990pf Form 2015

What is the 990pf Form

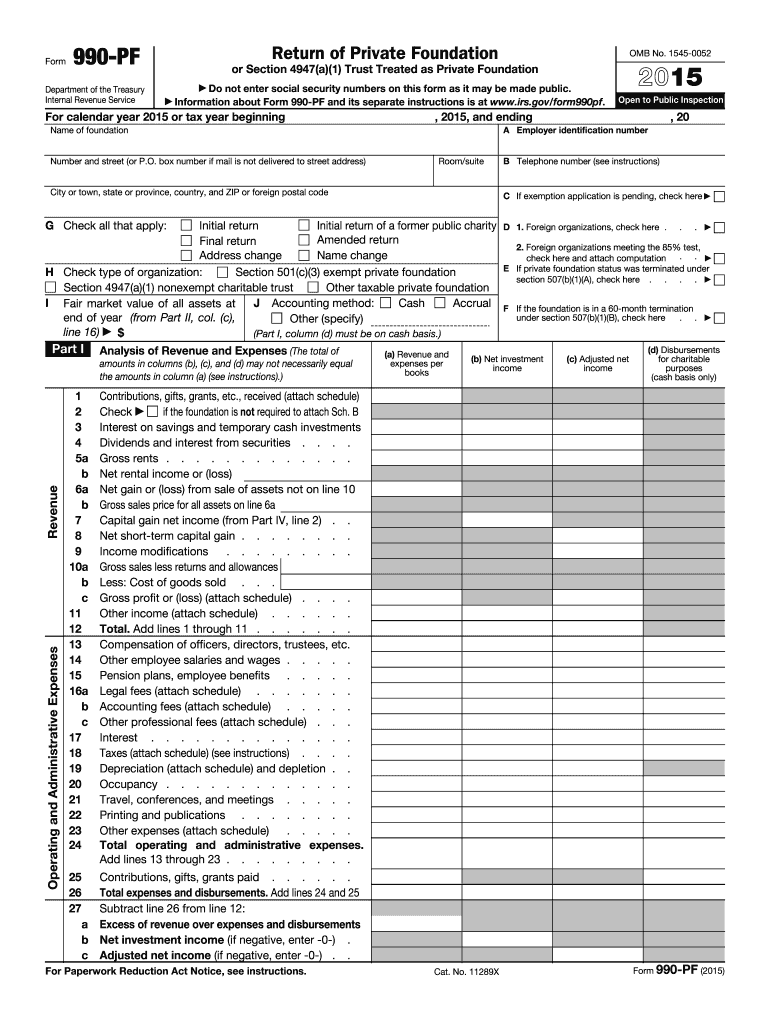

The 990pf Form, officially known as the Return of Private Foundation, is a tax document required by the Internal Revenue Service (IRS) for private foundations in the United States. This form provides detailed information about the foundation's financial activities, including income, expenses, and grants made during the tax year. It is essential for maintaining compliance with federal tax regulations and ensuring transparency in the foundation's operations.

How to use the 990pf Form

Using the 990pf Form involves several key steps to ensure accurate and compliant reporting. First, gather all necessary financial records, including income statements, balance sheets, and documentation of grants and expenditures. Next, complete the form by entering the required information in the designated sections, such as revenue sources and disbursements. After filling out the form, review it for accuracy and completeness before submitting it to the IRS. Utilizing eSignature solutions can facilitate the signing process, ensuring that the form is submitted efficiently and securely.

Steps to complete the 990pf Form

Completing the 990pf Form requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including bank statements and previous tax returns.

- Fill out the identification section, providing the foundation's name, address, and Employer Identification Number (EIN).

- Report the foundation's revenue, including contributions and investment income.

- Detail expenses, including administrative costs and grants awarded.

- Ensure all required schedules are completed, such as Schedule A for public charity status or Schedule B for contributors.

- Review the form for accuracy, ensuring all calculations are correct.

- Submit the completed form to the IRS by the designated deadline.

Legal use of the 990pf Form

The 990pf Form serves as a legal document that must be filed annually by private foundations. Its completion and submission are governed by IRS regulations, which require accurate reporting of financial activities. Failure to file the form or providing false information can result in penalties, including fines and loss of tax-exempt status. It is crucial for foundations to adhere to these legal requirements to maintain compliance and uphold their charitable missions.

Filing Deadlines / Important Dates

The filing deadline for the 990pf Form is typically the fifteenth day of the fifth month after the end of the foundation's fiscal year. For most private foundations operating on a calendar year, this means the form is due on May fifteenth. If additional time is needed, foundations can file for an extension, allowing for up to six additional months to submit the form. It is essential to keep track of these deadlines to avoid late fees and penalties.

Examples of using the 990pf Form

Private foundations use the 990pf Form to report a variety of financial activities. For instance, a foundation that provides grants to educational institutions must detail the amounts granted, the purpose of the grants, and the organizations receiving the funds. Additionally, foundations that invest in stocks or bonds must report their investment income and any changes in asset values. These examples illustrate the form's role in ensuring transparency and accountability in the foundation's financial practices.

Quick guide on how to complete 2015 990pf form

Easily Prepare 990pf Form on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage 990pf Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign 990pf Form Effortlessly

- Find 990pf Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal standing as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and eSign 990pf Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 990pf form

Create this form in 5 minutes!

How to create an eSignature for the 2015 990pf form

The best way to make an electronic signature for your PDF document in the online mode

The best way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the 990pf Form and why do I need it?

The 990pf Form is a crucial tax document for private foundations in the United States, required by the IRS for compliance and transparency. By filing the 990pf Form, organizations demonstrate their financial activities, ensuring accountability and maintaining tax-exempt status. Understanding its requirements is essential for any foundation.

-

How can airSlate SignNow help with the 990pf Form?

airSlate SignNow simplifies the process of preparing and submitting the 990pf Form by providing an intuitive platform for eSigning and document management. You can upload, edit, and share your 990pf Form securely, ensuring compliance and streamlining the filing process. This makes managing your foundation's documentation easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for the 990pf Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different organizational needs, including options for nonprofits. While there is a fee associated with using our platform, the cost is minimal compared to the time and resources saved in managing the 990pf Form and other documents. Explore our pricing page to find the best plan for your foundation.

-

What features does airSlate SignNow offer for managing the 990pf Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows specifically designed for documents like the 990pf Form. These functionalities allow you to streamline document preparation, reduce errors, and ensure timely submissions. Our user-friendly interface makes it easy to navigate and manage your filings.

-

Can I integrate airSlate SignNow with other software for the 990pf Form?

Absolutely! airSlate SignNow supports integrations with various accounting, tax preparation, and document management software, enhancing your ability to manage the 990pf Form efficiently. This ensures that all your financial data is synchronized and simplifies the workflow for filing your tax documents.

-

What are the benefits of using airSlate SignNow for the 990pf Form?

Using airSlate SignNow for the 990pf Form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your sensitive information remains confidential while providing a hassle-free solution for eSigning and sharing documents. This means your organization can focus more on its mission and less on paperwork.

-

Is airSlate SignNow user-friendly for filing the 990pf Form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to file the 990pf Form without extensive training. Our straightforward interface allows users to navigate the essential features quickly, ensuring that even those unfamiliar with digital forms can complete their filings with confidence.

Get more for 990pf Form

- Additional affected sibling for trio requisition form

- Track daily activity with apple watch apple support form

- Kristofer j jones md orthopaedic surgery sports medicine form

- Cancer form

- Bcia 8016 form instructions

- Cub scout medical form a b 2011

- Guardian group life claim form gg42

- Travel awards the american association of immunologists form

Find out other 990pf Form

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document