Form 2555 2012

What is the Form 2555

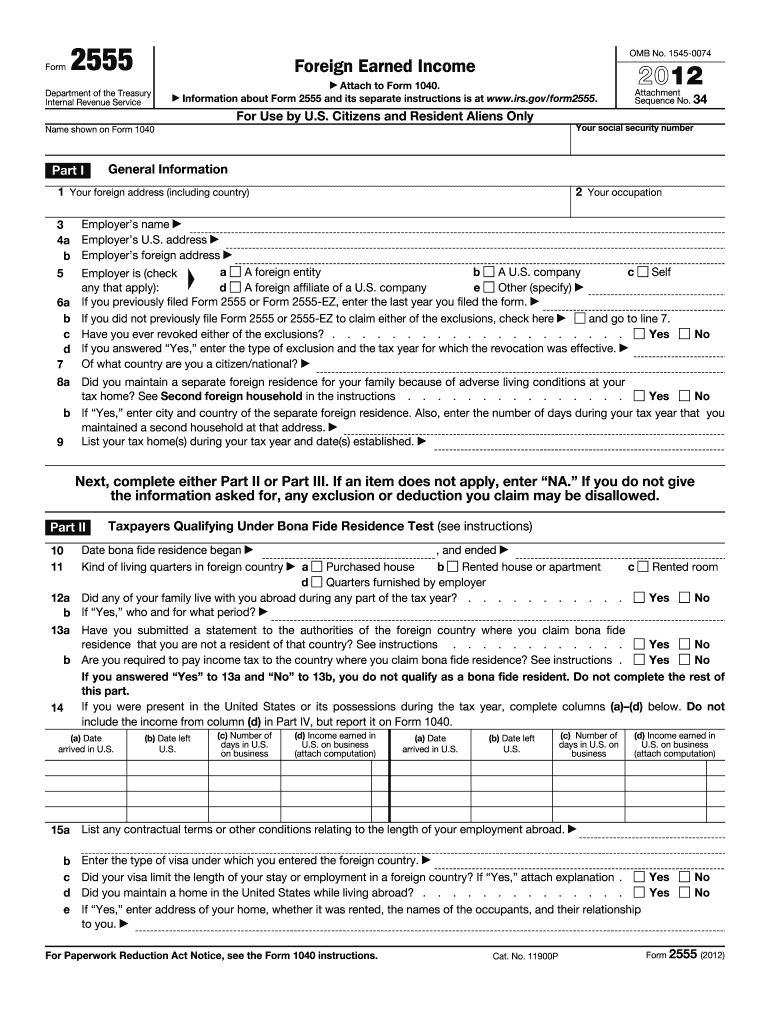

The Form 2555 is a tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion and the Foreign Housing Exclusion. This form allows eligible taxpayers to exclude a certain amount of their foreign earned income from U.S. taxation, which can significantly reduce their overall tax liability. The form is particularly relevant for individuals working abroad, as it helps them avoid double taxation on income earned outside the United States.

How to use the Form 2555

To effectively use the Form 2555, taxpayers must first determine their eligibility based on specific criteria, including their tax residency status and the nature of their foreign employment. After confirming eligibility, individuals can fill out the form by providing necessary details such as their foreign earned income, the dates of their foreign residence, and any housing expenses incurred. It is crucial to ensure that all information is accurate and complete to avoid issues with the IRS.

Steps to complete the Form 2555

Completing the Form 2555 involves several key steps:

- Determine eligibility: Confirm that you meet the requirements for the Foreign Earned Income Exclusion.

- Gather necessary documents: Collect records of your foreign income and housing expenses.

- Fill out the form: Provide personal information, details of your foreign earned income, and any applicable exclusions.

- Review and verify: Double-check all entries for accuracy before submission.

- Submit the form: File the completed Form 2555 with your annual tax return.

Legal use of the Form 2555

The legal use of the Form 2555 is governed by IRS regulations, which dictate how and when the form can be utilized. To ensure compliance, taxpayers must adhere to the eligibility criteria and accurately report their foreign income. Failure to comply with these regulations can result in penalties or disqualification from claiming the exclusions. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of using this form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 2555 is essential for compliance. Generally, the form must be submitted along with the annual tax return by the standard tax deadline, which is typically April 15. However, taxpayers residing outside the United States may qualify for an automatic extension, allowing them to file until June 15. It is important to keep track of these dates to avoid late filing penalties.

Required Documents

When completing the Form 2555, certain documents are necessary to support the information provided. These may include:

- Proof of foreign residency, such as a lease agreement or utility bills.

- Documentation of foreign earned income, such as pay stubs or tax statements from foreign employers.

- Records of housing expenses, including receipts for rent or mortgage payments.

Having these documents readily available can streamline the process and enhance accuracy when filling out the form.

Quick guide on how to complete 2012 form 2555

Effortlessly Prepare Form 2555 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Form 2555 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Modify and Electronically Sign Form 2555 with Ease

- Obtain Form 2555 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misdirected documents, cumbersome form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 2555 and facilitate outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 2555

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 2555

The best way to generate an electronic signature for your PDF file online

The best way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 2555 and how does it relate to airSlate SignNow?

Form 2555 is a tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. airSlate SignNow simplifies the process of filling out and eSigning Form 2555, allowing users to complete their tax documentation swiftly and efficiently.

-

How can airSlate SignNow help me fill out Form 2555?

airSlate SignNow provides intuitive tools for directly filling out Form 2555 digitally. With our easy-to-use template and eSignature capabilities, you can ensure your forms are completed accurately and submitted without delay.

-

Is there a pricing plan for using airSlate SignNow for Form 2555?

Yes, airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you're an individual or a company, you can find a cost-effective solution that provides seamless access to features for handling Form 2555 and other documents.

-

What features does airSlate SignNow offer for completing Form 2555?

AirSlate SignNow includes features like document templates, advanced editing tools, and secure eSignature options, specifically designed to facilitate the completion of Form 2555. These features enhance productivity while ensuring compliance with tax requirements.

-

Are there integrations available with airSlate SignNow for managing Form 2555?

Yes, airSlate SignNow integrates with popular business applications, making it easy to manage documents like Form 2555 alongside your existing workflows. This capability enhances collaboration and ensures all relevant data is accessible in one place.

-

What are the benefits of using airSlate SignNow to eSign Form 2555?

Using airSlate SignNow to eSign Form 2555 offers signNow benefits such as reduced processing time and improved accuracy. Our platform provides a secure, legally binding electronic signature solution that can streamline your tax filing process.

-

Can I track the status of my Form 2555 with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Form 2555 in real-time. You’ll receive notifications at each step, ensuring you’re always updated on the progress of your document.

Get more for Form 2555

- 3 2 1 code it second edition pdf free download epdf form

- Request for policy surrender form

- Physical exam checklist template form

- Cigna ivig prior authorization form

- Quality reporting form

- Gastroenterology intake form

- Select the office where your visit is located what is the date of form

- Cardiac biomarkers form

Find out other Form 2555

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast