IL 5754 Statement by Person Receiving Gambling Winnings Statement by Person Receiving Gambling Winnings Tax Illinois 2022

What is the IL 5754 Statement By Person Receiving Gambling Winnings

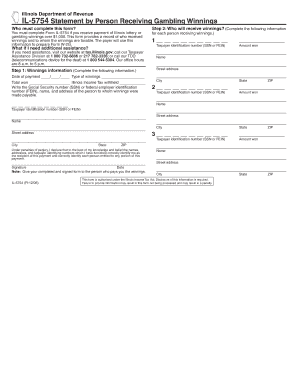

The IL 5754 Statement By Person Receiving Gambling Winnings is a tax form used in Illinois to report gambling winnings. This form is essential for individuals who receive gambling winnings that may be subject to state income tax. The IL 5754 serves as a declaration of the amount won and ensures compliance with state tax regulations. It is crucial for maintaining accurate records for both the taxpayer and the state, helping to clarify the tax obligations associated with gambling activities.

How to use the IL 5754 Statement By Person Receiving Gambling Winnings

Using the IL 5754 involves accurately reporting your gambling winnings to the state of Illinois. To complete the form, gather all relevant information regarding your gambling activities, including the total amount won and any taxes withheld. Once you have this information, fill out the form with the required details. After completing the IL 5754, you may need to submit it along with your state tax return, depending on your specific tax situation. Proper use of this form helps ensure that you meet your tax obligations and avoid potential penalties.

Steps to complete the IL 5754 Statement By Person Receiving Gambling Winnings

Completing the IL 5754 requires several key steps:

- Gather documentation of your gambling winnings, including receipts or statements from casinos or other gambling establishments.

- Fill in your personal information, such as your name, address, and Social Security number.

- Report the total amount of gambling winnings received during the tax year.

- Indicate any taxes that were withheld from your winnings.

- Review the completed form for accuracy before submitting it.

Legal use of the IL 5754 Statement By Person Receiving Gambling Winnings

The IL 5754 is legally recognized as a valid document for reporting gambling winnings in Illinois. It is important to use this form correctly to comply with state tax laws. Failure to report gambling winnings can lead to penalties, including fines or additional taxes owed. By using the IL 5754, taxpayers can ensure they are fulfilling their legal obligations while accurately reporting their income from gambling activities.

Key elements of the IL 5754 Statement By Person Receiving Gambling Winnings

Key elements of the IL 5754 include:

- Personal identification information of the taxpayer.

- The total amount of gambling winnings received.

- Any taxes withheld from the winnings.

- Signature of the taxpayer affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the IL 5754. Generally, the form must be submitted by the same deadline as your state income tax return. This is typically April 15 for most taxpayers. However, if you receive gambling winnings later in the year, ensure you report them in the appropriate tax year. Keeping track of these deadlines helps avoid late fees and ensures compliance with state tax regulations.

Quick guide on how to complete il 5754 statement by person receiving gambling winnings statement by person receiving gambling winnings tax illinois

Complete IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois effortlessly on any device

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois with ease

- Obtain IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow has designed for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Alter and eSign IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois while ensuring outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 5754 statement by person receiving gambling winnings statement by person receiving gambling winnings tax illinois

Create this form in 5 minutes!

How to create an eSignature for the il 5754 statement by person receiving gambling winnings statement by person receiving gambling winnings tax illinois

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IL 5754 Statement By Person Receiving Gambling Winnings?

The IL 5754 Statement By Person Receiving Gambling Winnings is a tax form used in Illinois to report gambling winnings. This form is essential for individuals who have received signNow gambling income and need to comply with state tax regulations. Properly completing this statement ensures that you meet your tax obligations in Illinois.

-

How can airSlate SignNow help with the IL 5754 Statement?

airSlate SignNow provides an efficient platform for creating, signing, and managing the IL 5754 Statement By Person Receiving Gambling Winnings. Our easy-to-use interface allows users to fill out the form digitally, ensuring accuracy and compliance with Illinois tax laws. This streamlines the process, saving you time and reducing the risk of errors.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your tax documents, including the IL 5754 Statement By Person Receiving Gambling Winnings, offers numerous benefits. Our platform enhances document security, provides easy access to templates, and allows for quick eSigning. This ensures that your tax filings are handled efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the IL 5754 Statement?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those who need to file the IL 5754 Statement By Person Receiving Gambling Winnings. Our plans are designed to be cost-effective, providing excellent value for businesses and individuals alike. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for tax filing?

Absolutely! airSlate SignNow can be integrated with various accounting and tax software, making it easier to manage your IL 5754 Statement By Person Receiving Gambling Winnings. This integration allows for seamless data transfer and ensures that your tax documents are always up-to-date. You can streamline your workflow and enhance productivity.

-

How secure is my information when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When you use our platform to manage the IL 5754 Statement By Person Receiving Gambling Winnings, your information is protected with advanced encryption and security protocols. We ensure that your sensitive data remains confidential and secure throughout the signing process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for document management, including customizable templates, eSigning, and real-time tracking. These features are particularly useful for managing the IL 5754 Statement By Person Receiving Gambling Winnings, as they simplify the process and enhance collaboration. You can easily monitor the status of your documents and ensure timely submissions.

Get more for IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois

- Application british overseas territory form

- Mac 1065 form

- Deferred payment agreement form

- Fillable texas home equity affidavit and agreement first lien form 3185

- Tax exempt form

- Tsp 60 form r

- Request for a roth transfer into the tsp request for a roth transfer into the tsp form

- Tsp 60 thrift savings plan form

Find out other IL 5754 Statement By Person Receiving Gambling Winnings Statement By Person Receiving Gambling Winnings Tax Illinois

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy