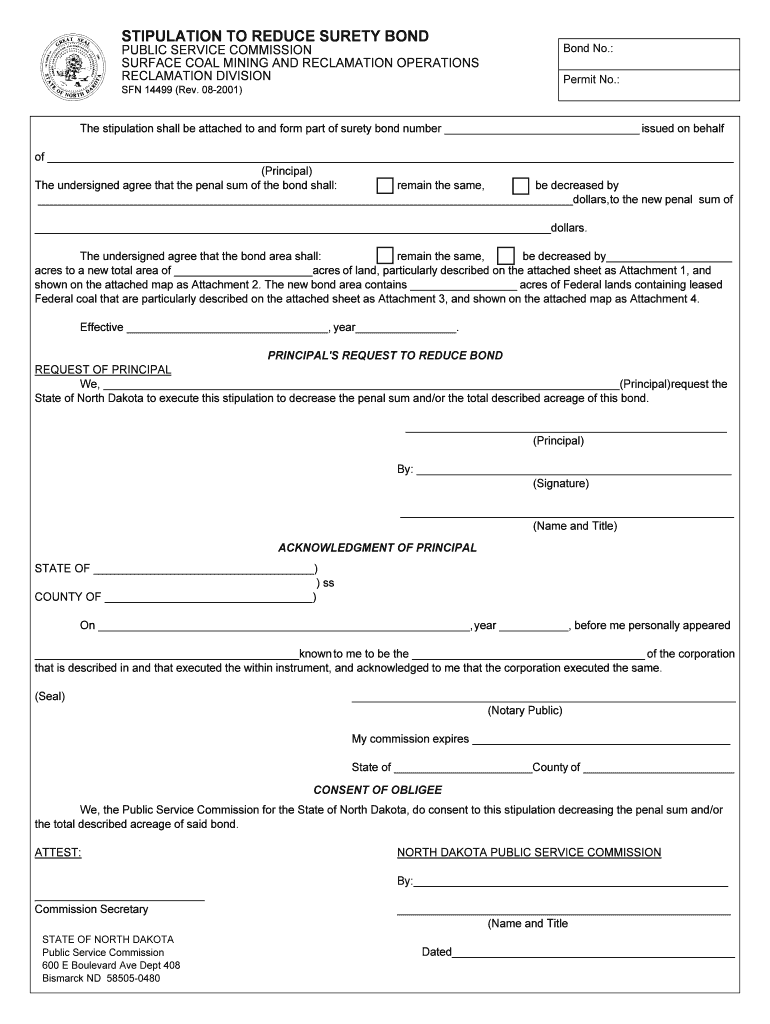

Printing L 408 FORMS 14499 FRP

What is the Printing L 408 FORMS 14499 FRP

The Printing L 408 FORMS 14499 FRP is a specific form used primarily within the framework of the Federal Reporting Program. This form is essential for businesses and organizations to report various financial activities and transactions to the Internal Revenue Service (IRS). It serves as a means to ensure compliance with federal regulations regarding income reporting, tax obligations, and other financial disclosures.

How to use the Printing L 408 FORMS 14499 FRP

Using the Printing L 408 FORMS 14499 FRP involves several key steps. First, gather all necessary information regarding the financial transactions that need to be reported. This includes details about the payees, amounts, and any relevant tax identification numbers. Next, fill out the form accurately, ensuring that all required fields are completed. After completing the form, it can be submitted either electronically or via traditional mail, depending on the specific requirements set forth by the IRS.

Steps to complete the Printing L 408 FORMS 14499 FRP

Completing the Printing L 408 FORMS 14499 FRP requires careful attention to detail. Follow these steps:

- Gather all relevant financial data, including transaction amounts and recipient information.

- Access the form, either digitally or through printed copies.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form according to IRS guidelines, either electronically or by mail.

Legal use of the Printing L 408 FORMS 14499 FRP

The legal use of the Printing L 408 FORMS 14499 FRP is crucial for maintaining compliance with federal tax laws. Businesses must accurately report their financial transactions to avoid penalties and ensure transparency. Failure to use this form correctly can lead to legal repercussions, including fines and audits. It is important to stay updated on any changes to regulations that may affect how this form should be used.

Filing Deadlines / Important Dates

Filing deadlines for the Printing L 408 FORMS 14499 FRP are established by the IRS and are critical for compliance. Typically, the form must be submitted by a specified date following the end of the tax year. It is essential for businesses to mark these deadlines on their calendars to avoid late submissions, which can incur penalties. Keeping track of these dates ensures that all reporting requirements are met in a timely manner.

Required Documents

To complete the Printing L 408 FORMS 14499 FRP, several documents are typically required. These may include:

- Financial records related to the transactions being reported.

- Tax identification numbers for both the business and the recipients.

- Previous year’s forms, if applicable, for reference.

Having these documents readily available will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete printing l 408 forms 14499 frp

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature with the Sign feature, which takes only a few seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors necessitating the reprinting of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Printing L 408 FORMS 14499 FRP

Create this form in 5 minutes!

How to create an eSignature for the printing l 408 forms 14499 frp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Printing L 408 FORMS 14499 FRP?

Printing L 408 FORMS 14499 FRP are specialized forms used for various business processes. These forms ensure compliance and streamline documentation, making them essential for organizations that require precise record-keeping. Utilizing airSlate SignNow, you can easily manage and eSign these forms.

-

How can airSlate SignNow help with Printing L 408 FORMS 14499 FRP?

airSlate SignNow provides a user-friendly platform to create, send, and eSign Printing L 408 FORMS 14499 FRP. The solution simplifies the entire process, allowing businesses to manage their documentation efficiently. With its intuitive interface, you can ensure that all forms are completed accurately and promptly.

-

What are the pricing options for using airSlate SignNow for Printing L 408 FORMS 14499 FRP?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses using Printing L 408 FORMS 14499 FRP. You can choose from various subscription tiers based on your usage and feature requirements. This flexibility ensures that you only pay for what you need while maximizing your investment.

-

Are there any integrations available for Printing L 408 FORMS 14499 FRP?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for Printing L 408 FORMS 14499 FRP. These integrations allow you to connect with CRM systems, cloud storage, and other tools, ensuring a smooth document management process. This connectivity helps streamline your operations and improve efficiency.

-

What are the benefits of using airSlate SignNow for Printing L 408 FORMS 14499 FRP?

Using airSlate SignNow for Printing L 408 FORMS 14499 FRP offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform allows for quick eSigning and tracking of forms, which saves time and minimizes errors. Additionally, it provides a secure environment for sensitive documents.

-

Can I customize Printing L 408 FORMS 14499 FRP in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize Printing L 408 FORMS 14499 FRP to fit your specific business needs. You can add your branding, modify fields, and adjust layouts to ensure that the forms meet your requirements. This customization enhances the user experience and maintains your brand identity.

-

Is it easy to track the status of Printing L 408 FORMS 14499 FRP with airSlate SignNow?

Yes, airSlate SignNow provides robust tracking features for Printing L 408 FORMS 14499 FRP. You can easily monitor the status of each form, including who has signed and who still needs to take action. This transparency helps you manage your documents effectively and ensures timely completion.

Get more for Printing L 408 FORMS 14499 FRP

Find out other Printing L 408 FORMS 14499 FRP

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors