Form 1099 G Rev March 2024-2026

What is the Form 1099 G?

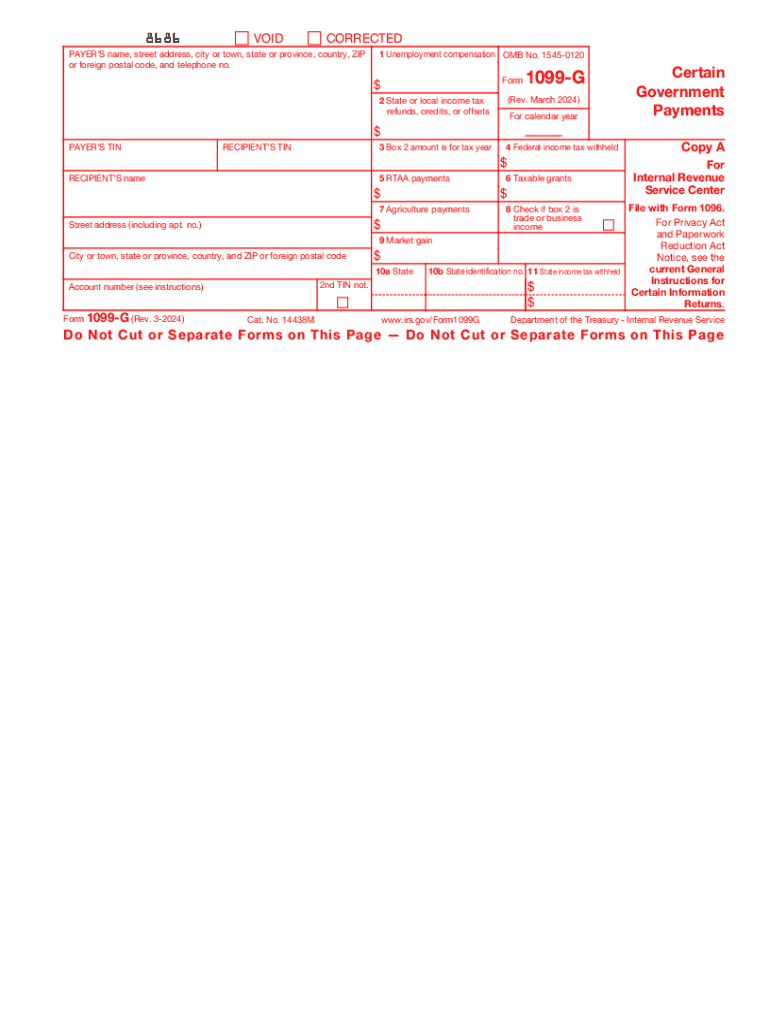

The Form 1099 G is a tax document used in the United States to report certain types of government payments. This form is primarily issued by federal or state agencies to individuals who have received unemployment compensation, state tax refunds, or other government payments. Understanding this form is crucial for accurately reporting income on your tax return.

How to Obtain the Form 1099 G

To obtain the Form 1099 G, individuals can typically access it through the website of the state agency that issued the payment. Many states provide downloadable versions of the form directly online. Alternatively, individuals may receive a physical copy by mail if they have received qualifying payments. Checking with the relevant state department of revenue or labor can also provide guidance on acquiring this form.

Steps to Complete the Form 1099 G

Completing the Form 1099 G involves several key steps:

- Gather necessary information, including your Social Security number and details of the payments received.

- Fill in the payer's information, including the name and address of the issuing agency.

- Report the total amount of unemployment compensation or tax refunds received in the appropriate boxes.

- Review the completed form for accuracy before submission.

Key Elements of the Form 1099 G

The Form 1099 G includes several important elements:

- Payer Information: This section contains details about the government agency that issued the payment.

- Recipient Information: This includes the taxpayer's name, address, and Social Security number.

- Payment Amounts: The form specifies the total amount of unemployment compensation and any state tax refunds.

IRS Guidelines for Form 1099 G

The IRS provides specific guidelines for the use of Form 1099 G. Taxpayers must ensure that the information reported on the form matches their records. The IRS requires that this form be filed by the end of January following the tax year in which the payments were made. Additionally, recipients should retain a copy for their records to assist in accurate tax filing.

Filing Deadlines for Form 1099 G

Filing deadlines for the Form 1099 G are crucial to avoid penalties. The form must be issued to recipients by January thirty-first of the year following the tax year in which the payments were made. If filing electronically, the deadline may extend to March thirty-first. It is important to adhere to these deadlines to ensure compliance with IRS regulations.

Quick guide on how to complete form 1099 g rev march

Complete Form 1099 G Rev March effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to find the correct form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly without any delays. Manage Form 1099 G Rev March on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and electronically sign Form 1099 G Rev March with ease

- Find Form 1099 G Rev March and click on Get Form to begin.

- Use the tools provided to complete your document.

- Highlight important areas of your documents or obscure sensitive information with tools that airSlate SignNow has specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 1099 G Rev March and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 g rev march

Create this form in 5 minutes!

How to create an eSignature for the form 1099 g rev march

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1099 g form?

A 1099 g form is a tax document used to report certain types of income, such as unemployment compensation or state tax refunds. Understanding how to manage your 1099 g is crucial for accurate tax filing. With airSlate SignNow, you can easily eSign and send your 1099 g forms securely.

-

How can airSlate SignNow help with 1099 g forms?

airSlate SignNow provides a user-friendly platform to eSign and send your 1099 g forms efficiently. Our solution ensures that your documents are securely stored and easily accessible, streamlining the process of managing your tax documents. This can save you time and reduce the stress associated with tax season.

-

Is there a cost associated with using airSlate SignNow for 1099 g forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solution allows you to manage your 1099 g forms without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing 1099 g forms?

airSlate SignNow includes features such as eSigning, document templates, and secure cloud storage, all tailored for managing 1099 g forms. These features enhance your workflow and ensure that your documents are handled efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for 1099 g management?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your 1099 g forms alongside your existing tools. This seamless integration helps streamline your workflow and enhances productivity, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow for handling 1099 g forms?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your 1099 g forms and sensitive information. You can trust that your documents are safe and secure while using our platform.

-

What are the benefits of using airSlate SignNow for 1099 g forms?

Using airSlate SignNow for your 1099 g forms offers numerous benefits, including time savings, enhanced security, and ease of use. Our platform simplifies the eSigning process, allowing you to focus on your business rather than paperwork. Additionally, you can access your documents anytime, anywhere.

Get more for Form 1099 G Rev March

- Form hr4

- Postgraduate training verification form

- Printable qdro forms texas

- Milwaukee recreation form

- From t2 for and later form

- City of tshwane guidelines for the design and construction of water and sanitation systems form

- Lion vs elephant digestion lab answer key form

- Tax residence certificate malta form

Find out other Form 1099 G Rev March

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word