Form 6252 2014

What is the Form 6252

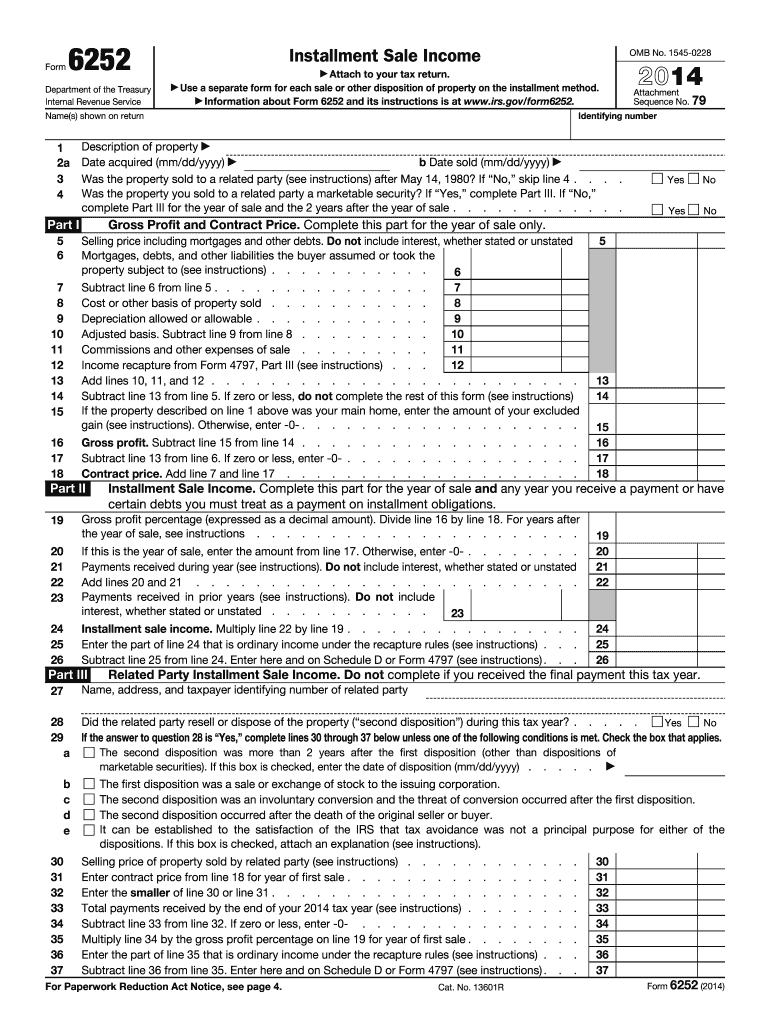

The Form 6252 is a tax document used by taxpayers in the United States to report the sale of property when the seller receives at least one payment after the year of sale. This form is particularly relevant for installment sales, allowing sellers to report their income over time rather than in a lump sum. The form is essential for accurately calculating the gain from the sale and ensuring compliance with IRS regulations.

How to use the Form 6252

Using Form 6252 involves several steps to ensure accurate reporting of installment sales. Taxpayers must first determine if the sale qualifies for installment reporting. If it does, complete the form by providing details such as the gross sales price, the adjusted basis of the property sold, and the amount received during the tax year. The form helps calculate the gain recognized for the year, which is crucial for tax liability. After completing the form, it should be attached to the taxpayer's annual income tax return.

Steps to complete the Form 6252

Completing Form 6252 requires careful attention to detail. Here are the steps:

- Gather necessary information about the sale, including the sales price and the property’s basis.

- Fill out the form sections, including the seller's details and the specifics of the sale.

- Calculate the gain from the sale by subtracting the adjusted basis from the gross sales price.

- Determine the amount received during the tax year and the gain to report for that year.

- Review the completed form for accuracy before submission.

Legal use of the Form 6252

The legal use of Form 6252 is governed by IRS guidelines, which stipulate that it must be filled out accurately to reflect the true nature of the sale. Failure to comply with these guidelines can lead to penalties or audits. The form must be submitted with the taxpayer's annual tax return to ensure that the reported income aligns with IRS records. Proper documentation and compliance with tax laws are crucial for the form's legal validity.

Filing Deadlines / Important Dates

Filing deadlines for Form 6252 align with the annual tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers should be aware of any changes in tax law that may affect deadlines and ensure timely submission to avoid penalties.

Required Documents

To complete Form 6252, taxpayers need to gather several documents, including:

- Sales agreement or contract detailing the terms of the sale.

- Records of payments received during the tax year.

- Documentation of the property's adjusted basis, including purchase price and any improvements made.

Having these documents ready will facilitate accurate completion of the form and help substantiate the reported information if needed.

Quick guide on how to complete 2014 form 6252

Easily Prepare Form 6252 on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any hassles. Handle Form 6252 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

Edit and eSign Form 6252 Effortlessly

- Obtain Form 6252 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Verify the details and then click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

No more worrying about lost or misplaced documents, cumbersome form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Form 6252 to guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 6252

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 6252

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 6252 and why is it important?

Form 6252 is used to report the sale of property where at least part of the payment is received in a year after the sale. It's crucial for accurately calculating capital gains and reporting income for tax purposes.

-

How can airSlate SignNow help me with Form 6252?

With airSlate SignNow, you can easily prepare, send, and eSign Form 6252 documents online. Our platform simplifies the signing process, allowing you to focus on your financial reporting needs without hassle.

-

Is there a cost associated with using airSlate SignNow for Form 6252?

Yes, airSlate SignNow offers various pricing plans that are cost-effective and designed to meet the needs of different businesses. You can efficiently manage Form 6252 documentation without breaking the bank.

-

What features does airSlate SignNow offer for Form 6252?

airSlate SignNow provides a range of features for handling Form 6252, including easy document templates, customizable workflows, and secure eSigning. These features enhance efficiency and accuracy in your tax documentation.

-

Can I integrate airSlate SignNow with other software for managing Form 6252?

Absolutely! airSlate SignNow seamlessly integrates with major software platforms so you can manage Form 6252 alongside other business applications. This allows for streamlined processes and improved productivity.

-

What are the benefits of using airSlate SignNow for Form 6252 over traditional methods?

Using airSlate SignNow for Form 6252 offers numerous benefits, including speed, convenience, and security. Digital eSigning minimizes paper waste and expedites the entire signing process, making it a modern solution for businesses.

-

Is airSlate SignNow secure for handling sensitive documents like Form 6252?

Yes, airSlate SignNow prioritizes your security with encryption and advanced security measures to protect sensitive documents like Form 6252. You can trust us to keep your information safe during the eSigning process.

Get more for Form 6252

- Dva fact sheets and forms

- Casa form 1365 2013 2019

- Ac2131 form

- Msf 4371 form

- License app renewal form

- Use this form if you are a member of the military superannuation and benefits scheme

- Bus travel assistance safety net application bus travel assistance safety net application form

- Mr205 drivers licencelearners permit application sa gov form

Find out other Form 6252

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation