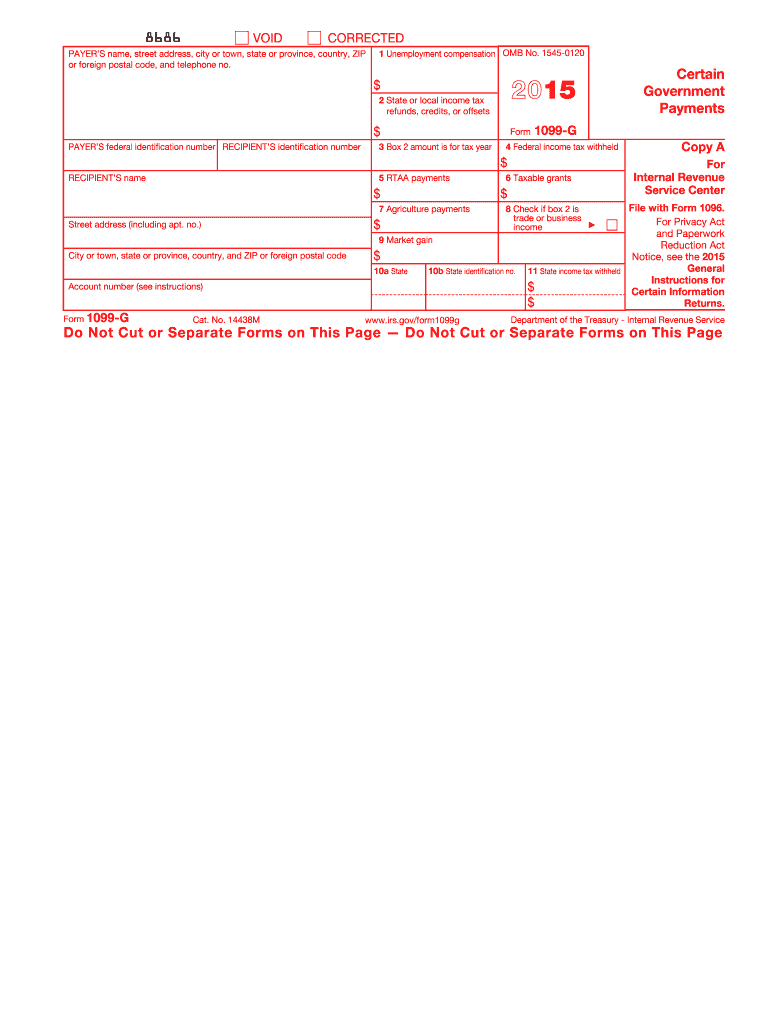

1099 G Form 2015

What is the 1099 G Form

The 1099 G Form is a tax document used in the United States to report certain types of government payments. These payments can include unemployment compensation, state tax refunds, and other government-issued payments. The form is essential for taxpayers who need to report this income on their federal tax returns. It helps the Internal Revenue Service (IRS) track the income received by individuals from government sources, ensuring accurate tax reporting and compliance.

How to use the 1099 G Form

Using the 1099 G Form involves several steps. First, you must receive the form from the appropriate government agency, such as your state’s unemployment office. Once you have the form, review the information to ensure accuracy, including your name, address, and the amounts reported. If the information is correct, you can use it to complete your federal tax return. The amounts reported on the 1099 G Form must be included in your taxable income for the year.

Steps to complete the 1099 G Form

Completing the 1099 G Form requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the issuing agency.

- Verify your personal information, including your name and Social Security number.

- Check the reported amounts for accuracy, ensuring they match your records.

- Report the amounts on your federal tax return, typically on Schedule 1 of Form 1040.

- Keep a copy of the form for your records, as you may need it for future reference or audits.

Key elements of the 1099 G Form

The 1099 G Form includes several key elements that are crucial for accurate reporting. These elements typically consist of:

- Payer Information: The name and address of the government agency issuing the payment.

- Recipient Information: Your name, address, and Social Security number.

- Payment Amounts: The total amount of unemployment compensation, state tax refunds, or other payments received during the tax year.

- Tax Year: The year for which the payments are reported.

IRS Guidelines

The IRS provides specific guidelines for the use of the 1099 G Form. These guidelines outline the requirements for reporting government payments and the deadlines for submitting the form. Taxpayers should ensure they are aware of the latest IRS regulations regarding the 1099 G Form to avoid penalties. It is advisable to consult the IRS website or a tax professional for detailed information on compliance and reporting requirements.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 G Form are critical for compliance. Typically, the form must be issued to recipients by January 31 of the year following the tax year. Additionally, the government agency must file the form with the IRS by the end of February if filing by paper or by the end of March if filing electronically. Missing these deadlines can result in penalties, so it is essential to stay informed about these important dates.

Quick guide on how to complete 2015 1099 g form

Prepare 1099 G Form effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers a superb eco-conscious substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly and without delays. Manage 1099 G Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to modify and eSign 1099 G Form seamlessly

- Find 1099 G Form and click on Get Form to begin.

- Take advantage of the tools we provide to fill in your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign 1099 G Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 g form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 g form

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the 1099 G Form and who needs it?

The 1099 G Form is a tax document used to report certain types of government payments, such as unemployment benefits and state tax refunds. Individuals receiving these payments must file a 1099 G Form with their tax returns, making it essential for accurate income reporting. Understanding the 1099 G Form is crucial for anyone who has received these benefits during the tax year.

-

How can airSlate SignNow help with the 1099 G Form?

airSlate SignNow provides a streamlined process for sending and electronically signing the 1099 G Form. With our user-friendly platform, you can easily create, send, and track the status of your 1099 G Form, ensuring that your documents are securely delivered and signed on time. This feature simplifies the filing process and helps you stay compliant with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the 1099 G Form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans include features that allow you to manage the 1099 G Form and other documents efficiently. You can choose a plan that suits your budget and requirements, ensuring you get the best value for your eSignature and document management needs.

-

What features does airSlate SignNow offer for managing the 1099 G Form?

AirSlate SignNow offers several features that enhance the management of the 1099 G Form, including customizable templates, secure eSigning, and real-time tracking. These tools make it easy to fill out, send, and receive the signed 1099 G Form, streamlining your tax documentation process. Our platform also ensures compliance and security, giving you peace of mind.

-

Can I integrate airSlate SignNow with other software for 1099 G Form management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing you to manage the 1099 G Form along with your financial documentation. This integration simplifies workflows and reduces the need for manual data entry, making it easier to stay organized and efficient during tax season.

-

How secure is airSlate SignNow for handling the 1099 G Form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and authentication protocols to protect your documents, including the 1099 G Form. You can be confident that your sensitive information is safeguarded throughout the signing process, ensuring compliance with data protection regulations.

-

Can I access my 1099 G Form anytime using airSlate SignNow?

Yes, with airSlate SignNow, you can access your 1099 G Form and other documents anytime, anywhere. Our cloud-based platform allows you to retrieve and manage your signed forms from any device with internet access, making it convenient to keep track of your tax documents throughout the year.

Get more for 1099 G Form

- Facility consent for surgery surgery center of the lakelands form

- Prescription drug benefit description cvs caremark form

- A second payment of 500 is due on or before january 30th form

- Regulation 4320 short term leaves for certified teachers form

- Form 14950 rev 8 2016 premium tax credit verification

- Emergency grant in aid emergency grant in aid application form

- Records amp forms management

- Phone 415338 2350 form

Find out other 1099 G Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors