ETP Employer Transit Pass Credit for C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries and Tax Exempt Form

Understanding the ETP Employer Transit Pass Credit

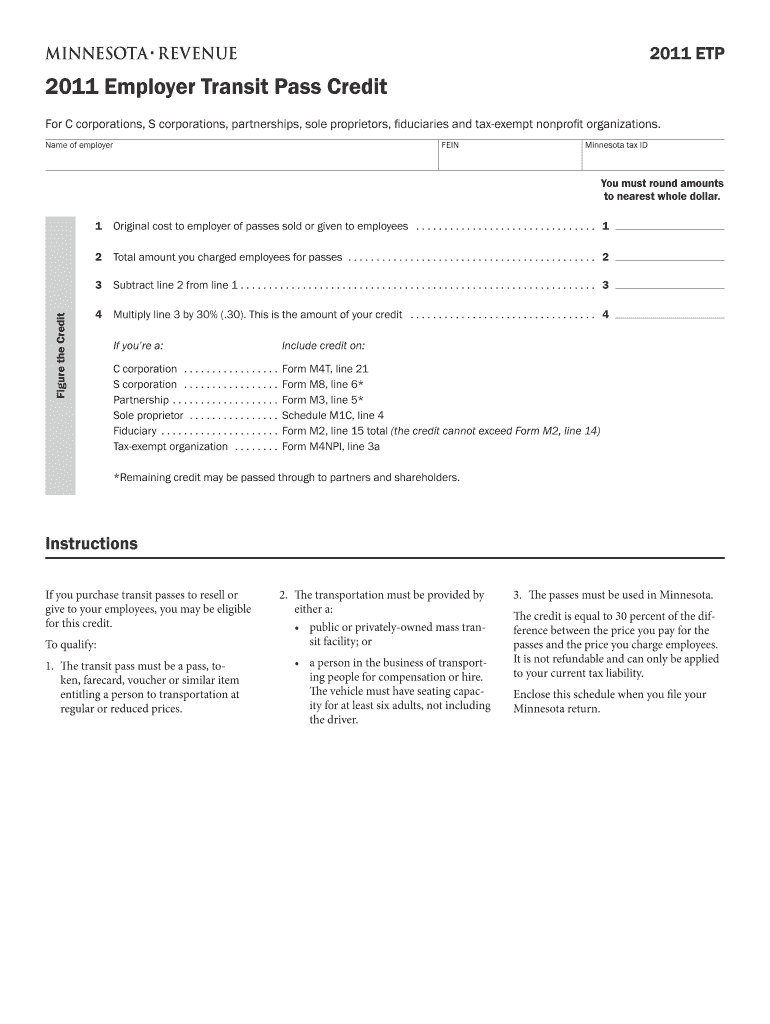

The ETP Employer Transit Pass Credit is a tax incentive designed for various business entities, including C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries, and tax-exempt Nonprofit Organizations. This credit allows eligible businesses to receive a tax benefit when they provide transit passes to their employees. The primary goal is to encourage the use of public transportation, thereby reducing traffic congestion and promoting environmental sustainability.

Eligibility Criteria for the ETP Employer Transit Pass Credit

To qualify for the ETP Employer Transit Pass Credit, businesses must meet specific criteria. Eligible entities include:

- C Corporations

- S Corporations

- Partnerships

- Sole Proprietors

- Fiduciaries

- Tax-exempt Nonprofit Organizations

Additionally, the transit passes must be provided to employees for commuting purposes, and the expense must be incurred during the tax year in which the credit is claimed.

Steps to Claim the ETP Employer Transit Pass Credit

Claiming the ETP Employer Transit Pass Credit involves several steps:

- Determine eligibility based on the business structure and transit pass provision.

- Document the expenses related to the purchase of transit passes for employees.

- Complete the necessary tax forms, including any specific schedules required for the credit.

- Submit the tax return by the designated filing deadline.

Maintaining accurate records of all transactions is essential to support the claim during any potential audits.

Required Documentation for the ETP Employer Transit Pass Credit

Businesses must gather specific documentation to substantiate their claims for the ETP Employer Transit Pass Credit. This includes:

- Receipts for the purchase of transit passes

- Records of employee eligibility and participation

- Tax forms and schedules that reflect the claimed credit

Ensuring that all documentation is complete and organized will facilitate a smoother filing process and help avoid potential issues with the IRS.

IRS Guidelines for the ETP Employer Transit Pass Credit

The Internal Revenue Service (IRS) provides guidelines on how to properly claim the ETP Employer Transit Pass Credit. These guidelines outline the eligibility requirements, the types of expenses that qualify, and the necessary forms to complete. It is crucial for businesses to familiarize themselves with these guidelines to ensure compliance and maximize the benefits of the credit.

Examples of Utilizing the ETP Employer Transit Pass Credit

Businesses can implement the ETP Employer Transit Pass Credit in various ways. For instance:

- A C Corporation can purchase monthly transit passes for its employees, enabling them to commute to work without the need for personal vehicles.

- A tax-exempt nonprofit organization may provide transit passes as part of its employee benefits package, promoting public transportation use among its staff.

These examples illustrate how different entities can leverage the credit to support their employees while benefiting from tax savings.

Quick guide on how to complete etp employer transit pass credit for c corporations s corporations partnerships sole proprietors fiduciaries and tax exempt 11332027

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can securely access the appropriate form and store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

Effortlessly edit and eSign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the etp employer transit pass credit for c corporations s corporations partnerships sole proprietors fiduciaries and tax exempt 11332027

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ETP Employer Transit Pass Credit?

The ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations is a tax incentive designed to encourage employers to provide transit passes to their employees. This credit helps businesses reduce their tax liability while promoting public transportation use among their workforce.

-

Who is eligible for the ETP Employer Transit Pass Credit?

Eligibility for the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations includes a wide range of business structures. Whether you operate as a corporation, partnership, or nonprofit, you can benefit from this credit if you provide transit passes to your employees.

-

How can businesses apply for the ETP Employer Transit Pass Credit?

To apply for the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations, businesses must complete the necessary tax forms and provide documentation of the transit passes issued. Consulting with a tax professional can streamline the application process and ensure compliance with IRS regulations.

-

What are the financial benefits of the ETP Employer Transit Pass Credit?

The ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations can signNowly reduce your tax burden. By taking advantage of this credit, businesses can lower their taxable income, leading to potential savings that can be reinvested into the company or used to enhance employee benefits.

-

Are there any limitations on the ETP Employer Transit Pass Credit?

Yes, the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations has specific limitations. Businesses should be aware of the maximum credit amount allowed and ensure that the transit passes provided meet the IRS criteria to qualify for the credit.

-

How does the ETP Employer Transit Pass Credit impact employee satisfaction?

Offering the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations can enhance employee satisfaction by providing a valuable benefit. Employees appreciate the support for their commuting costs, which can lead to increased morale and productivity in the workplace.

-

Can the ETP Employer Transit Pass Credit be combined with other tax credits?

Yes, businesses can often combine the ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt Nonprofit Organizations with other tax incentives. However, it is essential to consult with a tax advisor to understand the implications and ensure compliance with all applicable tax laws.

Get more for ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt

Find out other ETP Employer Transit Pass Credit For C Corporations, S Corporations, Partnerships, Sole Proprietors, Fiduciaries And Tax exempt

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile