1120 S Form 2010

What is the 1120 S Form

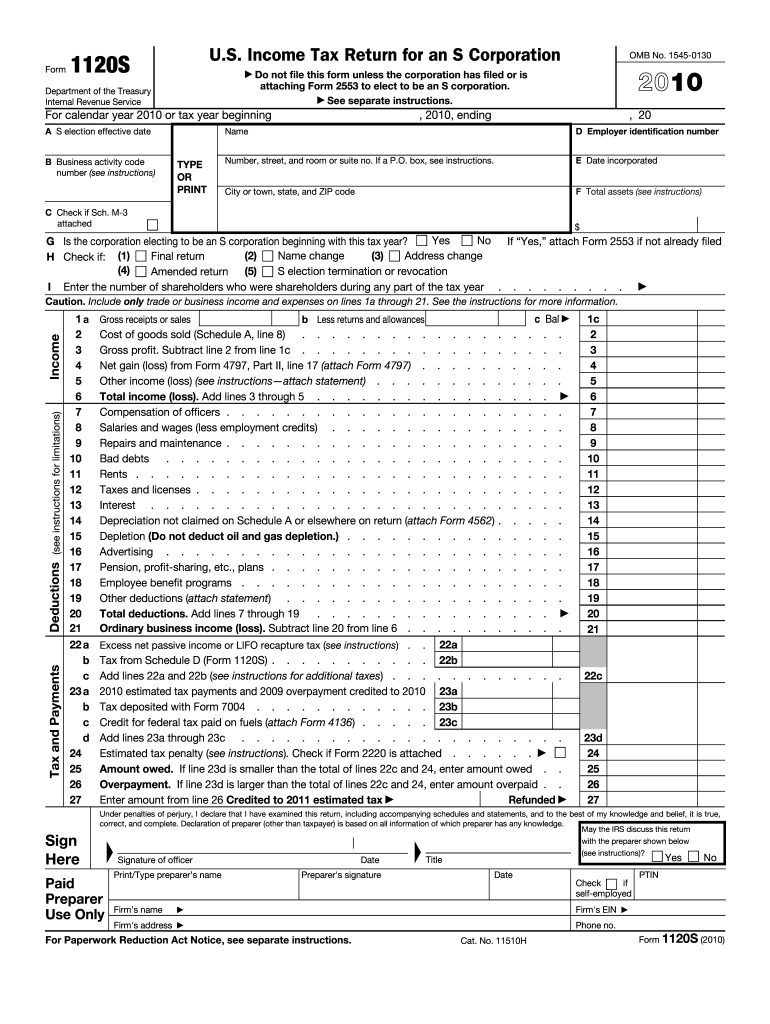

The 1120 S Form is a tax return form used by S corporations in the United States to report income, deductions, and credits. This form is essential for S corporations, which are special types of corporations that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The shareholders then report this information on their personal tax returns, avoiding double taxation at the corporate level.

How to use the 1120 S Form

To use the 1120 S Form effectively, S corporations must gather all necessary financial information for the tax year. This includes income from sales, cost of goods sold, and various business expenses. The form requires detailed reporting of income and deductions, and it must be signed by an authorized officer of the corporation. Once completed, the form is submitted to the IRS, along with any required schedules and attachments.

Steps to complete the 1120 S Form

Completing the 1120 S Form involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the form, starting with basic information such as the corporation's name, address, and Employer Identification Number (EIN).

- Report income, including gross receipts and other income sources.

- Detail deductions, such as salaries, rent, and other business expenses.

- Complete any necessary schedules, such as Schedule K-1, which reports each shareholder's share of income, deductions, and credits.

- Review the completed form for accuracy and ensure it is signed by an authorized officer.

Filing Deadlines / Important Dates

The deadline for filing the 1120 S Form is typically March 15 for calendar year taxpayers. If the corporation operates on a fiscal year basis, the form is due on the fifteenth day of the third month following the end of the fiscal year. Extensions can be requested, allowing for an additional six months to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal use of the 1120 S Form

The 1120 S Form is legally required for S corporations to report their income and expenses to the IRS. Proper completion and timely submission of this form ensure compliance with federal tax laws. Failure to file can result in penalties, including fines and interest on unpaid taxes. It is crucial for S corporations to maintain accurate records and adhere to all IRS guidelines regarding the use of this form.

Key elements of the 1120 S Form

The 1120 S Form includes several key elements that are essential for accurate reporting:

- Income Section: Details all sources of income, including sales and interest.

- Deductions Section: Lists all allowable business expenses that can reduce taxable income.

- Schedule K: Provides a summary of income, deductions, and credits for the corporation.

- Schedule K-1: Distributes income and deductions to individual shareholders for their personal tax returns.

Quick guide on how to complete 2010 1120 s form

Complete 1120 S Form seamlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Manage 1120 S Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest way to modify and eSign 1120 S Form effortlessly

- Find 1120 S Form and then click Get Form to initiate.

- Take advantage of the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Choose your preferred method to deliver your form—via email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you prefer. Alter and eSign 1120 S Form and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 1120 s form

Create this form in 5 minutes!

How to create an eSignature for the 2010 1120 s form

The best way to make an eSignature for a PDF in the online mode

The best way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the 1120 S Form and why is it important?

The 1120 S Form is a tax return form used by S corporations to report income, deductions, and taxes. It's crucial because it helps businesses comply with IRS regulations effectively while minimizing tax liabilities. Understanding how to accurately complete the 1120 S Form can save your business money and prevent potential legal issues.

-

How can airSlate SignNow help in managing the 1120 S Form?

airSlate SignNow simplifies the process of signing and sending the 1120 S Form electronically. With its user-friendly interface, you can easily upload your completed form, gather necessary signatures, and track document status in real-time, making tax season less stressful. This feature ensures that you can focus more on your business rather than paperwork.

-

What are the pricing options for using airSlate SignNow for 1120 S Form signing?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including monthly and annual subscriptions. Features such as unlimited document signing and templates are available in various tiers, ensuring you can manage your 1120 S Form effectively without breaking the bank. Visit our pricing page to find the perfect plan tailored for your needs.

-

Are there any features in airSlate SignNow specifically designed for the 1120 S Form?

Yes, airSlate SignNow includes features like customizable templates, document workflows, and audit trails specifically designed for managing forms like the 1120 S Form. These features help streamline the signing process, ensuring that all necessary signatures are obtained and documented properly. This reduces errors and improves compliance with IRS requirements.

-

Can I integrate airSlate SignNow with my accounting software for the 1120 S Form?

Absolutely! airSlate SignNow supports various integrations with popular accounting software, allowing you to import and export data necessary for the 1120 S Form seamlessly. This integration saves time and eliminates errors by ensuring that your financial data is accurate and readily available for tax preparation.

-

Is it safe to use airSlate SignNow for signing the 1120 S Form?

Yes, airSlate SignNow utilizes advanced encryption and security protocols to protect your documents, including the 1120 S Form. Our platform complies with strict security measures to ensure that your sensitive information remains private and secure. You can sign with confidence, knowing your data is in good hands.

-

What are the benefits of using airSlate SignNow for my 1120 S Form needs?

Using airSlate SignNow to handle your 1120 S Form offers numerous benefits, including fast and efficient document signing, cost savings on printing and faxing, and improved organization of your tax documents. Our solution enhances collaboration among team members, ensuring that everyone can access and sign the document promptly, resulting in quicker filing times.

Get more for 1120 S Form

Find out other 1120 S Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online