Form 990 Schedule a 2010

What is the Form 990 Schedule A

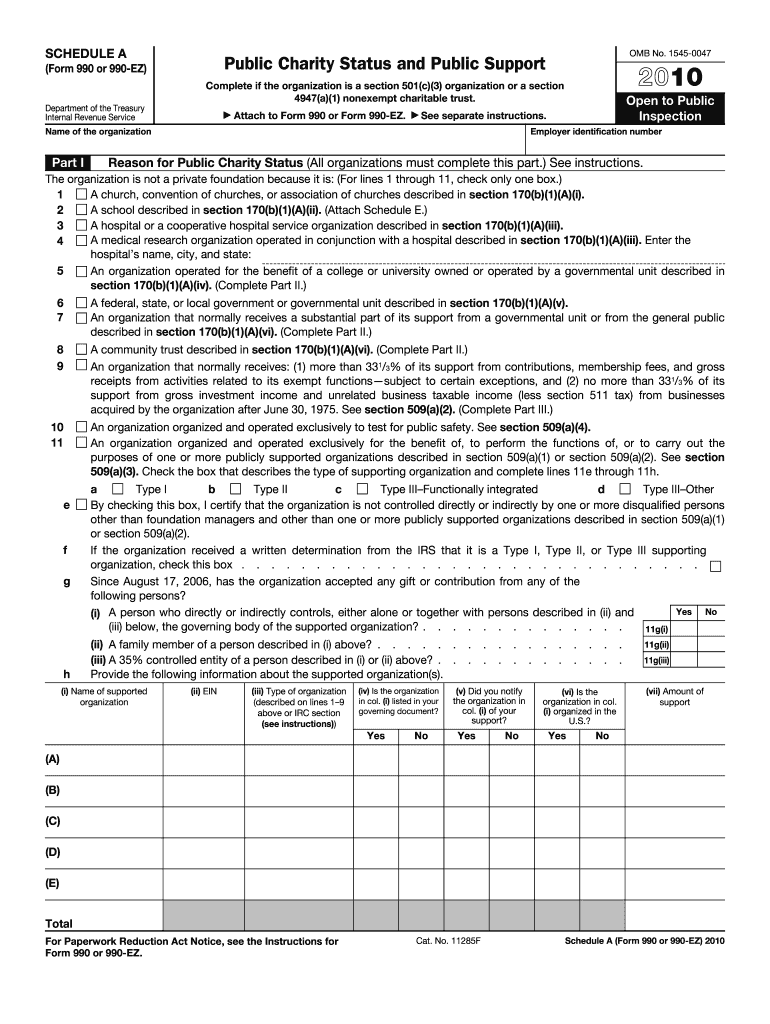

The Form 990 Schedule A is a tax form used by organizations exempt from federal income tax under section 501(c) of the Internal Revenue Code. This schedule is a supplemental document that provides detailed information about the organization’s public charity status. It helps the IRS determine whether the organization qualifies for tax-exempt status and maintains compliance with federal regulations. The form includes sections that require organizations to report their public support, contributions, and the nature of their activities.

How to use the Form 990 Schedule A

Using the Form 990 Schedule A involves several steps. First, organizations must gather the necessary financial information, including revenue sources and expenses. Next, they should complete the form by filling out each section accurately, ensuring that all required disclosures are included. After completing the form, organizations must review it for accuracy before submitting it along with their main Form 990. This ensures compliance with IRS requirements and maintains transparency regarding their charitable activities.

Steps to complete the Form 990 Schedule A

Completing the Form 990 Schedule A requires careful attention to detail. Here are the key steps:

- Gather financial records, including income statements and donation receipts.

- Identify the organization’s public support and contributions from the past five years.

- Fill out the sections on public support, detailing the sources and amounts of contributions.

- Complete any additional sections that apply to the organization, such as those related to specific types of activities.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form along with the main Form 990 by the designated deadline.

Legal use of the Form 990 Schedule A

The Form 990 Schedule A serves a critical legal purpose for tax-exempt organizations. It is used to demonstrate compliance with federal tax laws and to provide transparency to the public regarding the organization’s funding and activities. Organizations must ensure that the information reported is accurate and complete, as any discrepancies can lead to penalties or loss of tax-exempt status. Maintaining proper records and adhering to IRS guidelines is essential for legal compliance.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 Schedule A to avoid penalties. Typically, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. Extensions may be available, but they must be requested properly. It is important to keep track of these deadlines to ensure timely submission and compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 990 Schedule A can be submitted through various methods. Organizations may file the form electronically using the IRS e-file system, which is often the preferred method for efficiency and tracking. Alternatively, organizations can submit a paper version of the form by mailing it to the appropriate IRS address. In-person submissions are generally not accepted for this form. Choosing the right submission method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete 2010 form 990 schedule a 1651671

Complete Form 990 Schedule A effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Form 990 Schedule A on any device with airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to edit and eSign Form 990 Schedule A without difficulty

- Locate Form 990 Schedule A and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your updates.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 990 Schedule A and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 990 schedule a 1651671

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 990 schedule a 1651671

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is Form 990 Schedule A?

Form 990 Schedule A is a required attachment for certain tax-exempt organizations, providing detailed information about their public charity status. This form helps the IRS assess whether an organization qualifies for charitable contributions. Understanding this form is essential for compliance and transparency in nonprofit operations.

-

How can airSlate SignNow assist with Form 990 Schedule A?

airSlate SignNow streamlines the process of completing and eSigning Form 990 Schedule A by offering a user-friendly interface. Our platform ensures that you can easily gather necessary information and securely manage signatures. This efficiency aids in compliance and reduces the time spent on administrative tasks.

-

What are the pricing options for airSlate SignNow when handling Form 990 Schedule A?

airSlate SignNow offers flexible pricing plans to cater to various organizational needs, including features relevant for managing Form 990 Schedule A. You can choose from different subscription tiers that best fit your budget and requirements. Each plan provides essential functionalities to simplify your document management workflows.

-

Can I integrate airSlate SignNow with other software for Form 990 Schedule A management?

Yes, airSlate SignNow supports seamless integrations with various software systems, enhancing your ability to manage Form 990 Schedule A effectively. Integrations with accounting and CRM platforms allow for a smoother flow of information and improved collaboration. This facilitates more efficient tracking and preparation of required documents.

-

What features does airSlate SignNow offer to simplify Form 990 Schedule A preparation?

airSlate SignNow provides features like customizable templates, automated reminders, and secure eSigning to simplify the preparation of Form 990 Schedule A. These functionalities ensure you have everything needed at your fingertips, reducing complexity. The platform also allows users to collaborate in real-time, making the process more efficient.

-

How does airSlate SignNow ensure the security of my Form 990 Schedule A documents?

Security is a priority at airSlate SignNow, which employs advanced encryption and authentication measures to protect your Form 990 Schedule A documents. Our platform complies with industry standards for data privacy, ensuring that sensitive information remains secure. You can trust us to safeguard your organization’s data throughout the signing process.

-

Is there customer support available for help with Form 990 Schedule A?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any questions regarding Form 990 Schedule A. Our team is available via multiple channels to ensure you have the guidance needed for effective document management. We're here to help you maximize the benefits of our platform.

Get more for Form 990 Schedule A

- Connecticut petition for change of name adult form

- County colorado district court colorado center for divorce form

- Adding co conservator in california form

- Jdf 520 petition to terminte the parent child legal relationshipdoc form

- Bond waiver state of connecticut pc 280 rev 713 form

- Connecticut requestorder waiver of fees petitioner form

- Connecticut affidavit re change of name minor form

- Affidavit form 5522112

Find out other Form 990 Schedule A

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT