Form 8949 2015

What is the Form 8949

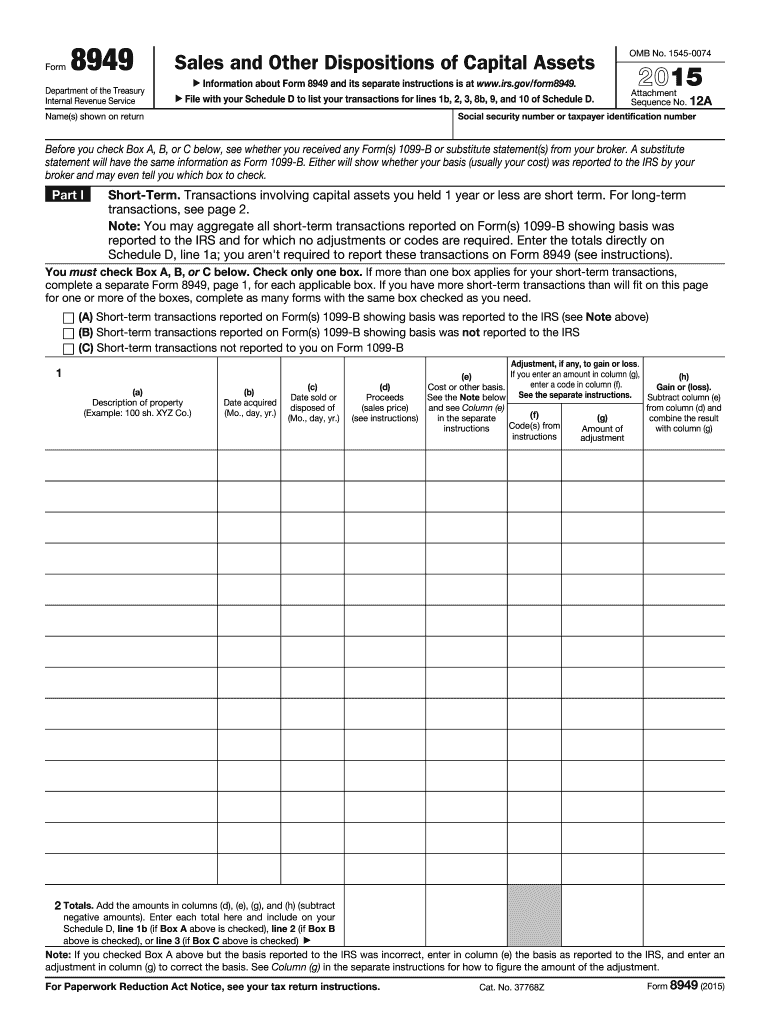

The Form 8949 is a tax form used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating the amount of tax owed on these transactions. It provides a detailed record of each sale, including the date of acquisition, date of sale, proceeds, and the cost basis of the asset. By using Form 8949, taxpayers ensure compliance with IRS regulations regarding capital gains reporting.

How to use the Form 8949

Using Form 8949 involves several key steps. First, gather all relevant information about the assets sold during the tax year. This includes details such as purchase and sale dates, proceeds from the sale, and the cost basis. Next, categorize each transaction into short-term or long-term based on the holding period of the asset. Short-term transactions are those held for one year or less, while long-term transactions are held for more than one year. Finally, enter the information into the appropriate sections of Form 8949 and calculate the total gains or losses to report on your tax return.

Steps to complete the Form 8949

Completing Form 8949 requires careful attention to detail. Start by filling out your personal information at the top of the form. Then, list each transaction in the designated columns, ensuring to include:

- The date you acquired the asset

- The date you sold the asset

- The proceeds from the sale

- The cost basis of the asset

- Any adjustments to gain or loss

After entering all transactions, calculate the total short-term and long-term gains or losses. These totals will be transferred to Schedule D of your tax return.

Legal use of the Form 8949

Form 8949 is legally binding when completed accurately and submitted in accordance with IRS guidelines. To ensure its legal standing, taxpayers must provide truthful and complete information. Additionally, the use of electronic signatures through compliant platforms can enhance the form's legitimacy. Adhering to the IRS requirements for reporting capital gains and losses is crucial for avoiding penalties and ensuring that the form is accepted by tax authorities.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8949. Taxpayers must follow the instructions outlined in the IRS Publication 550, which details the rules for capital gains and losses. It is important to keep accurate records of all transactions and to report them correctly on Form 8949. The IRS also emphasizes the importance of differentiating between short-term and long-term transactions, as they are taxed at different rates.

Filing Deadlines / Important Dates

Form 8949 must be filed along with your annual tax return, typically due on April fifteenth of each year. If you require additional time, you can file for an extension, which provides an additional six months to submit your return. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to stay informed about any changes to deadlines that the IRS may announce each tax year.

Quick guide on how to complete 2015 form 8949

Complete Form 8949 seamlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to generate, modify, and electronically sign your documents swiftly and without delays. Manage Form 8949 on any device with the airSlate SignNow Android or iOS applications and simplify any document-focused task today.

How to edit and electronically sign Form 8949 effortlessly

- Find Form 8949 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 8949 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form 8949

Create this form in 5 minutes!

How to create an eSignature for the 2015 form 8949

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form 8949 and why is it important?

Form 8949 is a crucial document used by taxpayers to report sales and other dispositions of capital assets. It helps individuals calculate their capital gains and losses, ensuring accurate tax reporting. By using airSlate SignNow, you can easily create and eSign your Form 8949, simplifying the submission process.

-

How can airSlate SignNow assist with completing Form 8949?

airSlate SignNow provides a user-friendly interface that allows you to fill out Form 8949 electronically. Its features include drag-and-drop tools and real-time collaboration, making your document management seamless. You can complete and eSign your Form 8949 in minutes, ensuring you meet tax deadlines effortlessly.

-

Is there a cost associated with using airSlate SignNow for Form 8949?

Yes, airSlate SignNow offers several pricing plans that cater to various needs, including features for managing Form 8949. The pricing plans are designed to be cost-effective, providing great value for businesses and individuals. Review the pricing options to determine the best fit for your Form 8949 needs.

-

What features does airSlate SignNow offer for Form 8949 users?

airSlate SignNow offers a range of features for users dealing with Form 8949, including eSigning, document templates, and secure cloud storage. These tools streamline the paperwork process, allowing for efficient document management. Moreover, you can track document status, ensuring timely submissions.

-

Can I integrate airSlate SignNow with other tools for Form 8949 management?

Absolutely! airSlate SignNow integrates with numerous third-party applications, enhancing your workflow for managing Form 8949. This includes integrations with popular accounting software, CRMs, and cloud storage solutions, enabling a comprehensive approach to document handling. Seamlessly send and eSign your Form 8949 alongside your favorite tools.

-

How secure is airSlate SignNow for signing Form 8949?

Security is a top priority for airSlate SignNow, especially when it comes to signing sensitive documents like Form 8949. The platform employs advanced encryption protocols and complies with industry standards to protect your data. You can eSign Form 8949 with confidence, knowing your information is secure.

-

What benefits does using airSlate SignNow provide for Form 8949 submissions?

Using airSlate SignNow for Form 8949 submissions offers numerous benefits, including time efficiency, reduced paperwork, and improved accuracy. The digital eSignature feature expedites the signing process, allowing for quicker tax submissions. Additionally, it minimizes the risk of errors often associated with paper forms.

Get more for Form 8949

- 2019 form uk vt01 fill online printable fillable blank

- Pdf agentadjuster name or address change request form texas

- Certify i we am the rightful owner of this vehicle or watercraft and am entitled to form

- Certificate of approved operations form

- How to request a review of a fine infringement noticecity of casey form

- D0307 claim for funeral benefit form

- Form 1365 application for casr part 66 licence initial issue schedule of experience soe

- Carer adjustment payment services australia form

Find out other Form 8949

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement