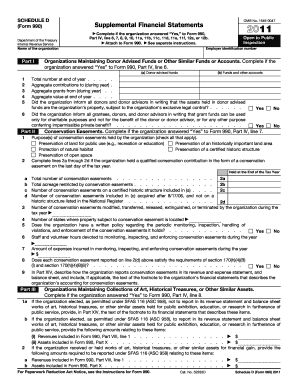

Form 990 Schedule D 2011

What is the Form 990 Schedule D

The Form 990 Schedule D is a supplemental schedule used by tax-exempt organizations to provide additional information about their financial activities. This form is essential for detailing the organization’s governance, policies, and financial practices. It helps the IRS and the public understand how the organization manages its assets and ensures compliance with federal regulations. Nonprofits must complete this form to maintain transparency and accountability in their operations.

How to use the Form 990 Schedule D

Using the Form 990 Schedule D involves several steps that ensure accurate reporting of an organization’s financial activities. Initially, organizations should gather relevant financial documents, including previous tax returns, financial statements, and any supporting documentation related to governance policies. Once these documents are collected, organizations can fill out the schedule by providing detailed information about their financial practices, including governance structures and policies on conflict of interest. It is crucial to ensure that all information is complete and accurate to avoid potential issues with the IRS.

Steps to complete the Form 990 Schedule D

Completing the Form 990 Schedule D requires a systematic approach to ensure all necessary information is included. Here are the steps to follow:

- Gather necessary financial documents and previous Form 990 filings.

- Review the instructions for Form 990 Schedule D to understand specific reporting requirements.

- Complete each section of the form, providing detailed information about governance, policies, and financial practices.

- Double-check all entries for accuracy and completeness.

- Submit the completed form along with the main Form 990 by the filing deadline.

Legal use of the Form 990 Schedule D

The legal use of the Form 990 Schedule D is governed by IRS regulations, which require tax-exempt organizations to provide accurate and truthful information. This form must be filed annually as part of the organization’s Form 990 submission. Failure to comply with these regulations can result in penalties, including loss of tax-exempt status. Organizations should ensure they understand the legal implications of the information provided on this form, as it is subject to public scrutiny and can affect their reputation and funding.

Key elements of the Form 990 Schedule D

Key elements of the Form 990 Schedule D include sections that address governance practices, policies on conflict of interest, and financial reporting. Organizations must disclose their board composition, meeting frequency, and any conflicts of interest that may arise. Additionally, the form requires details about financial controls and procedures in place to manage assets responsibly. These elements are crucial for demonstrating compliance with IRS regulations and fostering trust with stakeholders.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Schedule D align with the main Form 990 submission deadlines. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but it is essential to submit any requests before the original deadline to avoid penalties. Organizations should keep track of these important dates to ensure timely compliance.

Quick guide on how to complete form 990 schedule d 2011

Complete Form 990 Schedule D effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Form 990 Schedule D on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Form 990 Schedule D with ease

- Obtain Form 990 Schedule D and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tiresome form searches, or errors that require new document prints. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 990 Schedule D and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 990 schedule d 2011

Create this form in 5 minutes!

How to create an eSignature for the form 990 schedule d 2011

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Form 990 Schedule D?

Form 990 Schedule D is a supplement used by tax-exempt organizations to report their signNow investments. It provides detailed information on the fund's holdings, ensuring transparency and compliance with IRS requirements. Understanding this form is essential for nonprofits to maintain their tax-exempt status.

-

How can airSlate SignNow assist with Form 990 Schedule D preparation?

airSlate SignNow offers a streamlined solution for preparing and eSigning Form 990 Schedule D. Our platform allows users to effortlessly gather required signatures and securely share documents. With a user-friendly interface, preparing tax documentation has never been easier.

-

Is airSlate SignNow compliant with IRS regulations for Form 990 Schedule D?

Yes, airSlate SignNow ensures compliance with IRS regulations for Form 990 Schedule D. Our eSignature solution meets the legal requirements necessary for tax documentation. This means you can trust our platform to help you comply while facilitating the eSigning process.

-

What pricing options does airSlate SignNow offer for nonprofit organizations working on Form 990 Schedule D?

airSlate SignNow provides competitive pricing tailored for nonprofit organizations preparing Form 990 Schedule D. Our flexible plans are designed to accommodate different needs, ensuring cost-effective solutions for any budget. You can select a plan that best suits your organization’s requirements.

-

What features does airSlate SignNow provide for managing Form 990 Schedule D?

airSlate SignNow includes features such as template creation, document tracking, and custom workflows specifically for Form 990 Schedule D management. These functionalities enhance efficiency by simplifying the eSigning process and helping ensure that your documents are completed on time. With our platform, managing your tax documentation is straightforward.

-

Can airSlate SignNow integrate with other tools for Form 990 Schedule D management?

Absolutely! airSlate SignNow seamlessly integrates with various applications to enhance your Form 990 Schedule D management. Whether you use payment processing, CRM systems, or other productivity tools, our platform can connect to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule D?

Using airSlate SignNow for Form 990 Schedule D offers accessibility, speed, and security. Our platform allows you to eSign documents from anywhere, reducing delays in the filing process. Additionally, robust security features ensure that your important information remains protected.

Get more for Form 990 Schedule D

- Warning of default on commercial lease georgia form

- Warning of default on residential lease georgia form

- Landlord tenant closing statement to reconcile security deposit georgia form

- Name change for form

- Name change notification form georgia

- Commercial building or space lease georgia form

- Deed rights form

- Warranty deed georgia form

Find out other Form 990 Schedule D

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter