M706, Estate Tax Return to Be Used by an Estate of a Decedent Who Died in to File and Pay Minnesota Estate Tax Revenue State Mn Form

What is the M706, Estate Tax Return

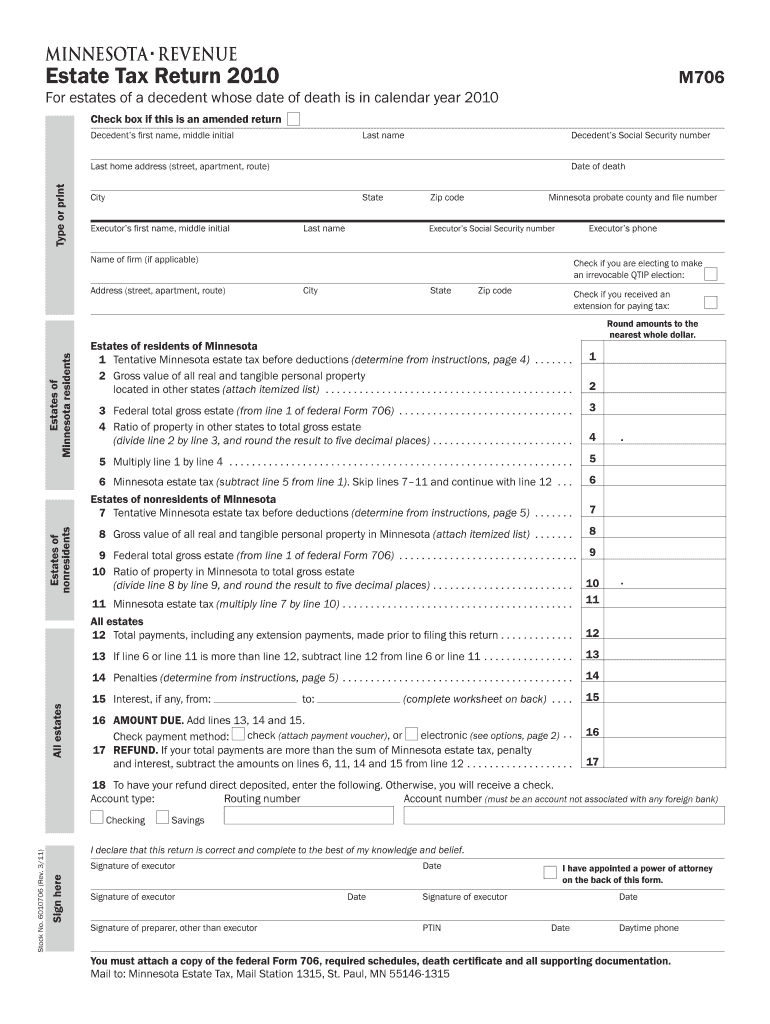

The M706, Estate Tax Return, is a form required by the state of Minnesota for estates of decedents who passed away within the state. This form is used to report the value of the estate and calculate the estate tax owed to the state. The M706 is essential for ensuring compliance with Minnesota estate tax laws, which apply to estates exceeding a certain value threshold. Filing this form accurately is crucial for the proper settlement of the decedent's estate and to avoid potential penalties.

How to use the M706, Estate Tax Return

To use the M706, estate representatives must gather all necessary financial information regarding the decedent's assets and liabilities. This includes real estate, bank accounts, investments, and any outstanding debts. Once all information is compiled, the representative can fill out the M706 form, ensuring that all sections are completed accurately. After completing the form, it should be submitted to the Minnesota Department of Revenue along with any required payments for taxes owed.

Steps to complete the M706, Estate Tax Return

Completing the M706 involves several key steps:

- Gather all relevant financial documents, including asset valuations and debts.

- Fill out the M706 form, providing detailed information about the estate.

- Calculate the total value of the estate to determine tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form along with any payment to the Minnesota Department of Revenue by the due date.

Key elements of the M706, Estate Tax Return

The M706 form includes several key elements that must be addressed:

- Identification of the decedent, including name and date of death.

- A detailed inventory of the estate's assets and liabilities.

- Calculation of the estate tax based on the total value of the estate.

- Signature of the estate representative, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important to adhere to filing deadlines when submitting the M706. The estate tax return is generally due nine months after the date of death of the decedent. Extensions may be available, but they must be requested in advance. Timely filing is crucial to avoid penalties and interest on unpaid taxes.

Required Documents

When preparing to file the M706, several documents are typically required:

- Death certificate of the decedent.

- Inventory of all assets owned by the decedent at the time of death.

- Documentation of debts and liabilities.

- Any previous tax returns that may affect the estate's tax calculations.

Quick guide on how to complete m706 estate tax return to be used by an estate of a decedent who died in to file and pay minnesota estate tax revenue state mn 11332006

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly option compared to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly, without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign [SKS] with Ease

- Access [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, or invite link—or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form searches, or mistakes necessitating new printed copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m706 estate tax return to be used by an estate of a decedent who died in to file and pay minnesota estate tax revenue state mn 11332006

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn?

The M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn is a form required for estates in Minnesota to report and pay estate taxes. This form ensures compliance with state tax laws and helps in the proper assessment of the estate's value.

-

How can airSlate SignNow assist with the M706, Estate Tax Return?

airSlate SignNow provides an efficient platform for completing and eSigning the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. Our user-friendly interface simplifies the process, ensuring that all necessary information is accurately captured and submitted.

-

What are the pricing options for using airSlate SignNow for estate tax returns?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those needing to file the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs.

-

What features does airSlate SignNow offer for estate tax document management?

With airSlate SignNow, you can easily create, edit, and eSign the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. Features include templates, secure storage, and real-time collaboration, making it easier to manage your estate tax documents efficiently.

-

Is airSlate SignNow secure for handling sensitive estate tax information?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn, are protected. We utilize advanced encryption and compliance measures to safeguard your sensitive information.

-

Can I integrate airSlate SignNow with other software for estate management?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help streamline the process of filing the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn. This allows for seamless data transfer and improved workflow efficiency.

-

What are the benefits of using airSlate SignNow for estate tax returns?

Using airSlate SignNow for the M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy. Our platform simplifies the entire process, making it easier for you to focus on other important aspects of estate management.

Get more for M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn

- Plaintiff39s motion for dismissal dallas county texas dallascounty form

- Motion to dismiss indictment motion to dismiss indictment deportation form

- Taa notice to vacate form pdf

- License and bcertificateb of marriage 80 kb superior court form

- Fa 4110v 2010 form

- 2013 1120 f form

- 2009 schedule eic form

- 1065 2014 form

Find out other M706, Estate Tax Return To Be Used By An Estate Of A Decedent Who Died In To File And Pay Minnesota Estate Tax Revenue State Mn

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy