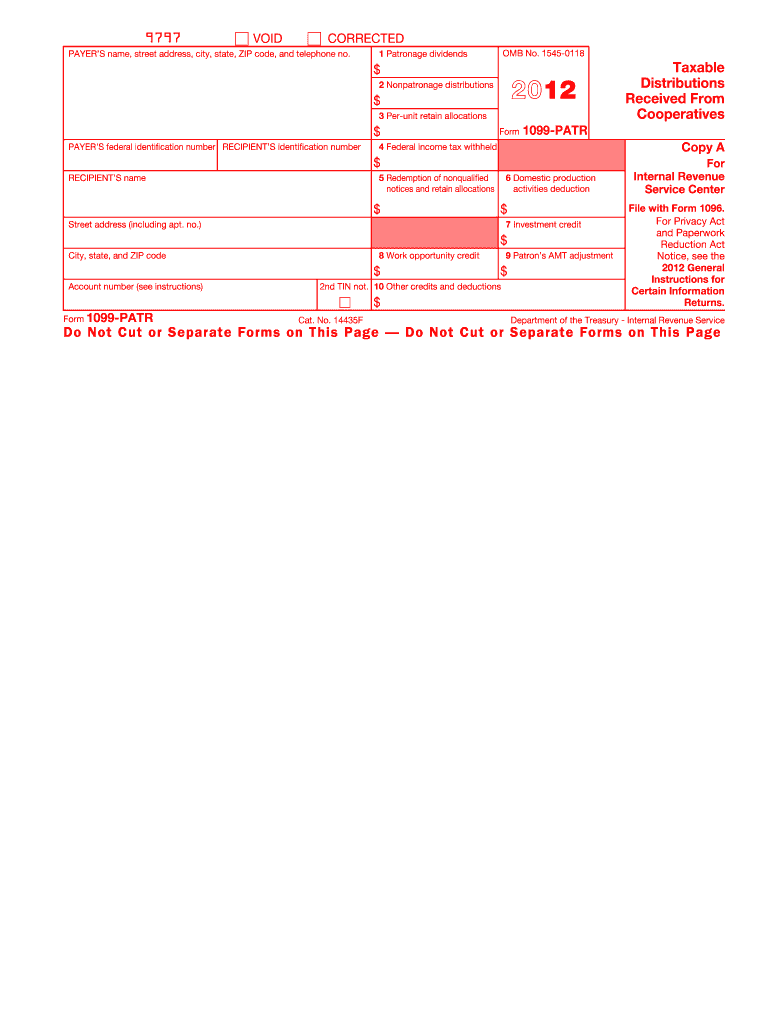

Blank 1099 Form 2012

What is the Blank 1099 Form

The Blank 1099 Form is a crucial tax document used in the United States to report various types of income received by individuals and businesses. This form is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employees. The 1099 series includes several variants, with the most common being the 1099-MISC and 1099-NEC, which specifically report non-employee compensation. Understanding this form is essential for ensuring compliance with IRS regulations and for accurate tax reporting.

How to use the Blank 1099 Form

Using the Blank 1099 Form involves several key steps. First, gather all necessary information about the payee, including their name, address, and taxpayer identification number (TIN). Next, determine the type of payment being reported, as this will dictate which variant of the 1099 form to use. After completing the form, ensure that copies are provided to both the payee and the IRS. It is important to retain a copy for your records as well. Proper usage of the form helps maintain transparency and accuracy in reporting income.

Steps to complete the Blank 1099 Form

Completing the Blank 1099 Form requires attention to detail. Follow these steps for accurate completion:

- Identify the correct form variant based on the type of payment.

- Fill in the payer's information, including name, address, and TIN.

- Enter the payee's information accurately.

- Specify the total amount paid in the appropriate box.

- Include any necessary federal or state tax withholding amounts.

- Review the form for accuracy before submission.

Legal use of the Blank 1099 Form

The Blank 1099 Form must be used in compliance with IRS regulations. It is legally required for businesses that have paid $600 or more to a non-employee during the tax year. Failure to issue this form can result in penalties for the payer. Additionally, the form must be filed by the deadline, which is typically January thirty-first of the following year. Proper legal use ensures that both the payer and payee meet their tax obligations and avoid potential audits.

Filing Deadlines / Important Dates

Timely filing of the Blank 1099 Form is essential to avoid penalties. The IRS requires that the form be filed by January thirty-first for the previous tax year. If you are filing electronically, the deadline may extend to March second. It is advisable to keep track of these dates to ensure compliance and avoid any late fees. Marking these deadlines on your calendar can help facilitate timely submissions.

Examples of using the Blank 1099 Form

There are various scenarios in which the Blank 1099 Form is applicable. For instance, a business may use it to report payments made to a freelance graphic designer for services rendered. Similarly, if a landlord receives rental income exceeding $600 from a tenant, they must report this income using the 1099 form. These examples highlight the form's versatility in documenting different types of income and ensuring proper tax reporting.

Quick guide on how to complete blank 2012 1099 form

Effortlessly Prepare Blank 1099 Form on Any Device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to generate, modify, and electronically sign your documents quickly without any hold-ups. Manage Blank 1099 Form on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Blank 1099 Form effortlessly

- Obtain Blank 1099 Form and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with a few clicks from any device you choose. Edit and electronically sign Blank 1099 Form and ensure outstanding communication at any point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct blank 2012 1099 form

Create this form in 5 minutes!

How to create an eSignature for the blank 2012 1099 form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a Blank 1099 Form and when should I use it?

A Blank 1099 Form is a tax document used to report various types of income other than wages, salaries, and tips. You should use a Blank 1099 Form when you need to report payments made to independent contractors or freelancers. It's essential for tax compliance and helps both you and the recipient accurately report income to the IRS.

-

How can I fill out a Blank 1099 Form using airSlate SignNow?

Filling out a Blank 1099 Form is simple with airSlate SignNow. You can upload your form, fill in the necessary fields, and electronically sign it all within our platform. Our user-friendly interface makes it easy to complete your Blank 1099 Form efficiently.

-

Is airSlate SignNow a cost-effective solution for creating Blank 1099 Forms?

Yes, airSlate SignNow offers a cost-effective solution for creating and managing Blank 1099 Forms. Our pricing plans are designed to meet the needs of businesses of all sizes, allowing you to streamline your document signing process without breaking the bank.

-

What features does airSlate SignNow offer for handling Blank 1099 Forms?

airSlate SignNow provides a range of features for handling Blank 1099 Forms, including secure e-signature capabilities, customizable templates, and integration with popular accounting software. These features ensure that your document management is efficient and compliant with tax regulations.

-

Can I integrate airSlate SignNow with other applications for managing Blank 1099 Forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRMs and accounting software, to enhance your workflow when managing Blank 1099 Forms. This integration allows for easier data transfer and better overall efficiency in your document processes.

-

What are the benefits of using airSlate SignNow for Blank 1099 Forms?

Using airSlate SignNow for Blank 1099 Forms provides several benefits, including faster processing times, enhanced security with encrypted e-signatures, and the ability to track document status in real-time. This ensures that your forms are completed swiftly and securely.

-

How does airSlate SignNow ensure the security of my Blank 1099 Forms?

airSlate SignNow prioritizes security by employing industry-standard encryption protocols to protect your Blank 1099 Forms. Additionally, we provide features like two-factor authentication and audit trails to ensure that your documents remain confidential and tamper-proof.

Get more for Blank 1099 Form

- Tys16 transcript request form university of maryland oes umd

- Health screening consent form

- Denver health specialty clinic referral form

- Alternative break info packet suny oswego form

- Liberty university transcripts form

- Official mail and distribution center fort rucker us army form

- Admission status change from conditional to regular gram form

- 3 gc mccollum administration building centralsan form

Find out other Blank 1099 Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT