Form 4797 2014

What is the Form 4797

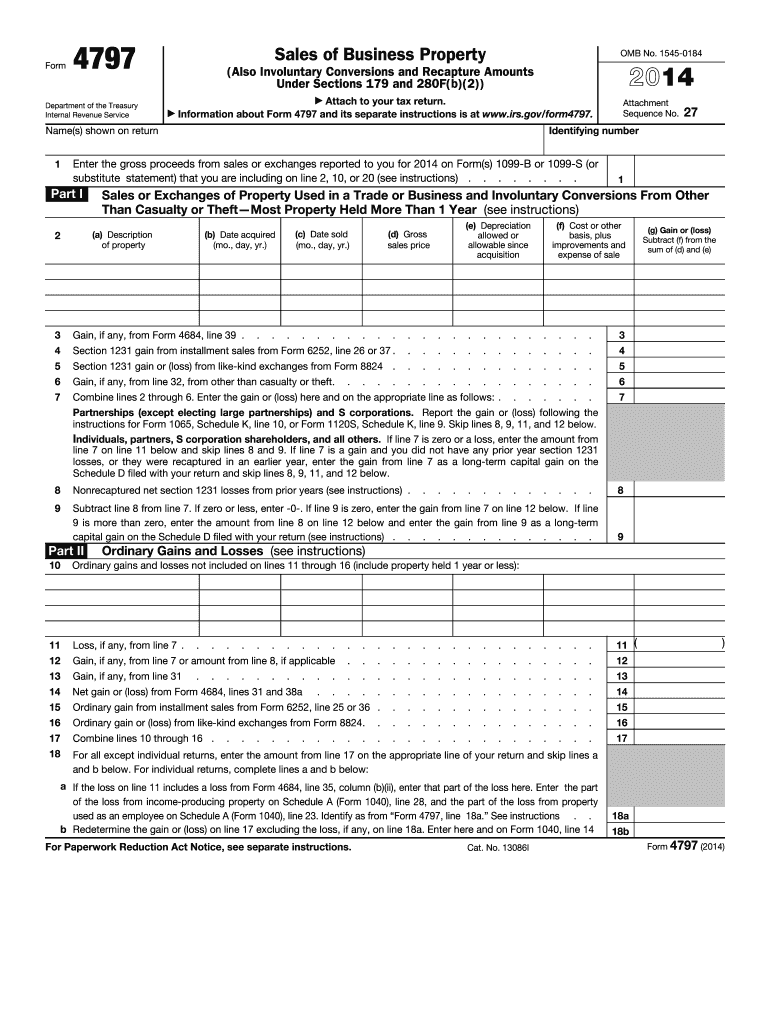

The Form 4797 is a tax form used by businesses and individuals to report the sale of business property. This form is essential for reporting gains or losses from the sale or exchange of assets used in a trade or business, including real estate, machinery, and equipment. It is primarily utilized by taxpayers who have disposed of property that was held for more than one year, allowing them to calculate the appropriate tax implications of their transactions.

How to use the Form 4797

Using the Form 4797 involves several steps to ensure accurate reporting of asset sales. Taxpayers must first gather all relevant information regarding the assets sold, including purchase date, sale date, and the original cost. The form requires detailed entries about the type of property, the date of sale, and the selling price. After filling out the form, it should be included with the taxpayer's annual income tax return, ensuring that all income and deductions are reported accurately.

Steps to complete the Form 4797

Completing the Form 4797 involves a systematic approach:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Identify the type of property sold and provide details such as the date acquired and date sold.

- Calculate the gain or loss for each asset by subtracting the adjusted basis from the selling price.

- Complete the appropriate sections for ordinary gains and losses, as well as capital gains.

- Review the form for accuracy before submitting it with your tax return.

Legal use of the Form 4797

The legal use of the Form 4797 is governed by IRS regulations. It must be filed correctly to ensure compliance with tax laws. Failing to report sales accurately can lead to penalties or audits. Taxpayers should maintain records of all transactions related to the assets reported on the form for at least three years, as the IRS may request documentation to verify the information submitted.

Filing Deadlines / Important Dates

Filing the Form 4797 must align with the taxpayer's annual tax return deadlines. Typically, individual tax returns are due on April 15 of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should be aware of any extensions they may qualify for, which can provide additional time to file the form without incurring penalties.

Examples of using the Form 4797

Examples of using the Form 4797 include situations where a business sells a piece of equipment that has been used for more than one year. If the equipment was purchased for ten thousand dollars and sold for fifteen thousand dollars, the gain of five thousand dollars must be reported on the form. Another example is when a property owner sells a rental property, requiring them to report the sale and any depreciation recapture on the form.

Quick guide on how to complete 2014 form 4797

Complete Form 4797 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without interruptions. Manage Form 4797 on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign Form 4797 with ease

- Obtain Form 4797 and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 4797 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 4797

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 4797

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF on Android devices

People also ask

-

What is Form 4797 and when do I need it?

Form 4797 is used to report the sale of business property, including the sale of real estate, and is essential for accurately calculating capital gains or losses. You need to file this form when you dispose of property used in your business or trade. Ensure you keep track of all relevant transactions to complete Form 4797 correctly.

-

How can airSlate SignNow help with Form 4797?

airSlate SignNow simplifies the process of preparing and signing your Form 4797 by allowing you to send and eSign necessary documents electronically. With its user-friendly interface, you can easily upload your documents and ensure that they are signed securely and accurately. This capability helps streamline your tax reporting process.

-

Is airSlate SignNow affordable for small businesses needing Form 4797?

Yes, airSlate SignNow offers a cost-effective solution tailored for small businesses that need help with Form 4797. With various pricing plans, it's designed to fit different budgets while providing essential features to manage your eSignatures and documents efficiently. This makes it accessible for any business, big or small.

-

What features does airSlate SignNow offer for handling Form 4797 submissions?

airSlate SignNow provides robust features such as document templates, automated reminders, and real-time tracking for Form 4797 submissions. These tools enhance the efficiency of your document handling process while ensuring that you stay compliant with tax regulations. Additionally, you can access your completed forms anytime online.

-

Can I integrate airSlate SignNow with my accounting software for Form 4797?

Absolutely! airSlate SignNow integrates seamlessly with many popular accounting software solutions, allowing you to streamline the preparation of Form 4797. This integration ensures all your financial data syncs smoothly, reducing manual entry errors and improving overall accuracy. You can manage all your documents from one platform.

-

Does airSlate SignNow provide templates for Form 4797?

Yes, airSlate SignNow offers pre-built templates that can be customized for Form 4797. This feature saves time by providing a framework to work from, ensuring all necessary sections are included. You can easily fill out and eSign the document within the platform, tailoring it to your specific needs.

-

What security measures does airSlate SignNow implement for Form 4797 documents?

airSlate SignNow prioritizes document security for sensitive forms like Form 4797 by implementing advanced encryption methods and secure cloud storage. Your documents are protected from unauthorized access, ensuring that your clients’ information remains confidential. You can confidently manage your forms under industry-standard security protocols.

Get more for Form 4797

Find out other Form 4797

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free