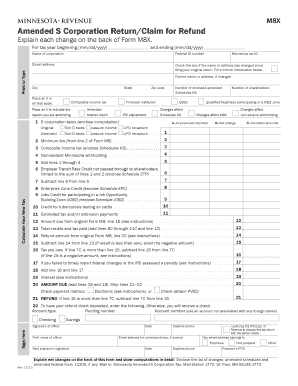

Amended S Corporation ReturnClaim for Refund Minnesota Revenue State Mn Form

What is the Amended S Corporation Return Claim For Refund in Minnesota?

The Amended S Corporation Return Claim for Refund in Minnesota is a specific tax form used by S Corporations to correct previously filed tax returns. This form allows businesses to amend their income, deductions, and credits reported on their original returns. By submitting this form, S Corporations can seek refunds for overpaid taxes or correct errors that may affect their tax liabilities. It is essential for ensuring compliance with state tax regulations and accurately reflecting the corporation's financial position.

Steps to Complete the Amended S Corporation Return Claim For Refund

Completing the Amended S Corporation Return Claim for Refund involves several key steps:

- Gather Documentation: Collect all relevant financial documents, including the original tax return and supporting schedules.

- Identify Errors: Review the original return to pinpoint inaccuracies or changes in income, deductions, or credits.

- Fill Out the Form: Complete the amended return form, ensuring all corrections are clearly indicated.

- Attach Supporting Documents: Include any necessary documentation that supports the changes made in the amended return.

- Review and Sign: Carefully review the completed form for accuracy, then sign and date it.

- Submit the Form: Send the amended return to the appropriate Minnesota state tax authority, following the specified submission guidelines.

Required Documents for the Amended S Corporation Return Claim For Refund

When filing the Amended S Corporation Return Claim for Refund, certain documents are essential to support your claim:

- Original S Corporation tax return (Form M1120S)

- Amended return form (specific to Minnesota)

- Supporting schedules that detail income, deductions, and credits

- Any additional documentation that justifies the changes made

Filing Deadlines for the Amended S Corporation Return Claim For Refund

Filing deadlines for the Amended S Corporation Return Claim for Refund are critical for compliance. Generally, the amended return must be filed within three years from the original due date of the return or within one year from the date the tax was paid, whichever is later. It is important to keep track of these dates to avoid penalties and ensure timely processing of your claim.

State-Specific Rules for the Amended S Corporation Return Claim For Refund

Each state has unique regulations governing the Amended S Corporation Return Claim for Refund. In Minnesota, it is crucial to adhere to state-specific guidelines, including:

- Understanding the specific forms required by the Minnesota Department of Revenue.

- Being aware of any additional documentation that may be necessary for state compliance.

- Following Minnesota's rules regarding the calculation of tax liabilities and refunds.

Legal Use of the Amended S Corporation Return Claim For Refund

The legal use of the Amended S Corporation Return Claim for Refund is essential for ensuring compliance with tax laws. This form must be used appropriately to correct errors or to claim refunds based on legitimate changes in financial reporting. Misuse of the form can lead to penalties or audits by the Minnesota Department of Revenue, making it vital for S Corporations to understand and follow the legal requirements surrounding its use.

Quick guide on how to complete amended s corporation returnclaim for refund minnesota revenue state mn

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the needed form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related procedure today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow parts of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require new copies of documents. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Amended S Corporation ReturnClaim For Refund Minnesota Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the amended s corporation returnclaim for refund minnesota revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Amended S Corporation Return Claim For Refund in Minnesota?

An Amended S Corporation Return Claim For Refund in Minnesota is a process that allows S corporations to correct previously filed tax returns and claim refunds for overpaid taxes. This is essential for ensuring compliance with Minnesota Revenue State Mn regulations and maximizing potential refunds.

-

How can airSlate SignNow assist with filing an Amended S Corporation Return Claim For Refund in Minnesota?

airSlate SignNow provides a user-friendly platform that simplifies the process of preparing and submitting an Amended S Corporation Return Claim For Refund in Minnesota. With our eSigning features, you can easily gather necessary signatures and ensure your documents are submitted accurately and on time.

-

What are the costs associated with using airSlate SignNow for Amended S Corporation Returns?

airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution for managing Amended S Corporation Return Claims For Refund in Minnesota. You can choose from different subscription tiers based on your usage and features required.

-

Are there any specific features in airSlate SignNow that help with tax document management?

Yes, airSlate SignNow includes features such as document templates, automated workflows, and secure cloud storage, which are particularly beneficial for managing tax documents like the Amended S Corporation Return Claim For Refund in Minnesota. These features streamline the process and enhance efficiency.

-

Can I integrate airSlate SignNow with other accounting software for my Amended S Corporation Return?

Absolutely! airSlate SignNow offers integrations with popular accounting software, allowing you to seamlessly manage your Amended S Corporation Return Claim For Refund in Minnesota alongside your financial records. This integration helps maintain accuracy and saves time.

-

What benefits does airSlate SignNow provide for businesses filing Amended S Corporation Returns?

Using airSlate SignNow for your Amended S Corporation Return Claim For Refund in Minnesota provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled professionally and securely.

-

Is there customer support available for questions about Amended S Corporation Returns?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding your Amended S Corporation Return Claim For Refund in Minnesota. Our team is available to provide guidance and ensure you have a smooth experience.

Get more for Amended S Corporation ReturnClaim For Refund Minnesota Revenue State Mn

Find out other Amended S Corporation ReturnClaim For Refund Minnesota Revenue State Mn

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free