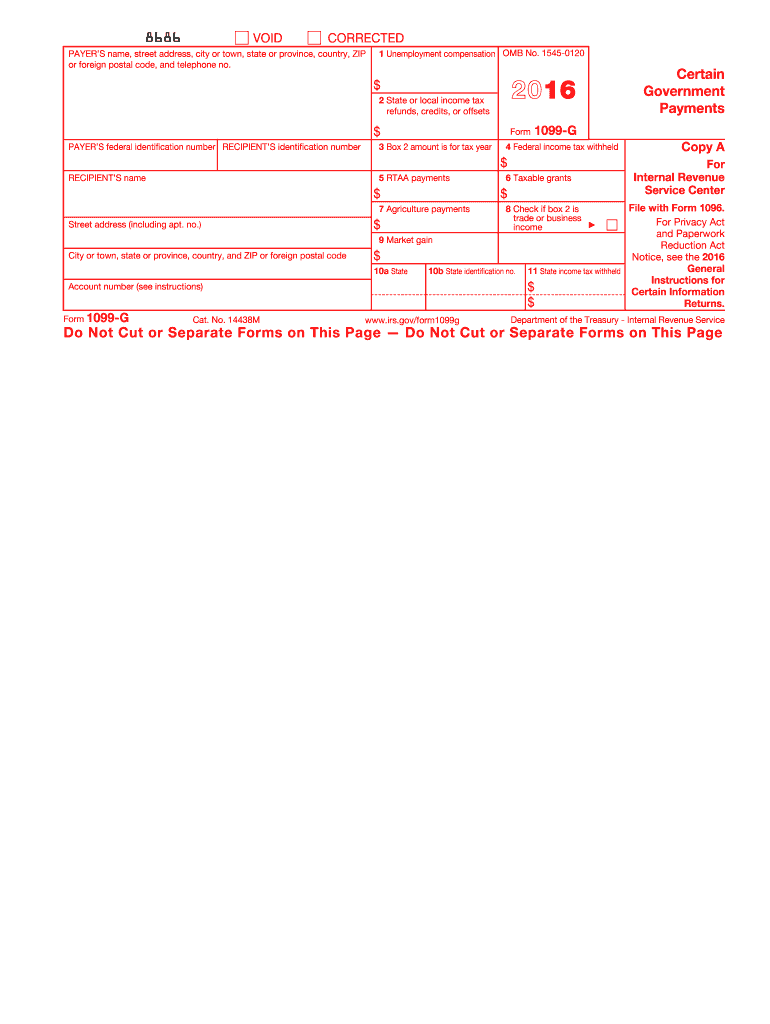

Form 1099g 2016

What is the Form 1099-G

The Form 1099-G is a tax document used in the United States to report certain government payments. This form is typically issued by state and local governments to individuals who have received unemployment compensation, state tax refunds, or other government payments. The information reported on the Form 1099-G is essential for taxpayers as it helps them accurately report their income when filing their federal tax returns. Understanding this form is crucial for ensuring compliance with tax regulations and avoiding potential penalties.

How to Obtain the Form 1099-G

To obtain the Form 1099-G, individuals can follow several methods. Most states provide the form electronically through their official tax department websites. Taxpayers can log in to their state tax accounts to download or print their 1099-G forms. Additionally, some states may send the form by mail to eligible recipients. If an individual has not received their form by the end of January, they should contact their state tax agency for assistance. It is important to ensure that the information is accurate and complete before using it for tax filing purposes.

Steps to Complete the Form 1099-G

Completing the Form 1099-G involves several key steps. First, gather all necessary information, including the total amount of unemployment compensation or state tax refunds received. Next, enter the recipient's name, address, and taxpayer identification number accurately. Ensure that the amounts reported in the appropriate boxes reflect the total payments received during the tax year. After filling out the form, review it carefully for any errors or omissions. Finally, submit the completed Form 1099-G to the appropriate tax authority and retain a copy for personal records.

Legal Use of the Form 1099-G

The legal use of the Form 1099-G is governed by IRS regulations. Recipients of this form must report the income indicated on it when filing their federal tax returns. Failure to report this income can lead to penalties and interest charges from the IRS. It is essential for taxpayers to keep the form in a safe place and refer to it when preparing their tax returns. Additionally, the form must be issued by the deadline set by the IRS to ensure compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099-G are crucial for compliance with tax regulations. Typically, the form must be issued to recipients by January thirty-first of the year following the tax year. Additionally, the filing deadline for submitting the form to the IRS is usually the end of February if filed by paper, or March thirty-first if filed electronically. Taxpayers should be aware of these dates to avoid penalties and ensure timely reporting of their income.

Who Issues the Form 1099-G

The Form 1099-G is primarily issued by state and local government agencies. These agencies are responsible for reporting payments made to individuals, such as unemployment benefits or state tax refunds. It is important for recipients to verify that the form has been issued by the correct agency and to ensure that all information is accurate. If discrepancies arise, individuals should contact the issuing agency for clarification and corrections.

Quick guide on how to complete form 1099g 2016

Effortlessly Prepare Form 1099g on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 1099g across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electrically Sign Form 1099g with Ease

- Obtain Form 1099g and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Indicate important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to preserve your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 1099g ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099g 2016

Create this form in 5 minutes!

How to create an eSignature for the form 1099g 2016

How to generate an eSignature for your Form 1099g 2016 in the online mode

How to generate an electronic signature for your Form 1099g 2016 in Google Chrome

How to generate an eSignature for putting it on the Form 1099g 2016 in Gmail

How to make an eSignature for the Form 1099g 2016 right from your smartphone

How to make an electronic signature for the Form 1099g 2016 on iOS

How to generate an electronic signature for the Form 1099g 2016 on Android OS

People also ask

-

What is Form 1099g and why is it important?

Form 1099g is a tax form used to report certain government payments, such as unemployment compensation or state tax refunds. It's important because it helps individuals accurately report their income to the IRS, ensuring compliance with tax regulations. Using airSlate SignNow, you can easily eSign and manage your Form 1099g, streamlining your tax preparation process.

-

How can airSlate SignNow help me with Form 1099g?

airSlate SignNow offers a user-friendly platform that allows you to send, receive, and eSign Form 1099g efficiently. With our solution, you can eliminate the hassle of printing and mailing physical documents, as everything can be handled electronically. This not only saves time but also enhances the security of your sensitive tax information.

-

Is there a cost to use airSlate SignNow for managing Form 1099g?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our cost-effective solution provides unlimited eSigning and document management features, making it easier for you to handle Form 1099g and other essential documents. You can choose a plan that fits your budget while still ensuring compliance with tax requirements.

-

Can I integrate airSlate SignNow with my accounting software for Form 1099g?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to streamline your workflow when managing Form 1099g. This integration ensures that your tax documents are automatically populated and sent for eSigning, reducing manual entry errors and saving you valuable time.

-

What security features does airSlate SignNow offer for Form 1099g?

Security is a top priority at airSlate SignNow. When handling Form 1099g or any sensitive documents, we employ industry-standard encryption and secure data storage to protect your information. Additionally, our platform is compliant with various regulations, ensuring your documents are handled securely throughout the signing process.

-

Can I track the status of my Form 1099g sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including Form 1099g. You can easily monitor the status of your sent forms and receive notifications when they are viewed, signed, or completed. This feature helps you stay organized and ensures that your tax documents are processed promptly.

-

What support options does airSlate SignNow provide for Form 1099g users?

Our dedicated support team is here to help you with any questions or issues related to Form 1099g or our platform. We offer multiple support channels, including live chat, email support, and an extensive knowledge base with guides and FAQs. Whether you need help with eSigning or document management, our team is ready to assist you.

Get more for Form 1099g

Find out other Form 1099g

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word