2290 Form 2011

What is the 2290 Form

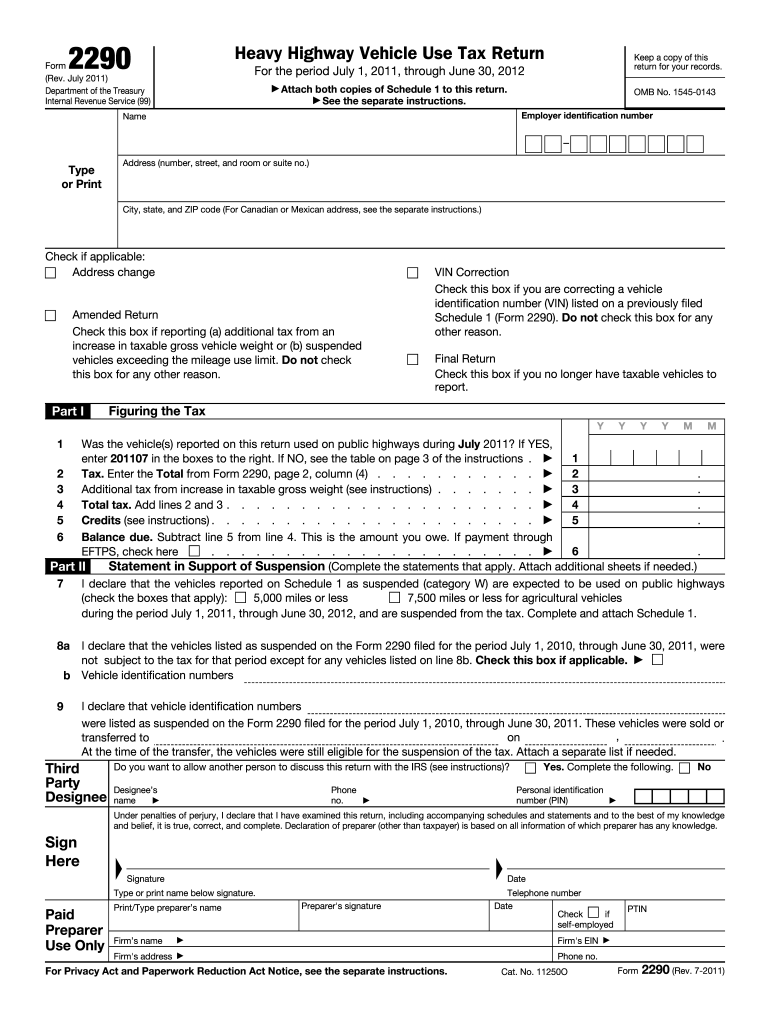

The 2290 Form, officially known as the Heavy Highway Vehicle Use Tax Return, is a tax form used by businesses and individuals who operate heavy vehicles with a gross weight of 55,000 pounds or more on public highways. This form is primarily used to report and pay the federal highway use tax, which is necessary for maintaining and improving the nation's highways. The tax is calculated based on the weight of the vehicle and the number of months it is operated during the tax period.

How to obtain the 2290 Form

The 2290 Form can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF that can be printed and filled out manually. Additionally, businesses can access the form through various tax preparation software that supports IRS forms. It is important to ensure that you are using the most current version of the form to avoid any compliance issues.

Steps to complete the 2290 Form

Completing the 2290 Form involves several key steps:

- Gather necessary information, including the vehicle identification number (VIN), gross weight, and the number of months the vehicle was in use.

- Calculate the total tax owed based on the vehicle's weight and the applicable tax rate.

- Fill out the form accurately, ensuring all information is complete and correct.

- Sign and date the form, certifying that the information provided is true and accurate.

- Submit the form electronically or by mail, along with payment for any taxes owed.

Legal use of the 2290 Form

The 2290 Form is a legal document that must be filed in accordance with IRS regulations. It serves as proof of payment for the highway use tax and is essential for compliance. Failure to file the form or pay the required tax can result in penalties and interest charges. It is crucial for businesses to maintain accurate records and ensure timely submission to avoid legal complications.

Filing Deadlines / Important Dates

The filing deadline for the 2290 Form is typically the last day of the month following the month in which the vehicle was first used on public highways. For example, if a vehicle was first used in July, the form must be filed by August 31. Additionally, if the vehicle is used for less than a full year, the tax is prorated based on the number of months the vehicle is in operation. It is important to keep track of these dates to ensure timely compliance.

Form Submission Methods

The 2290 Form can be submitted in several ways:

- Electronically through the IRS e-file system, which is the fastest and most efficient method.

- By mail, sending the completed form to the appropriate IRS address based on your location.

- In-person at designated IRS offices, although this option may not be as common.

Quick guide on how to complete 2011 2290 form

Complete 2290 Form effortlessly on any device

Online document management has surged in popularity among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents quickly without delays. Handle 2290 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and electronically sign 2290 Form with ease

- Obtain 2290 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 2290 Form to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 2290 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 2290 form

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is the 2290 Form and who needs to file it?

The 2290 Form is a federal tax form required by the IRS for heavy vehicle use. Businesses that operate vehicles with a gross weight of 55,000 pounds or more must file this form annually. Using airSlate SignNow simplifies this process, allowing users to electronically sign and submit the 2290 Form quickly and efficiently.

-

How does airSlate SignNow streamline the 2290 Form filing process?

airSlate SignNow streamlines the 2290 Form filing process by providing a user-friendly platform where businesses can prepare, eSign, and submit their forms effortlessly. Integrated features allow for easy document management and secure electronic signatures, ensuring compliance with IRS requirements while saving time.

-

What are the pricing options for using airSlate SignNow for the 2290 Form?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs. Users can choose from monthly or annual subscriptions, which include features like unlimited document uploads and eSigning capabilities for the 2290 Form. This cost-effective solution provides great value for businesses of all sizes.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2290 Form?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage your 2290 Form alongside your financial records. This integration ensures a smoother workflow, allowing for automatic data import and better organization of tax documentation.

-

What security measures does airSlate SignNow implement for the 2290 Form?

airSlate SignNow prioritizes the security of your data by utilizing advanced encryption techniques and secure cloud storage. When you eSign the 2290 Form through our platform, you can trust that your information is protected. Additionally, our compliance with industry standards adds an extra layer of security for your sensitive documents.

-

How can airSlate SignNow enhance collaboration on 2290 Form preparation?

With airSlate SignNow, teams can collaborate in real-time on the preparation of the 2290 Form. Users can share documents easily, leave comments, and track changes, making it convenient for multiple stakeholders to participate in the process. This feature promotes efficiency and accuracy in filing federal tax forms.

-

What support options are available if I have questions about the 2290 Form?

airSlate SignNow provides a variety of support options for users navigating the 2290 Form. Customers can access extensive help documentation, video tutorials, or contact our dedicated support team via chat or email. Whether you have technical questions or need filing assistance, our support team is here to help.

Get more for 2290 Form

Find out other 2290 Form

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free