1099 G 2018

What is the 1099 G?

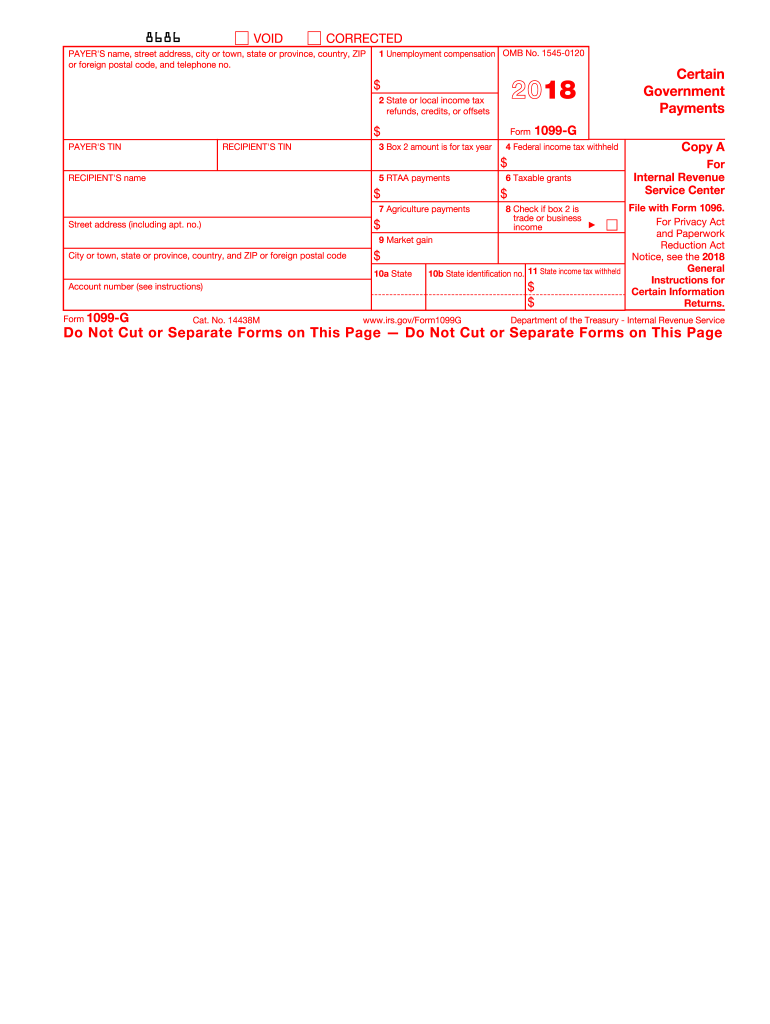

The 1099 G form is a tax document used to report certain types of government payments. This includes unemployment compensation, state tax refunds, and other government payments made to individuals. The form is issued by state and local governments and is an important part of the tax filing process for recipients. Understanding the 1099 G is essential for accurately reporting income and ensuring compliance with tax regulations.

How to obtain the 1099 G

To obtain a 1099 G form, individuals can typically request it from the state agency that issued the payments. Many states provide access to these forms online through their official websites. Recipients may also receive the form by mail if they have provided their address to the agency. It is important to ensure that personal information is up to date to avoid delays in receiving the form.

Steps to complete the 1099 G

Completing the 1099 G involves several key steps:

- Gather all relevant information, including the amounts received and the purpose of the payments.

- Fill out the form accurately, ensuring that all required fields are completed.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS or include it with your tax return, as required.

Key elements of the 1099 G

Key elements of the 1099 G form include:

- Payer Information: The name and address of the government agency issuing the payment.

- Recipient Information: The name, address, and taxpayer identification number of the individual receiving the payment.

- Payment Amounts: The total amount of unemployment compensation or other payments made during the tax year.

- State Tax Refunds: Any state tax refunds that may be applicable.

IRS Guidelines

The IRS provides specific guidelines for the use and reporting of the 1099 G form. Recipients must report the income shown on the form when filing their federal tax returns. It is crucial to keep a copy of the form for personal records, as it may be needed for future reference or in case of an audit. The IRS also outlines deadlines for issuing and filing the form, which must be adhered to in order to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 G form are typically aligned with the general tax filing deadlines. The form must be issued to recipients by January 31 of the year following the tax year in which the payments were made. Additionally, the form must be submitted to the IRS by the end of February if filed by paper, or by March 31 if filed electronically. Staying aware of these dates is essential for timely compliance.

Quick guide on how to complete 1099 g 2018 2019 form

Discover the simplest method to complete and endorse your 1099 G

Are you still spending time preparing your official paperwork on paper instead of online? airSlate SignNow presents a superior option to complete and endorse your 1099 G and associated forms for public services. Our advanced electronic signature solution offers you everything necessary to handle documents swiftly and in compliance with official standards - robust PDF editing, managing, securing, endorsing, and sharing features all available within a user-friendly interface.

Only a few steps are required to complete and endorse your 1099 G:

- Add the editable template to the editor using the Get Form button.

- Review what information you need to supply in your 1099 G.

- Navigate through the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the sections with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is essential or Conceal areas that are no longer relevant.

- Press Sign to generate a legally binding electronic signature using any preferred option.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished 1099 G in the Documents folder within your profile, download it, or transfer it to your chosen cloud storage. Our service also provides adaptable form sharing. There’s no need to print your forms when you need to submit them to the appropriate public office - utilize email, fax, or request a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1099 g 2018 2019 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

Create this form in 5 minutes!

How to create an eSignature for the 1099 g 2018 2019 form

How to create an electronic signature for your 1099 G 2018 2019 Form online

How to make an electronic signature for your 1099 G 2018 2019 Form in Chrome

How to generate an eSignature for signing the 1099 G 2018 2019 Form in Gmail

How to create an electronic signature for the 1099 G 2018 2019 Form straight from your smartphone

How to make an eSignature for the 1099 G 2018 2019 Form on iOS

How to make an eSignature for the 1099 G 2018 2019 Form on Android OS

People also ask

-

What is a California 1099 form PDF and why is it important?

The California 1099 form PDF is a tax document used to report various types of income other than wages. It's important for freelancers, independent contractors, and businesses to ensure compliance with state tax regulations. Completing the California 1099 form PDF accurately helps avoid penalties from the IRS and state authorities.

-

How can airSlate SignNow help with the California 1099 form PDF?

airSlate SignNow facilitates the seamless creation, signing, and management of the California 1099 form PDF. Our platform ensures that businesses can easily fill out and electronically sign the 1099 forms, streamlining the entire process and enhancing efficiency. Moreover, it helps maintain compliance with California tax laws.

-

Is there a cost associated with using airSlate SignNow for the California 1099 form PDF?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides businesses with tools to manage the California 1099 form PDF and other documents efficiently. Check our website for detailed pricing information and find a plan that fits your budget.

-

Can I store my California 1099 form PDF securely with airSlate SignNow?

Absolutely! airSlate SignNow offers secure storage for all your documents, including the California 1099 form PDF. With advanced encryption and compliance with industry standards, you can trust that your sensitive information is safe and accessible whenever you need it.

-

Does airSlate SignNow integrate with other software for handling the California 1099 form PDF?

Yes, airSlate SignNow provides integrations with various business applications such as accounting software and CRMs. This allows for seamless data transfer and automatic population of fields in your California 1099 form PDF, saving you time and reducing the chance of errors when completing financial documents.

-

How does airSlate SignNow enhance the eSigning process for the California 1099 form PDF?

airSlate SignNow enhances the eSigning process by offering a user-friendly interface that allows for quick signing of the California 1099 form PDF. Recipients can sign from any device without the need for printing or scanning, making the process fast and convenient. This feature signNowly reduces turnaround time for important tax documents.

-

Can multiple users collaborate on the California 1099 form PDF using airSlate SignNow?

Yes, airSlate SignNow supports collaboration among multiple users when handling the California 1099 form PDF. Team members can review, edit, and sign the document in real-time, ensuring that everyone involved stays updated and that the document is completed efficiently. This collaborative feature is ideal for businesses with multiple stakeholders.

Get more for 1099 G

- Fb 1380 e form

- Vics bol form

- Ahca affidavit 2010 form

- Blank usmc fitrep 1610 form

- Application form for non resident indians nri union bank of india

- Form lb 0441 2013 2019

- Sec 44 worksheet trigonometric functions of any angle form

- Travel consent form ector county independent school district ectorcountyisd

Find out other 1099 G

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice

- Electronic signature California Customer Complaint Form Online

- Electronic signature Alaska Refund Request Form Later

- How Can I Electronic signature Texas Customer Return Report

- How Do I Electronic signature Florida Reseller Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later