Form 990 Ez 2010

What is the Form 990 EZ

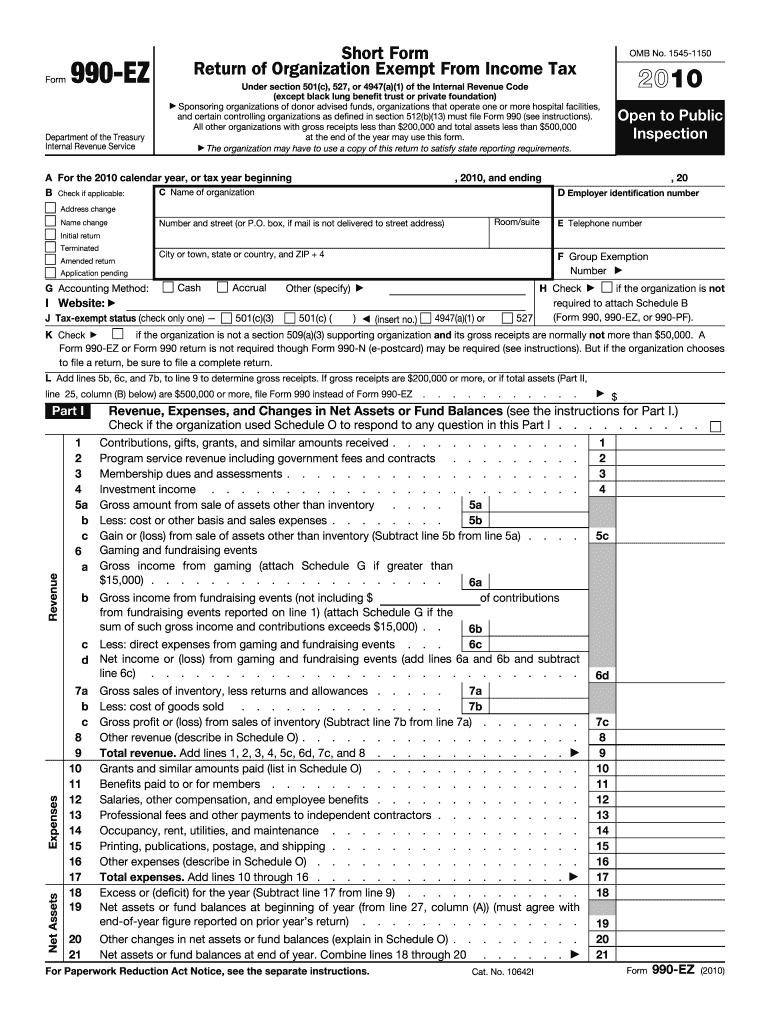

The Form 990 EZ is a simplified version of the standard Form 990, used by tax-exempt organizations in the United States to report their financial information to the Internal Revenue Service (IRS). This form is designed for smaller organizations that have gross receipts of less than $200,000 and total assets of less than $500,000. By using Form 990 EZ, eligible organizations can provide essential details about their income, expenses, and activities in a more straightforward format, making it easier to comply with federal tax reporting requirements.

How to use the Form 990 EZ

To effectively use the Form 990 EZ, organizations must first ensure they meet the eligibility criteria based on their financial thresholds. Once confirmed, they can obtain the form from the IRS website or other authorized sources. The organization should gather all necessary financial documentation, including income statements, balance sheets, and records of expenses. After filling out the form, it must be signed by an authorized individual, such as the executive director or board chair, before submission to the IRS.

Steps to complete the Form 990 EZ

Completing the Form 990 EZ involves several key steps:

- Gather financial records, including income, expenses, and asset information.

- Download the Form 990 EZ from the IRS website.

- Fill in the required fields, ensuring accuracy in reporting financial data.

- Review the completed form for any errors or omissions.

- Sign the form by an authorized representative of the organization.

- Submit the form to the IRS by the designated deadline, either electronically or by mail.

Legal use of the Form 990 EZ

The Form 990 EZ is legally binding when completed and submitted according to IRS guidelines. Organizations must ensure that the information provided is accurate and truthful to avoid potential penalties. The form must be signed by an authorized individual, which adds to its legal standing. Compliance with the IRS's filing requirements is essential for maintaining tax-exempt status and avoiding issues with federal regulations.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the Form 990 EZ. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For example, if an organization’s fiscal year ends on December 31, the Form 990 EZ must be filed by May 15 of the following year. It is crucial for organizations to track these deadlines to maintain compliance and avoid late filing penalties.

Required Documents

When completing the Form 990 EZ, organizations should prepare several key documents, including:

- Financial statements, including income and expense reports.

- Balance sheets detailing assets and liabilities.

- Records of contributions and grants received.

- Documentation of any program service accomplishments.

Having these documents ready will streamline the completion process and ensure accurate reporting.

Penalties for Non-Compliance

Failure to file the Form 990 EZ or submitting inaccurate information can result in significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, organizations that do not comply with filing requirements risk losing their tax-exempt status. It is essential for organizations to prioritize timely and accurate submissions to avoid these consequences.

Quick guide on how to complete 2010 form 990 ez

Effortlessly prepare Form 990 Ez on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle Form 990 Ez on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to edit and electronically sign Form 990 Ez with ease

- Obtain Form 990 Ez and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or downloading it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Edit and electronically sign Form 990 Ez and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 990 ez

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 990 ez

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is Form 990 Ez?

Form 990 Ez is a simplified version of Form 990, designed for smaller tax-exempt organizations to report their financial information to the IRS. It allows organizations with gross receipts of less than $200,000 and total assets of less than $500,000 to complete their filing more efficiently. Utilizing airSlate SignNow can streamline this process with eSignature capabilities.

-

How does airSlate SignNow help with filing Form 990 Ez?

airSlate SignNow facilitates the smooth completion and submission of Form 990 Ez by providing an easy-to-use platform for eSigning and sending documents. Our solution helps you manage and track the entire process, ensuring that all files are securely signed and stored for your records. This transforms a traditionally tedious task into a simplified and efficient workflow.

-

What are the pricing options for using airSlate SignNow for Form 990 Ez?

airSlate SignNow offers flexible pricing plans that cater to various business needs, ensuring affordability while filing Form 990 Ez. You can choose from monthly subscriptions or annual plans that provide signNow savings. Each plan includes features that enhance your document management and eSignature processes.

-

What features does airSlate SignNow offer for Form 990 Ez?

With airSlate SignNow, you have access to a range of features to assist with Form 990 Ez, including customizable templates, secure eSigning, and document tracking. Our platform also integrates seamlessly with various business applications, enabling a smooth user experience. These features simplify the filing process and improve organization within your workflows.

-

Are there any benefits of using airSlate SignNow for non-profit organizations filing Form 990 Ez?

Non-profit organizations benefit greatly from using airSlate SignNow for filing Form 990 Ez as it reduces the time and effort required for document management. The eSignature feature ensures that approvals are quick and legally binding, while our templates help standardize submissions. This efficiency allows organizations to focus more on their mission and less on paperwork.

-

Can I integrate airSlate SignNow with other tools while filing Form 990 Ez?

Yes, airSlate SignNow offers robust integrations with a variety of business tools that can enhance your experience while filing Form 990 Ez. Whether you use CRM systems, cloud storage solutions, or accounting software, our platform can connect seamlessly. This integration capability makes document preparation and compliance easier and more organized.

-

Is airSlate SignNow secure for filing Form 990 Ez?

Absolutely! airSlate SignNow prioritizes security for all document transactions, including the filing of Form 990 Ez. Our platform employs advanced encryption and complies with legal standards to protect sensitive information. You can rest assured that your documents are in safe hands while using our eSigning services.

Get more for Form 990 Ez

Find out other Form 990 Ez

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now