Form 1120 M 2 2011

What is the Form 1120 M-2

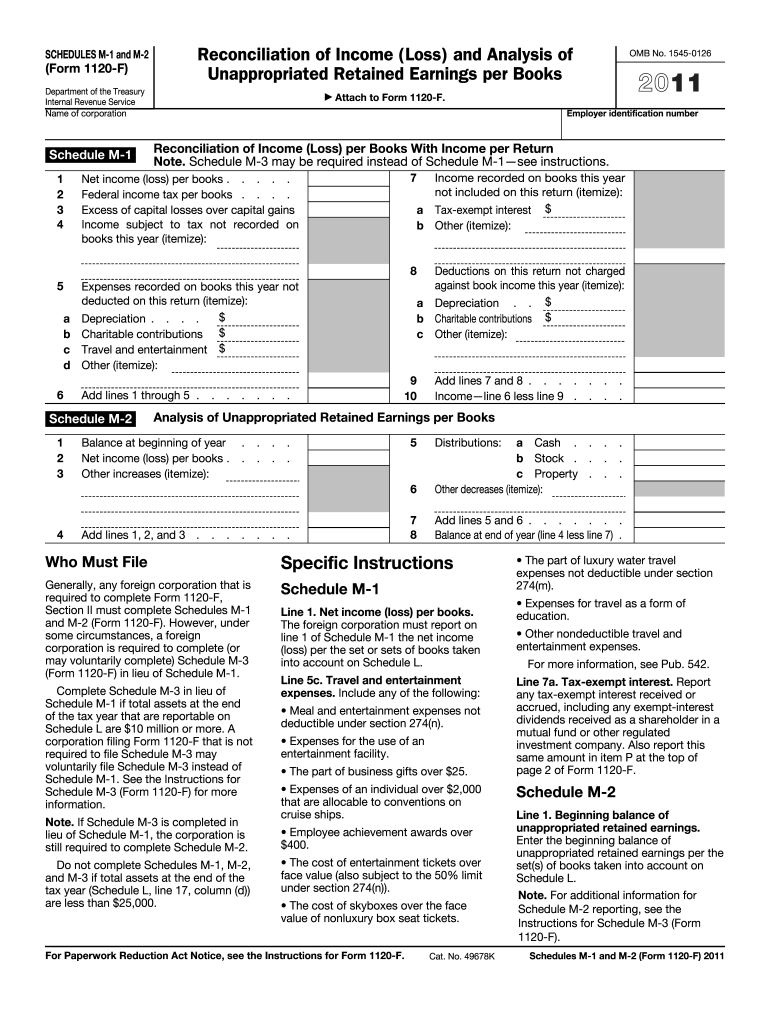

The Form 1120 M-2 is a tax form used by corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is specifically designed for corporations that are required to file an income tax return under Subchapter C of the Internal Revenue Code. It helps the IRS assess the tax liability of corporations and ensures compliance with federal tax regulations. The form includes various sections that require detailed financial information, making it essential for accurate tax reporting.

How to use the Form 1120 M-2

Using the Form 1120 M-2 involves several steps to ensure accurate completion and compliance with IRS requirements. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, carefully fill out each section of the form, ensuring that all figures are accurate and reflect your corporation's financial activities for the tax year. It is important to follow IRS guidelines closely, as errors can lead to delays or penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference and the specific requirements for your corporation.

Steps to complete the Form 1120 M-2

Completing the Form 1120 M-2 requires a systematic approach to ensure all information is accurate and comprehensive. Follow these steps:

- Collect all relevant financial documents, including income statements and expense records.

- Begin filling out the form by entering your corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report your corporation's total income in the appropriate section, including gross receipts and other income sources.

- Detail all allowable deductions, ensuring that you have documentation to support each claim.

- Calculate your corporation's taxable income and the resulting tax liability.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 1120 M-2

The Form 1120 M-2 is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal standing, it is crucial to provide accurate information and maintain compliance with all applicable tax laws. The form must be signed by an authorized officer of the corporation, which adds an additional layer of legal validity. Electronic signatures are accepted, provided that they meet the requirements set forth by the IRS. Adhering to these legal stipulations helps prevent issues such as audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 M-2 are critical for compliance. Typically, corporations must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For most corporations operating on a calendar year, this means the deadline is April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is important for corporations to be aware of these deadlines to avoid late filing penalties and interest charges.

Form Submission Methods

Corporations can submit the Form 1120 M-2 through various methods, including electronic filing and traditional mail. Electronic filing is often preferred due to its speed and efficiency, allowing for quicker processing by the IRS. Corporations can use IRS-approved software to file electronically, which also helps reduce errors. Alternatively, the form can be printed and mailed to the appropriate IRS address. When submitting by mail, it is advisable to use a trackable mailing service to confirm delivery.

Quick guide on how to complete form 1120 m 2 2011

Effortlessly Prepare Form 1120 M 2 on Any Device

Digital document management has gained widespread popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without hassles. Manage Form 1120 M 2 on any platform using airSlate SignNow's Android or iOS applications and simplify all document-related tasks today.

Edit and eSign Form 1120 M 2 with Ease

- Find Form 1120 M 2 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or hide sensitive details with the tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or errors requiring the printing of new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 1120 M 2 to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 m 2 2011

Create this form in 5 minutes!

How to create an eSignature for the form 1120 m 2 2011

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 1120 M 2?

Form 1120 M 2 is a tax form used by corporations to report specific income and deductions. It is essential for accurately filing corporate taxes and ensuring compliance with IRS regulations. Understanding Form 1120 M 2 can help businesses minimize their tax liability and streamline the tax filing process.

-

How does airSlate SignNow assist with Form 1120 M 2?

airSlate SignNow streamlines the process of sending and eSigning Form 1120 M 2 documents, making it easier for businesses to manage their tax filings. Our platform ensures that all necessary signatures are obtained promptly, allowing for a hassle-free submission. With airSlate SignNow, you can focus on your business while we handle the paperwork.

-

What are the pricing options for using airSlate SignNow to manage Form 1120 M 2?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Our plans provide cost-effective solutions for document management, including Form 1120 M 2. Visit our pricing page for detailed information about the options available to meet your budget and needs.

-

What features does airSlate SignNow offer for Form 1120 M 2 preparation?

With airSlate SignNow, users benefit from features such as document templates, eSigning, and cloud storage when preparing Form 1120 M 2. Our intuitive interface allows easy customization of tax forms, ensuring accuracy and compliance. These features help simplify the complex process of preparing and filing tax documents.

-

Can I integrate airSlate SignNow with my accounting software for Form 1120 M 2?

Yes, airSlate SignNow offers seamless integrations with various accounting software, enhancing the workflow for Form 1120 M 2 preparation. By connecting with your existing tools, you can import and manage data more efficiently. This integration eliminates redundancies and helps keep your records organized.

-

What are the benefits of using airSlate SignNow for my Form 1120 M 2 needs?

Using airSlate SignNow for your Form 1120 M 2 needs offers numerous benefits, including time savings and increased accuracy. Our platform automates processes and reduces human error, which can be crucial during tax season. Additionally, you'll gain access to a secure and compliant eSignature solution that enhances document management.

-

Is airSlate SignNow secure for handling Form 1120 M 2 documents?

Absolutely! airSlate SignNow prioritizes security, employing industry-standard encryption protocols to protect your Form 1120 M 2 documents. We adhere to compliance regulations to ensure your sensitive information remains safe throughout the signing process. You can trust us to keep your paperwork confidential and secure.

Get more for Form 1120 M 2

- Name affidavit of buyer georgia form

- Georgia affidavit form

- Non foreign affidavit under irc 1445 georgia form

- Owners or sellers affidavit of no liens georgia form

- Affidavit financial status 497303907 form

- Complex will with credit shelter marital trust for large estates georgia form

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497303911 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497303912 form

Find out other Form 1120 M 2

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent