignNow, businesses can easily eSign and send this form securely, ensuring compliance and accuracy in your tax reporting.

-

Is airSlate SignNow suitable for filing Illinois Form 4562?

Yes, airSlate SignNow is an excellent choice for filing Illinois Form 4562. Our platform allows you to prepare, sign, and store this form digitally, streamlining your tax documentation process while remaining compliant with state regulations.

-

What features does airSlate SignNow offer for managing Illinois Form 4562?

airSlate SignNow provides features such as customizable templates, secure electronic signatures, and document tracking specifically for Illinois Form 4562. These tools help ensure that your tax documents are signed and submitted on time.

-

How does airSlate SignNow ensure the security of Illinois Form 4562 submissions?

When using airSlate SignNow for Illinois Form 4562, your data is protected with bank-level encryption and secure storage. We prioritize your privacy and ensure that your sensitive tax information remains confidential throughout the signing process.

-

Can I integrate airSlate SignNow with my accounting software for Illinois Form 4562?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage Illinois Form 4562 alongside your other financial documents. This integration streamlines your workflow and simplifies the filing process.

-

What are the pricing options for airSlate SignNow when using it for Illinois Form 4562?

airSlate SignNow offers flexible pricing plans to accommodate different business needs when preparing Illinois Form 4562. You can choose from monthly or annual subscriptions, ensuring you get the best value for your eSigning and document management needs.

-

Can I track the status of my Illinois Form 4562 after sending it with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Illinois Form 4562 in real-time. You will receive notifications when the form is viewed, signed, and completed, keeping you informed throughout the process.

Get more for Illinois Form 4562

Find out other Illinois Form 4562

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online