Form 2350 2014

What is the Form 2350

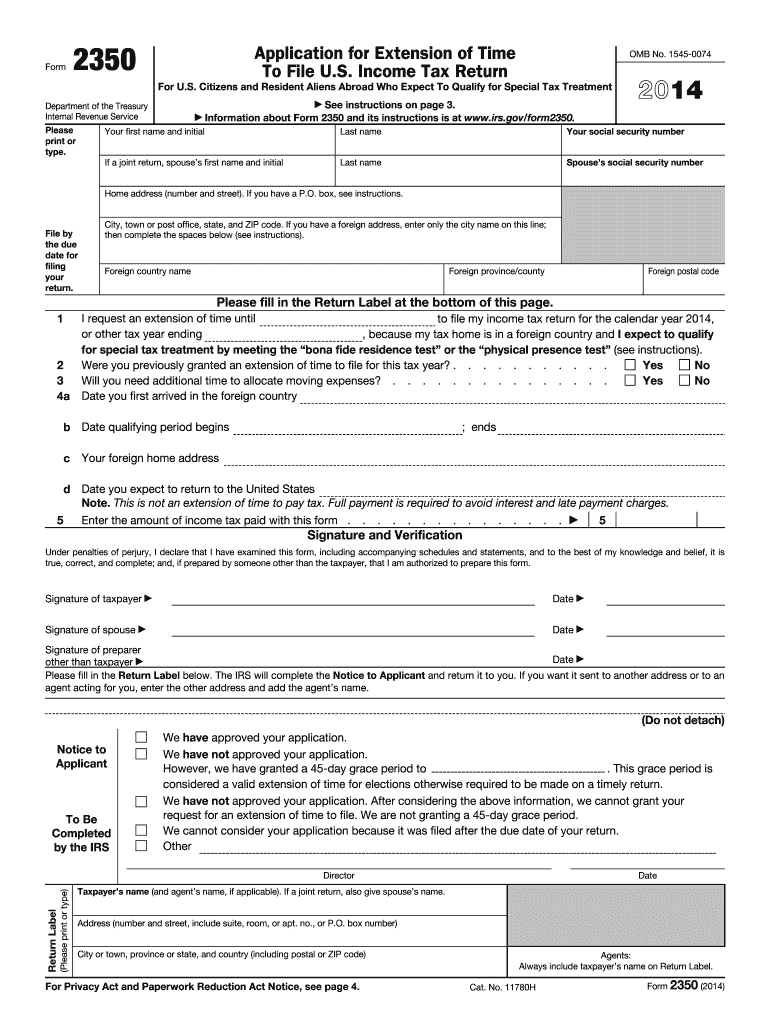

The Form 2350, officially known as the Application for Extension of Time to File U.S. Income Tax Return, is a document used by taxpayers in the United States to request an extension for filing their federal income tax returns. This form is particularly useful for individuals who need additional time to gather necessary documentation or who may be facing extenuating circumstances that prevent them from filing by the standard deadline. By submitting Form 2350, taxpayers can extend their filing deadline, typically by six months, ensuring they avoid late filing penalties.

How to use the Form 2350

Using Form 2350 involves several straightforward steps. First, taxpayers must accurately complete the form by providing their personal information, including name, address, and Social Security number. Next, they should indicate the type of tax return they are extending, typically the Form 1040. It is essential to provide a valid reason for the extension request, as this helps the IRS understand the taxpayer's situation. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference and the IRS guidelines for that tax year.

Steps to complete the Form 2350

Completing Form 2350 requires careful attention to detail. The following steps outline the process:

- Gather necessary documents, such as income statements and previous tax returns.

- Fill out the personal information section, ensuring accuracy.

- Specify the type of tax return for which you are requesting an extension.

- Provide a valid reason for needing the extension.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the IRS e-file system or mail it to the appropriate address.

Legal use of the Form 2350

The legal use of Form 2350 is governed by IRS regulations. When properly completed and submitted, the form serves as a legitimate request for an extension of time to file a tax return. It is crucial for taxpayers to adhere to the guidelines set forth by the IRS to ensure their extension is granted. Failure to comply with these regulations may result in penalties or interest on any taxes owed. Additionally, the form must be submitted before the original tax filing deadline to be considered valid.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 2350 is vital for taxpayers. The standard deadline for filing individual tax returns is typically April 15. If a taxpayer submits Form 2350 by this date, they can receive an extension until October 15. However, it is important to note that this extension only applies to the filing of the return, not the payment of any taxes owed. Taxpayers should ensure that any taxes due are paid by the original deadline to avoid penalties.

Required Documents

When completing Form 2350, certain documents may be required to support the extension request. These documents can include:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Any other documentation that substantiates the reason for the extension.

Having these documents readily available can streamline the completion process and ensure accuracy in the information provided.

Quick guide on how to complete 2014 form 2350

Effortlessly prepare Form 2350 on any device

The management of online documents has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents quickly and without delays. Handle Form 2350 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form 2350 without hassle

- Find Form 2350 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors requiring new printed document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 2350 to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 2350

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 2350

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Form 2350 and how does it work with airSlate SignNow?

Form 2350 is a crucial document used by taxpayers to request an extension for filing their tax returns. With airSlate SignNow, you can easily upload, send, and eSign your Form 2350 securely, ensuring that your tax extension requests are processed without delays.

-

Can I customize Form 2350 templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form 2350 templates to fit your specific needs. You can add your branding, modify fields, and create a streamlined signing experience for all parties involved.

-

Is there a cost associated with using airSlate SignNow for Form 2350?

airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. You can choose a plan that best suits your needs for managing Form 2350 and other documents with ease.

-

What features does airSlate SignNow offer for managing Form 2350?

airSlate SignNow provides a range of features for managing Form 2350, including document tracking, automated reminders, and a user-friendly interface for signing. These features help streamline the process and ensure that your tax form is submitted on time.

-

How secure is the signing process for Form 2350 with airSlate SignNow?

The signing process for Form 2350 with airSlate SignNow is highly secure, with end-to-end encryption and compliance with industry standards. Your sensitive tax information is protected, giving you peace of mind while managing your documents.

-

Can I integrate airSlate SignNow with other software for handling Form 2350?

Yes, airSlate SignNow offers seamless integrations with various software tools, making it easy to manage Form 2350 alongside your existing workflows. Integrations with CRM systems, cloud storage, and more enhance your document management capabilities.

-

What are the benefits of using airSlate SignNow for Form 2350 over traditional methods?

Using airSlate SignNow for Form 2350 offers numerous benefits over traditional methods, including faster processing times, reduced paperwork, and enhanced accessibility. This digital solution simplifies the eSigning process, making it more efficient and eco-friendly.

Get more for Form 2350

- Huntington hospital tuition reimbursement application form

- Functions related to patient care at tgh are required to complete an authorization form

- 2450 holcombe blvd form

- Identification user form

- Whalen ampamp mcelmoyle family medicine whalen ampamp mcelmoyle family medicine form

- Mecnewpatientinfoform2015rev415doc

- Californiachoice new hire enrollment quote request cc 0170 form

- Workplace health amp wellness form

Find out other Form 2350

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free