Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name and Initial Last Name Social Security Number If You Form

Understanding the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

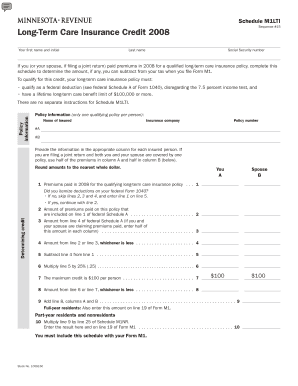

The Schedule M1LTI Sequence #15 Long Term Care Insurance Credit is designed for taxpayers who have paid premiums for qualified long-term care insurance. This credit can help reduce your overall tax liability. It is essential for individuals or couples filing a joint return to accurately report their premiums and provide their names and Social Security numbers. This credit is particularly beneficial for those planning for future healthcare needs, as it acknowledges the financial burden of long-term care.

Steps to Complete the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

Completing the Schedule M1LTI Sequence #15 involves several key steps:

- Gather all necessary documentation regarding long-term care insurance premiums paid.

- Fill in your first name, initial of your last name, and Social Security number, as well as your spouse's information if filing jointly.

- Calculate the total amount of premiums paid for qualified long-term care insurance during the tax year.

- Enter the calculated amount on the appropriate line of the Schedule M1LTI.

- Review your entries for accuracy before submitting the form.

Eligibility Criteria for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

To qualify for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit, you must meet specific eligibility criteria:

- You must have paid premiums for a qualified long-term care insurance policy.

- The policy must meet IRS requirements for long-term care insurance.

- Taxpayers must be filing a tax return, either individually or jointly with a spouse.

Required Documents for Filing the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

When preparing to file the Schedule M1LTI, ensure you have the following documents ready:

- Proof of premium payments, such as receipts or statements from your insurance provider.

- Your Social Security number and that of your spouse if applicable.

- Any other relevant tax documents that support your claim for the credit.

IRS Guidelines for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

The IRS provides specific guidelines for claiming the Schedule M1LTI Sequence #15 credit. It is crucial to follow these guidelines to ensure compliance and avoid penalties:

- Review the IRS instructions for Schedule M1LTI to understand the eligibility and documentation requirements.

- Ensure that the long-term care insurance policy meets the IRS definition of qualified coverage.

- Keep records of all documents used to support your claim for at least three years after filing.

Filing Deadlines for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit

Filing deadlines for the Schedule M1LTI Sequence #15 are aligned with the general tax filing deadlines. Typically, the deadline for filing your federal tax return is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to file your return on time to avoid penalties and interest on any taxes owed.

Quick guide on how to complete schedule m1lti sequence 15 long term care insurance credit your first name and initial last name social security number if you

Complete [SKS] effortlessly on any device

Online document administration has become popular among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the right form and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to initiate.

- Utilize the tools we provide to finalize your document.

- Select signNow parts of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Decide how you wish to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign [SKS] and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

Create this form in 5 minutes!

How to create an eSignature for the schedule m1lti sequence 15 long term care insurance credit your first name and initial last name social security number if you

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

The Schedule M1LTI Sequence #15 Long Term Care Insurance Credit allows taxpayers to claim a credit for premiums paid for qualified long-term care insurance. This credit is available if you or your spouse, if filing a joint return, paid premiums in for a qualified long-term care insurance policy. It's essential to provide your first name, initial last name, and Social Security number when filing.

-

Who qualifies for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

To qualify for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit, you must have paid premiums for a qualified long-term care insurance policy. This applies to you or your spouse if you are filing a joint return. Ensure that the policy meets the necessary requirements set by the IRS to be eligible for the credit.

-

How do I apply for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

To apply for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit, you need to complete the appropriate tax forms, including providing your first name, initial last name, and Social Security number. Make sure to include documentation of the premiums paid for qualified long-term care insurance. Consulting a tax professional can help ensure you complete the application correctly.

-

What are the benefits of claiming the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

Claiming the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit can signNowly reduce your tax liability. This credit helps offset the costs of long-term care insurance premiums, making it more affordable. By utilizing this credit, you can ensure better financial planning for potential long-term care needs.

-

Are there any limitations on the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

Yes, there are limitations on the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit. The amount of the credit may be capped based on the premiums paid and the age of the insured. It's crucial to review the IRS guidelines to understand the specific limitations that may apply to your situation.

-

Can I claim the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit for my spouse?

Yes, you can claim the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit for your spouse if you are filing a joint return. Ensure that you provide your spouse's first name, initial last name, and Social Security number, along with the premiums paid for their qualified long-term care insurance policy.

-

What documents do I need to provide for the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit?

To claim the Schedule M1LTI Sequence #15 Long Term Care Insurance Credit, you need to provide documentation of the premiums paid for qualified long-term care insurance. This includes policy statements and proof of payment. Additionally, include your first name, initial last name, and Social Security number on your tax forms.

Get more for Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

Find out other Schedule M1LTI Sequence #15 Long Term Care Insurance Credit Your First Name And Initial Last Name Social Security Number If You

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later