8809 Form 2015

What is the 8809 Form

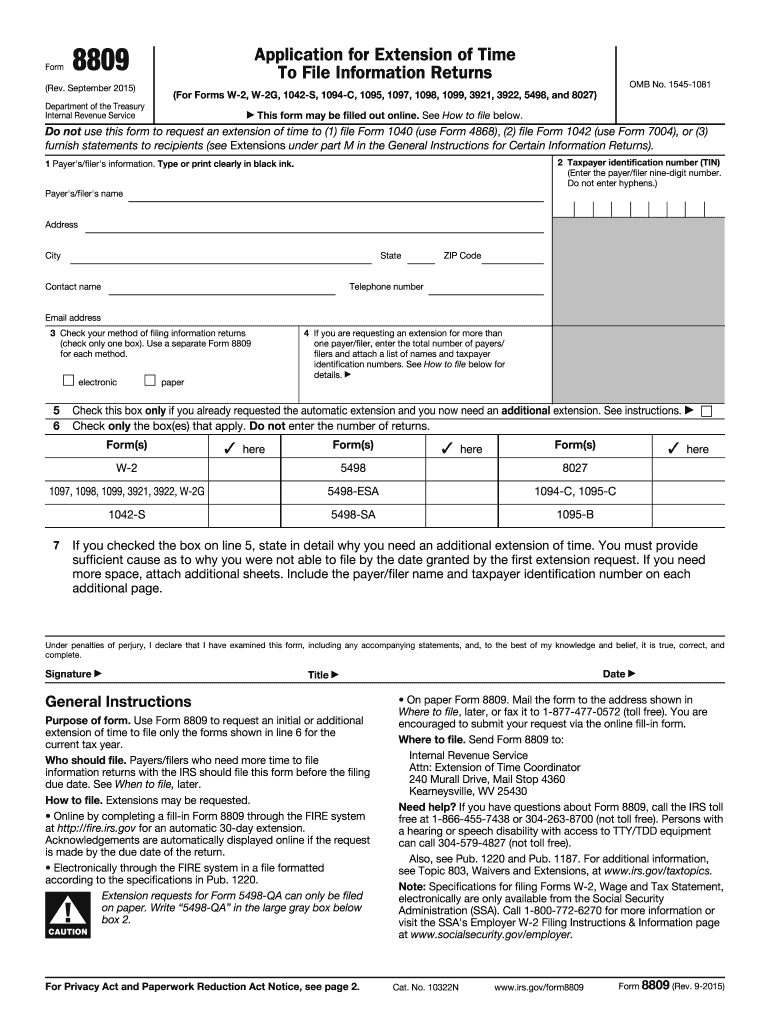

The 8809 Form, officially known as the Application for Extension of Time to File Information Returns, is a crucial document for businesses and organizations that need additional time to file various information returns with the Internal Revenue Service (IRS). This form is particularly relevant for entities that may not meet the original filing deadline for forms such as W-2s and 1099s. By submitting the 8809 Form, filers can request an automatic extension, ensuring compliance with IRS regulations while avoiding potential penalties for late submissions.

How to use the 8809 Form

Using the 8809 Form involves a straightforward process. First, ensure that you have the correct version of the form, which can be obtained from the IRS website or through authorized providers. Fill out the required information, including your name, contact information, and the type of returns for which you are requesting an extension. Once completed, submit the form to the IRS by the original due date of the returns. It is important to remember that this form does not extend the time for payment of any tax owed; it solely extends the filing deadline.

Steps to complete the 8809 Form

Completing the 8809 Form requires attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the 8809 Form from the IRS.

- Fill in your name, address, and taxpayer identification number.

- Indicate the type of information returns for which you are requesting an extension.

- Provide a reason for the extension request, if applicable.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the IRS by the original due date of the returns.

Legal use of the 8809 Form

The 8809 Form is legally recognized as a valid request for an extension of time to file information returns. When properly completed and submitted, it provides filers with a safeguard against penalties for late filing. It is essential to adhere to IRS guidelines regarding the form's use, including submission deadlines and the types of returns eligible for extension. Failure to comply with these regulations may result in penalties or denial of the extension request.

Filing Deadlines / Important Dates

Filing deadlines for the 8809 Form are critical to ensure compliance. The form must be submitted by the original due date of the information returns for which you are requesting an extension. For most information returns, this is typically January thirty-first for forms like W-2 and January thirty-first for 1099 forms. It is advisable to keep track of these dates to avoid penalties and ensure that your extension request is processed in a timely manner.

Form Submission Methods (Online / Mail / In-Person)

The 8809 Form can be submitted to the IRS through various methods. Filers can choose to submit the form online using the IRS e-file system, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate IRS address, depending on the type of return and the filer's location. In-person submissions are generally not accepted for this form, making online and mail submissions the primary options for filers.

Quick guide on how to complete 2015 8809 form

Complete 8809 Form effortlessly on any gadget

Web-based document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents quickly without delays. Manage 8809 Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

Steps to modify and eSign 8809 Form with ease

- Obtain 8809 Form and click on Get Form to begin.

- Utilize the features we provide to finish your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign 8809 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8809 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8809 form

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the 8809 Form and why is it important?

The 8809 Form is an important document used for requesting an extension of time to file certain information returns. Businesses utilize this form to ensure compliance with IRS regulations without facing penalties for late submission. Understanding the 8809 Form is crucial for timely and accurate tax filing.

-

How can airSlate SignNow help with the 8809 Form?

airSlate SignNow streamlines the process of completing and submitting your 8809 Form electronically. Our platform offers easy-to-use eSigning features that guide users through form completion, enhancing accuracy and efficiency. This ensures that your 8809 Form is filed correctly and on time.

-

Are there any costs associated with using airSlate SignNow for the 8809 Form?

Yes, airSlate SignNow offers various pricing plans designed to meet different business needs. Each plan includes features that facilitate the completion and signing of the 8809 Form, making our solution both cost-effective and valuable. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow offer for managing the 8809 Form?

airSlate SignNow provides a robust set of features like eSignature, document templates, and real-time collaboration specifically for the 8809 Form. These tools enhance user experience and ensure that all necessary stakeholders can review and sign off on the form quickly. This leads to faster processing times and improved compliance.

-

Can I integrate airSlate SignNow with other applications for the 8809 Form?

Absolutely! airSlate SignNow offers integrations with popular business applications, allowing for seamless handling of the 8809 Form. Whether you're using CRM systems or accounting software, our platform allows for easy document sharing and management, simplifying your workflow.

-

What are the benefits of using airSlate SignNow for the 8809 Form?

Using airSlate SignNow for your 8809 Form provides multiple benefits, including enhanced document security, faster turnaround times, and improved accuracy. Our intuitive platform makes it easy for users to navigate, ultimately saving time and reducing the risk of errors during the filing process.

-

Is airSlate SignNow compliant with regulations for the 8809 Form?

Yes, airSlate SignNow adheres to all necessary compliance standards, ensuring that the handling of your 8809 Form is secure and legally valid. We prioritize data protection, giving users peace of mind when sharing sensitive information. Compliance with IRS regulations is essential when filing forms like the 8809.

Get more for 8809 Form

Find out other 8809 Form

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement