Earned Income Credit Tax Table Form 2013

What is the Earned Income Credit Tax Table Form

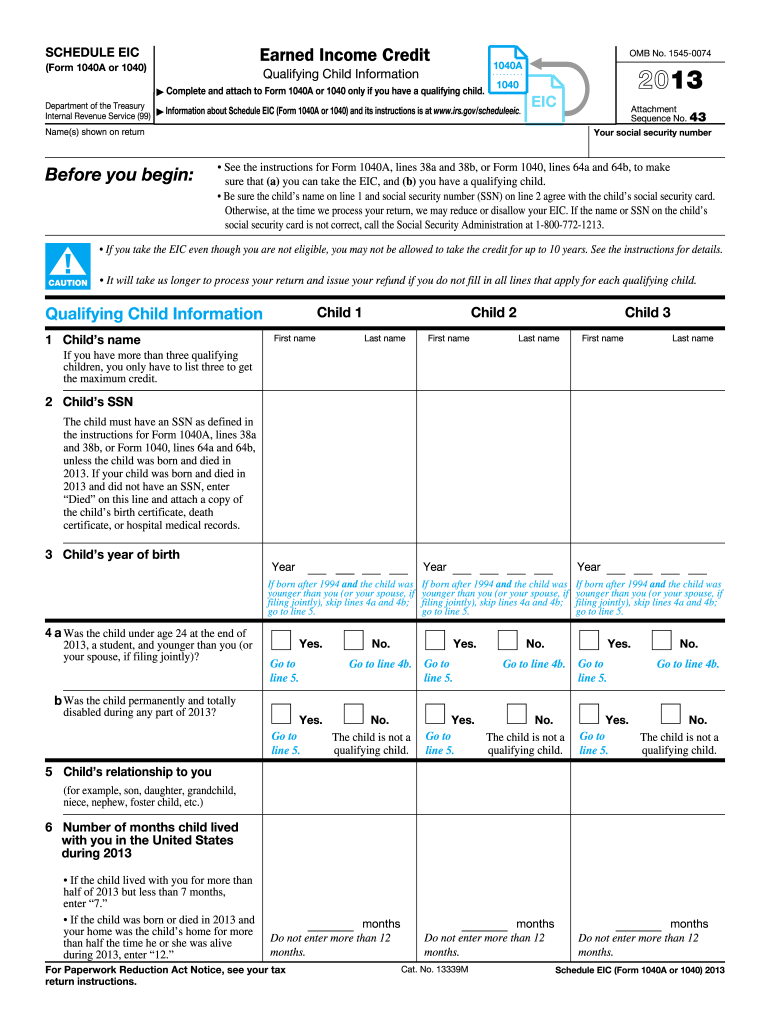

The Earned Income Credit Tax Table Form is a document used by eligible taxpayers in the United States to determine their eligibility for the Earned Income Tax Credit (EITC). This credit is designed to benefit low- to moderate-income workers, providing them with a refundable tax credit that can reduce their tax liability or result in a refund. The form includes a table that outlines the income thresholds and credit amounts based on filing status and the number of qualifying children. Understanding this form is essential for maximizing potential tax benefits.

How to use the Earned Income Credit Tax Table Form

Using the Earned Income Credit Tax Table Form involves several steps. First, taxpayers need to gather their income information for the tax year. Next, they should identify their filing status, whether single, married filing jointly, or head of household. Once this information is collected, taxpayers can reference the tax table to determine their credit amount based on their earned income and number of qualifying children. It is important to ensure that all information is accurate to avoid any discrepancies during the filing process.

Steps to complete the Earned Income Credit Tax Table Form

Completing the Earned Income Credit Tax Table Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including W-2 forms and any other income statements.

- Determine your filing status and the number of qualifying children you have.

- Locate the Earned Income Credit Tax Table in the IRS instructions for your tax return.

- Find your income range in the table and note the corresponding credit amount.

- Fill out the relevant sections of your tax return, including the calculated credit.

Eligibility Criteria

To qualify for the Earned Income Tax Credit, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits set by the IRS, which vary based on filing status and number of children.

- Having a valid Social Security number.

- Being a U.S. citizen or a resident alien for the entire tax year.

- Not filing as married filing separately.

Form Submission Methods

The Earned Income Credit Tax Table Form can be submitted through various methods. Taxpayers can file their tax returns online using tax preparation software, which often includes the necessary forms and calculations. Alternatively, individuals may choose to mail their completed tax returns to the IRS. For those who prefer in-person assistance, many local tax preparation services can help with form completion and submission. Each method has its own advantages, depending on the taxpayer's comfort level and resources.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the Earned Income Credit Tax Table Form. These guidelines outline eligibility requirements, income limits, and the process for claiming the credit. Taxpayers are encouraged to review the instructions provided by the IRS carefully to ensure compliance and to understand the implications of the credit on their overall tax situation. Staying informed about any updates to the tax code is crucial for accurate filing.

Quick guide on how to complete earned income credit tax table 2013 form

Accomplish Earned Income Credit Tax Table Form effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Handle Earned Income Credit Tax Table Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

The simplest method to modify and electronically sign Earned Income Credit Tax Table Form without hassle

- Find Earned Income Credit Tax Table Form and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method of delivering your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Earned Income Credit Tax Table Form to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct earned income credit tax table 2013 form

Create this form in 5 minutes!

How to create an eSignature for the earned income credit tax table 2013 form

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Earned Income Credit Tax Table Form?

The Earned Income Credit Tax Table Form is a crucial IRS document that helps taxpayers determine their eligibility for the Earned Income Tax Credit (EITC). This form establishes the amount of credit you can claim based on your income level and number of qualifying children. Understanding this form is essential for ensuring you receive the maximum tax benefits available.

-

How can I use the Earned Income Credit Tax Table Form when filing taxes?

To use the Earned Income Credit Tax Table Form effectively, first verify your eligibility by reviewing your income and family structure. Then, follow the instructions on the form to calculate your potential credit amount and fill it out accurately to avoid any issues during tax filing. Incorporating this form into your tax preparation process can signNowly optimize your refund.

-

Is there a cost associated with the Earned Income Credit Tax Table Form?

The Earned Income Credit Tax Table Form itself is provided by the IRS at no cost. However, if you utilize tax preparation software or services, there may be associated fees. It's recommended to explore free resources or services that can help you understand and complete this form without incurring unnecessary costs.

-

How does airSlate SignNow facilitate the use of the Earned Income Credit Tax Table Form?

airSlate SignNow streamlines the process of completing the Earned Income Credit Tax Table Form by letting users electronically sign and send documentation securely. Our platform provides intuitive templates and integrated collaborative tools that simplify tax document management. This way, you can focus more on maximizing your tax benefits rather than struggling with paperwork.

-

What features does airSlate SignNow offer for tax-related documents?

airSlate SignNow offers features like e-signatures, document templates, and cloud storage specifically designed for tax documents, including the Earned Income Credit Tax Table Form. Users can track the status of their documents, send reminders, and ensure compliance with legal standards. These features enhance efficiency and security when managing financial documents.

-

Can the Earned Income Credit Tax Table Form be integrated with other software?

Yes, the Earned Income Credit Tax Table Form can be integrated with various tax preparation and accounting software through airSlate SignNow's open API. This facilitates seamless data transfer and management between platforms, saving time and reducing errors. Such integrations ensure you have all necessary documents organized within your preferred systems.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Earned Income Credit Tax Table Form provides efficiency, security, and ease of use. Our solution allows for quick and secure document signing, reducing the need for paper and in-person meetings. Additionally, the platform ensures your documents are compliant and easily accessible, enhancing overall productivity during tax season.

Get more for Earned Income Credit Tax Table Form

- South african journal of science volume 112 issue 34 form

- 1 insuredannuitant information

- 3 2 1 code it second edition pdf free download epdf form

- Request for policy surrender form

- Physical exam checklist template form

- Cigna ivig prior authorization form

- Quality reporting form

- Gastroenterology intake form

Find out other Earned Income Credit Tax Table Form

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document