Form 8867 2014

What is the Form 8867

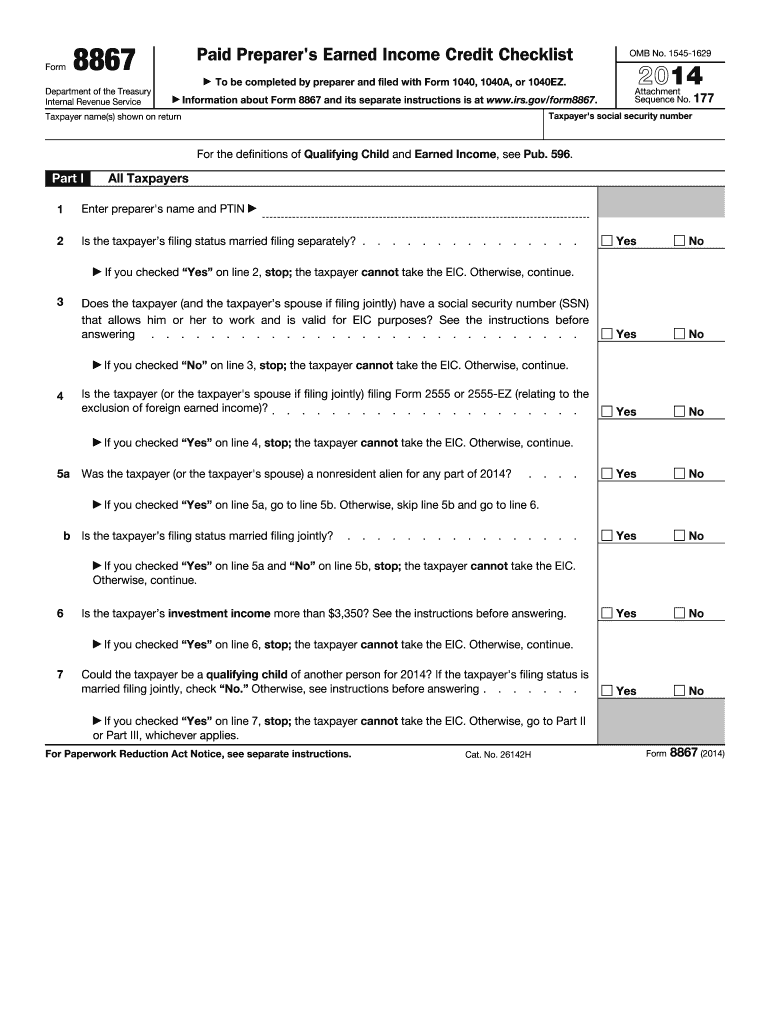

The Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a document used by tax preparers in the United States to ensure compliance with the due diligence requirements for claiming certain tax credits. This form is primarily associated with the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), and other related credits. Tax preparers must complete this form to demonstrate that they have fulfilled their responsibilities in verifying the eligibility of their clients for these credits.

How to use the Form 8867

Using the Form 8867 involves several steps that tax preparers must follow to ensure accuracy and compliance. First, preparers should gather all necessary information from their clients, including income details, filing status, and dependent information. Next, they must complete the form by checking off the required due diligence steps that have been taken. This includes verifying the taxpayer's eligibility for credits and maintaining proper documentation. Finally, the completed Form 8867 should be submitted alongside the taxpayer's return to the IRS.

Steps to complete the Form 8867

Completing the Form 8867 involves a systematic approach:

- Gather all relevant taxpayer information, including income and dependent details.

- Review the eligibility criteria for the EITC, CTC, and other applicable credits.

- Complete each section of the form, ensuring that all due diligence steps are documented.

- Sign and date the form, confirming that all information is accurate and complete.

- Submit the form with the taxpayer's tax return to the IRS.

Legal use of the Form 8867

The legal use of Form 8867 is crucial for tax preparers to avoid penalties. The IRS requires that this form be completed accurately to demonstrate due diligence in claiming tax credits. Failure to properly complete the form can result in penalties for both the preparer and the taxpayer. It is essential that all information provided on the form is truthful and that proper documentation is maintained to support the claims made.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8867 align with the overall tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Tax preparers should ensure that the Form 8867 is submitted alongside the tax return by the due date to avoid any compliance issues.

Penalties for Non-Compliance

Non-compliance with the requirements associated with Form 8867 can lead to significant penalties. Tax preparers may face fines if they fail to demonstrate due diligence when claiming tax credits. Additionally, taxpayers may lose out on credits if the form is not completed correctly or submitted on time. It is crucial for both parties to understand their responsibilities to mitigate these risks.

Quick guide on how to complete 2014 form 8867

Effortlessly Create Form 8867 on Any Device

Digital document management has become widely accepted among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and safely keep it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents rapidly without delays. Manage Form 8867 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The simplest method to alter and eSign Form 8867 effortlessly

- Find Form 8867 and click on Get Form to begin.

- Use the features we offer to fill out your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that reason.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as an ordinary wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form 8867 while ensuring effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8867

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8867

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is Form 8867 and why is it important?

Form 8867 is used by tax preparers to verify eligibility for the Earned Income Tax Credit (EITC). It is crucial for ensuring compliance with IRS regulations and helping clients maximize their tax returns. Understanding Form 8867 can enhance your service offerings and build trust with clients.

-

How can airSlate SignNow help with Form 8867?

airSlate SignNow streamlines the process of collecting electronic signatures for Form 8867, making it easy for tax preparers to obtain client approvals quickly. Our platform ensures that the document is securely shared and signed, enhancing efficiency and reducing turnaround time.

-

Is airSlate SignNow compatible with Form 8867 e-filing?

Yes, airSlate SignNow is compatible with e-filing processes involving Form 8867. Our solution enables seamless integration with popular tax software, allowing you to efficiently manage your documents and submissions without any hassle.

-

What features does airSlate SignNow offer for managing Form 8867?

airSlate SignNow offers features such as customizable templates, in-document signing, and tracking capabilities for Form 8867. These tools help you manage your documents more effectively and ensure that all necessary signatures are obtained promptly.

-

How much does it cost to use airSlate SignNow for Form 8867?

airSlate SignNow offers flexible pricing plans that cater to various business sizes. Our cost-effective solutions allow you to choose a plan that best fits your needs, ensuring that you can manage Form 8867 efficiently without breaking the bank.

-

Can I integrate airSlate SignNow with other software for Form 8867?

Absolutely! airSlate SignNow integrates with many popular software applications, which allows you to streamline your workflow when working with Form 8867. This integration helps you maintain a smooth process from document creation to e-signature.

-

What benefits does airSlate SignNow provide for handling Form 8867?

Using airSlate SignNow for Form 8867 provides numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely while making it easier for clients to sign and return forms.

Get more for Form 8867

- Forms and publicationsoffice of student financial services

- Student emergency funds application form

- Transcriptsoffice of the registraruniversity of la verne form

- Sonoma state university transcript request form

- La verne ca recently sold homes realtorcom form

- Community service verification form community service verification form

- Student id last four digits of ssn birth date form

- Purchasing card sign out sheet ball state university form

Find out other Form 8867

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application