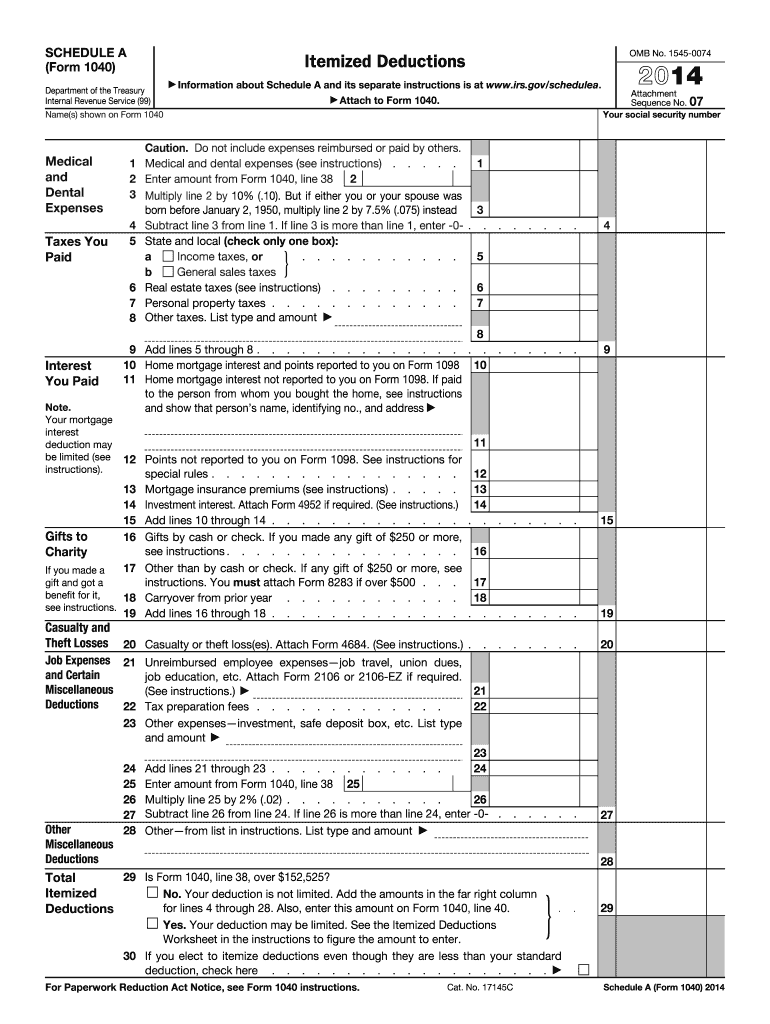

Irs Schedule Form 2014

What is the IRS Schedule Form

The IRS Schedule Form is a document used by taxpayers in the United States to report additional income, deductions, or credits that are not included on the main tax return form. This form allows individuals and businesses to provide detailed information necessary for accurate tax calculation. Depending on the specific schedule, it may pertain to various aspects of income, such as capital gains, dividends, or self-employment income. Understanding the purpose of the IRS Schedule Form is crucial for ensuring compliance with tax regulations and optimizing potential tax benefits.

How to use the IRS Schedule Form

Using the IRS Schedule Form involves several key steps. First, identify the specific schedule that corresponds to your tax situation, such as Schedule C for self-employment income or Schedule D for capital gains. Once you have the correct form, gather all necessary financial documents, including income statements and receipts for deductions. Fill out the form accurately, ensuring that all figures are correct and that you follow the instructions provided by the IRS. After completing the form, it should be attached to your main tax return when filing.

Steps to complete the IRS Schedule Form

Completing the IRS Schedule Form requires careful attention to detail. Here are the steps to follow:

- Determine which schedule applies to your tax situation.

- Collect relevant financial documents, such as W-2s, 1099s, and expense receipts.

- Fill out the form, ensuring that all information is accurate and complete.

- Double-check your calculations to avoid errors.

- Attach the completed schedule to your main tax return.

- File your tax return by the designated deadline, whether electronically or by mail.

Legal use of the IRS Schedule Form

The legal use of the IRS Schedule Form is essential for compliance with federal tax laws. Each schedule must be filled out accurately and truthfully to avoid penalties or audits. The IRS requires taxpayers to maintain records supporting the information reported on the schedules. Failure to comply with these requirements can result in legal consequences, including fines or additional taxes owed. It is important to understand the legal implications of the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule Form coincide with the overall tax return deadlines. Typically, individual tax returns are due on April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to be aware of any changes in deadlines, especially for extensions or specific circumstances that may apply to your situation. Keeping track of these important dates helps ensure timely filing and compliance.

Required Documents

To complete the IRS Schedule Form accurately, certain documents are required. These may include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements and investment records

- Any relevant tax documents from previous years

Gathering these documents in advance can streamline the completion process and reduce the risk of errors.

Examples of using the IRS Schedule Form

There are various scenarios in which the IRS Schedule Form is utilized. For instance, a self-employed individual would use Schedule C to report income and expenses related to their business. Similarly, an investor would use Schedule D to report capital gains and losses from the sale of assets. Each example highlights the importance of selecting the correct schedule to ensure accurate reporting and compliance with tax laws.

Quick guide on how to complete 2014 irs schedule form

Effortlessly prepare Irs Schedule Form on any device

Managing documents online has surged in popularity among both businesses and individuals. It offers an excellent environmentally friendly substitute to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Handle Irs Schedule Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Irs Schedule Form with ease

- Locate Irs Schedule Form and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Irs Schedule Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 irs schedule form

Create this form in 5 minutes!

How to create an eSignature for the 2014 irs schedule form

The way to generate an eSignature for your PDF file online

The way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Irs Schedule Form and why is it important?

The Irs Schedule Form is a specific document used for reporting various income, deductions, and credits to the IRS. This form is essential for ensuring that your tax return is complete and accurate, which can help you avoid penalties and maximize your tax benefits.

-

How can airSlate SignNow assist with completing the Irs Schedule Form?

airSlate SignNow simplifies the process of completing the Irs Schedule Form by providing a user-friendly platform for eSigning and managing documents. It allows users to fill out forms electronically, ensuring accuracy and reducing the risk of errors commonly associated with handwritten submissions.

-

Is airSlate SignNow cost-effective for businesses needing the Irs Schedule Form?

Yes, airSlate SignNow offers competitive pricing that makes it an affordable solution for businesses of all sizes. With various pricing plans, you can find one that fits your budget while gaining access to essential features for managing the Irs Schedule Form and other documents.

-

What features does airSlate SignNow offer for the Irs Schedule Form?

airSlate SignNow includes features such as document templates, customizable workflows, and secure storage, all of which can enhance the management of your Irs Schedule Form. These tools streamline the completion and submission process, saving you valuable time.

-

Can I integrate airSlate SignNow with other software for the Irs Schedule Form?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions such as CRM systems, accounting software, and cloud storage services. This flexibility allows you to manage your Irs Schedule Form within your existing workflows, making the process even more efficient.

-

How does airSlate SignNow ensure the security of my Irs Schedule Form?

Security is a top priority for airSlate SignNow, which uses advanced encryption and authentication measures to protect your documents. When handling your Irs Schedule Form, you can trust that your sensitive information remains secure and confidential.

-

What benefits does airSlate SignNow offer for eSigning documents like the Irs Schedule Form?

By using airSlate SignNow for eSigning documents like the Irs Schedule Form, you expedite the signature process and reduce turnaround times. This not only enhances the efficiency of your tax documentation but also provides a legally binding electronic signature that is recognized by the IRS.

Get more for Irs Schedule Form

Find out other Irs Schedule Form

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure