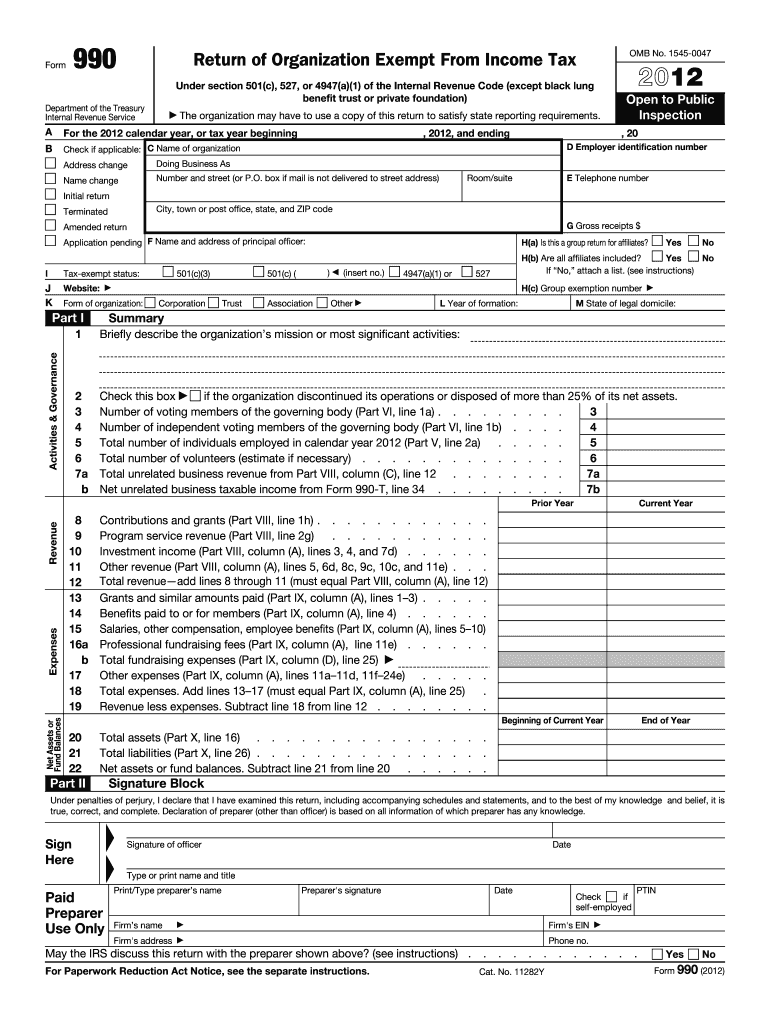

Form Irs 2012

What is the Form Irs

The Form Irs refers to various forms issued by the Internal Revenue Service (IRS) for tax purposes. These forms are essential for individuals and businesses to report income, claim deductions, and fulfill their tax obligations. Each form serves a specific purpose, such as the W-2 for reporting wages or the 1040 for individual income tax returns. Understanding the purpose of each form is crucial for compliance with federal tax laws.

How to use the Form Irs

Using the Form Irs involves several steps, starting with identifying the correct form for your tax situation. Once you have the appropriate form, you need to gather necessary information, such as income details and deductions. After filling out the form accurately, you can submit it electronically or by mail. It is important to ensure that all entries are correct to avoid delays or penalties.

Steps to complete the Form Irs

Completing the Form Irs requires careful attention to detail. Follow these steps:

- Determine the correct form based on your tax situation.

- Gather all necessary documents, including income statements and receipts for deductions.

- Fill out the form accurately, ensuring all information is complete.

- Review the form for any errors or omissions.

- Submit the form by the deadline, either electronically or via mail.

Legal use of the Form Irs

The legal use of the Form Irs is governed by IRS regulations. It is essential to use the form as intended to ensure compliance with tax laws. Falsifying information or failing to file the form can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of the form helps taxpayers avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form Irs vary depending on the specific form and the taxpayer's situation. Generally, individual income tax returns are due on April 15 of each year. However, extensions may be available. It is important to keep track of these deadlines to avoid late fees and ensure timely processing of your tax documents.

Form Submission Methods (Online / Mail / In-Person)

There are several methods to submit the Form Irs. Taxpayers can file online using IRS-approved e-filing software, which is often the fastest method. Alternatively, forms can be mailed to the appropriate IRS address based on the form type and the taxpayer's location. In-person submission is typically reserved for specific situations, such as seeking assistance from IRS representatives at local offices.

Penalties for Non-Compliance

Failing to comply with the requirements of the Form Irs can lead to various penalties. These may include financial fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing of tax forms.

Quick guide on how to complete 2012 form irs

Complete Form Irs effortlessly on any gadget

Web-based document administration has become increasingly favored by companies and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed files, allowing you to obtain the correct format and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form Irs on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and eSign Form Irs with ease

- Find Form Irs and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then hit the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from your preferred device. Edit and eSign Form Irs and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form irs

Create this form in 5 minutes!

How to create an eSignature for the 2012 form irs

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form Irs and how can airSlate SignNow help with it?

Form Irs is a crucial document used for various tax-related purposes. airSlate SignNow simplifies the process of completing and signing Form Irs by providing an intuitive platform where users can easily fill out, sign, and send their forms securely.

-

Is there a free trial available for using airSlate SignNow with Form Irs?

Yes, airSlate SignNow offers a free trial, allowing users to explore its features and functionalities related to Form Irs. This trial provides an opportunity to experience the ease of eSigning and document management without any initial investment.

-

What features does airSlate SignNow offer for managing Form Irs?

airSlate SignNow includes features such as document templates, automated workflows, and real-time tracking to help users manage Form Irs efficiently. These features streamline the signing process, making it easier to keep track of submissions and statuses.

-

How secure is airSlate SignNow when handling Form Irs?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form Irs. The platform employs advanced encryption, secure access protocols, and compliance with industry regulations to ensure that your data remains confidential and protected.

-

Can I integrate airSlate SignNow with other applications for Form Irs?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to enhance your workflow while managing Form Irs. Whether it's CRM systems, cloud storage, or accounting software, you can easily connect and streamline your processes.

-

What are the pricing options for airSlate SignNow users focusing on Form Irs?

airSlate SignNow offers flexible pricing plans tailored to suit different needs, including users managing Form Irs. With affordable monthly subscriptions and scalable options, you can choose the plan that best fits your business requirements without overspending.

-

How can airSlate SignNow benefit my business in processing Form Irs?

Using airSlate SignNow to process Form Irs can signNowly enhance your business efficiency. The platform simplifies document management, reduces turnaround times, and helps ensure compliance, ultimately saving you time and resources while improving organizational workflows.

Get more for Form Irs

Find out other Form Irs

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure