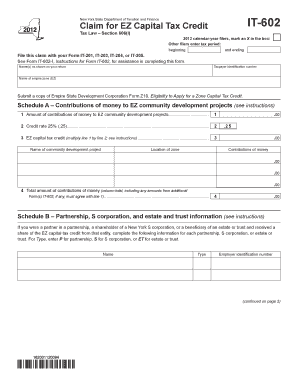

It 602 New York State Department of Taxation and Finance Claim for EZ Capital Tax Credit Tax Law Section 606l Calendar Year File Form

What is the IT-602 Claim for EZ Capital Tax Credit?

The IT-602 form is a specific document issued by the New York State Department of Taxation and Finance. It is designed for taxpayers seeking to claim the EZ Capital Tax Credit under Tax Law Section 606l. This credit is available to eligible businesses that have made qualified investments in New York State. The form must be filled out accurately to ensure compliance with state tax regulations and to facilitate the processing of the credit claim.

Steps to Complete the IT-602 Claim

Completing the IT-602 involves several key steps. First, you need to gather all relevant financial information regarding your business's qualified investments. Next, fill out the form by providing details such as your business name, tax identification number, and the specific tax period for which you are claiming the credit. Be sure to mark an X in the appropriate box for calendar year filers and enter the tax period beginning and ending dates if you are an other filer. Finally, review the form for accuracy before submission.

Eligibility Criteria for the IT-602 Claim

To qualify for the EZ Capital Tax Credit and successfully submit the IT-602 form, businesses must meet certain eligibility criteria. This includes being a registered business entity in New York State and having made qualified investments that meet the requirements set forth in Tax Law Section 606l. It is important to ensure that all investments are documented and that the business complies with any additional requirements specified by the New York State Department of Taxation and Finance.

Required Documents for Submission

When filing the IT-602 claim, specific documents must accompany the form to substantiate the claim. These documents may include proof of the qualified investments made, such as receipts, invoices, or financial statements. Additionally, any supporting documentation that demonstrates compliance with the eligibility criteria should be included. Ensuring that all required documents are submitted can help avoid delays in processing your claim.

Form Submission Methods

The IT-602 form can be submitted through various methods. Taxpayers have the option to file the form online, mail it to the appropriate tax office, or submit it in person at designated locations. Each submission method may have different processing times, so it is advisable to choose the method that best suits your needs and timelines.

Filing Deadlines for the IT-602 Claim

Filing deadlines for the IT-602 claim are crucial to ensure that you receive the tax credit in a timely manner. Typically, the claim must be filed by the due date of your tax return for the year in which the qualified investments were made. It is important to verify the specific deadlines for the current tax year, as these can vary and may be subject to change.

Quick guide on how to complete it 602 new york state department of taxation and finance claim for ez capital tax credit tax law section 606l calendar year

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it on the cloud. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related operation today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential information with specialized tools provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), or a shared link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 602 new york state department of taxation and finance claim for ez capital tax credit tax law section 606l calendar year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit?

The IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit is a form used by eligible businesses to claim tax credits under Tax Law Section 606l. This form is essential for calendar year filers and requires specific information regarding the tax period. Completing this form accurately can help businesses maximize their tax benefits.

-

Who qualifies to file the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit?

To qualify for the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit, businesses must meet certain criteria outlined in Tax Law Section 606l. Generally, this includes businesses that have made qualified investments in New York State. It's important to review the eligibility requirements before filing.

-

How do I complete the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit?

Completing the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit involves filling out the required sections accurately. You need to mark an X in the appropriate box for calendar year filers and enter the tax period beginning and ending dates. Ensure all information is correct to avoid delays in processing.

-

What are the benefits of using airSlate SignNow for filing the IT 602 form?

Using airSlate SignNow to file the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit streamlines the process of document signing and submission. Our platform is user-friendly and cost-effective, ensuring that you can complete your claims efficiently. Additionally, it provides secure storage and easy access to your documents.

-

Is there a cost associated with using airSlate SignNow for the IT 602 filing?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be affordable for businesses of all sizes. Our pricing plans are flexible and cater to various needs, ensuring you get the best value for your investment in filing the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit.

-

Can I integrate airSlate SignNow with other software for filing the IT 602 form?

Absolutely! airSlate SignNow offers integrations with various software solutions that can enhance your filing process for the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit. This allows for seamless data transfer and improved efficiency in managing your tax documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides a range of features for managing tax documents, including eSignature capabilities, document templates, and secure cloud storage. These features are particularly useful for filing the IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit, ensuring that your documents are organized and easily accessible.

Get more for IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit Tax Law Section 606l Calendar year File

- How to use the salutation dear friendampquot for organizations form

- License agreement go far form

- Assignment of portion of expected interest in estate form

- Assignment and assumption agreement 74744doc2 form

- Code of laws title 29 chapter 3 mortgages and deeds form

- Asset purchase agreement simple pdf and word download form

- Employment agreement with vice president of sales and marketing form

- Between name of designer of form

Find out other IT 602 New York State Department Of Taxation And Finance Claim For EZ Capital Tax Credit Tax Law Section 606l Calendar year File

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT