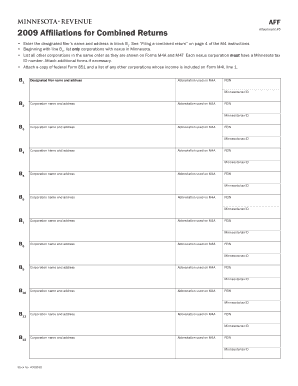

AFF Attachment #5 Affiliations for Combined Returns Enter the Designated Filer S Name and Address in Block B1 Form

Understanding the AFF Attachment #5 Affiliations for Combined Returns

The AFF Attachment #5 is a crucial document used in the context of combined returns for tax purposes. This attachment is specifically designed to report affiliations among various entities that are part of a combined tax return. It is essential for ensuring that the designated filer’s name and address are accurately recorded in Block B1. This information helps the IRS and state tax authorities identify the primary entity responsible for the tax obligations of the combined group.

Steps to Complete the AFF Attachment #5

Completing the AFF Attachment #5 requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by gathering the necessary information about all entities involved in the combined return.

- In Block B1, enter the designated filer’s name and address. This should reflect the entity that will be filing the combined return.

- Ensure that all affiliations are clearly documented in the appropriate sections of the form.

- Review the completed attachment for any errors or omissions before submission.

Legal Use of the AFF Attachment #5

The AFF Attachment #5 is legally required for entities that are filing a combined return. It serves to disclose the relationships between the entities involved, which is important for compliance with federal and state tax regulations. Failure to include this attachment when required may result in penalties or delays in processing the tax return.

IRS Guidelines for the AFF Attachment #5

The IRS provides specific guidelines for completing the AFF Attachment #5. These guidelines outline the necessary information to include and the format in which it should be presented. It is important to refer to the latest IRS instructions to ensure compliance and avoid potential issues during the filing process.

Filing Deadlines for the AFF Attachment #5

Timely submission of the AFF Attachment #5 is critical. The deadlines for filing typically align with the due dates for the combined returns. It is advisable to check the IRS calendar for specific dates and ensure that all attachments are submitted on time to avoid penalties.

Required Documents for the AFF Attachment #5

When preparing to file the AFF Attachment #5, it is important to have all relevant documents on hand. This includes:

- Tax identification numbers for all entities involved.

- Financial statements or records that support the affiliations being reported.

- Any prior year tax returns that may provide context for the current filing.

Quick guide on how to complete aff attachment 5 affiliations for combined returns enter the designated filer s name and address in block b1

Prepare [SKS] seamlessly on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to alter and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Employ the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically supplies for that purpose.

- Generate your signature with the Sign tool, which only takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign [SKS], ensuring effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aff attachment 5 affiliations for combined returns enter the designated filer s name and address in block b1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the AFF Attachment #5 Affiliations For Combined Returns?

The AFF Attachment #5 Affiliations For Combined Returns is designed to provide essential information about the designated filer’s name and address in Block B1. This ensures that all relevant affiliations are accurately reported for tax purposes. By using airSlate SignNow, you can easily manage and eSign this document, streamlining your compliance process.

-

How does airSlate SignNow simplify the process of filling out the AFF Attachment #5?

airSlate SignNow simplifies the process by allowing users to fill out the AFF Attachment #5 Affiliations For Combined Returns digitally. You can enter the designated filer’s name and address in Block B1 directly on our platform, reducing the risk of errors. This user-friendly interface ensures that your documents are completed efficiently and accurately.

-

Is there a cost associated with using airSlate SignNow for the AFF Attachment #5?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans are flexible, allowing you to choose the best option that fits your needs for managing documents like the AFF Attachment #5 Affiliations For Combined Returns. You can start with a free trial to explore our features before committing.

-

What features does airSlate SignNow offer for managing the AFF Attachment #5?

airSlate SignNow offers a range of features for managing the AFF Attachment #5 Affiliations For Combined Returns, including eSigning, document templates, and secure cloud storage. These features help ensure that your documents are not only completed correctly but also stored safely for future reference. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for handling the AFF Attachment #5?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to handle the AFF Attachment #5 Affiliations For Combined Returns alongside your existing tools. Whether you use accounting software or CRM systems, our platform can seamlessly connect to enhance your workflow and document management.

-

What are the benefits of using airSlate SignNow for the AFF Attachment #5?

Using airSlate SignNow for the AFF Attachment #5 Affiliations For Combined Returns provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign documents quickly, ensuring compliance with tax regulations. Additionally, you can access your documents anytime, anywhere, which adds convenience to your workflow.

-

How secure is airSlate SignNow when handling sensitive documents like the AFF Attachment #5?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect sensitive documents, including the AFF Attachment #5 Affiliations For Combined Returns. You can trust that your data is safe while using our platform, allowing you to focus on your business without worrying about document security.

Get more for AFF Attachment #5 Affiliations For Combined Returns Enter The Designated Filer S Name And Address In Block B1

Find out other AFF Attachment #5 Affiliations For Combined Returns Enter The Designated Filer S Name And Address In Block B1

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit