1120s Form 2015

What is the 1120S Form

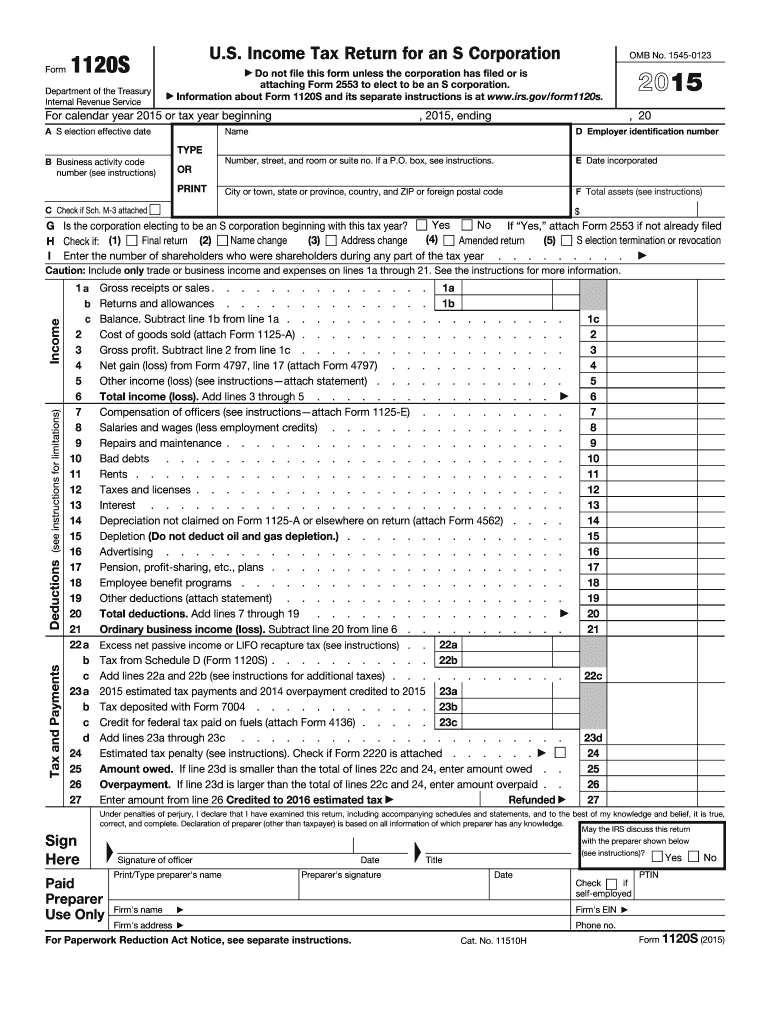

The 1120S Form is a tax document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). S corporations are special tax entities that allow income to pass through to shareholders, avoiding double taxation. This form is essential for S corporations to maintain their tax status and ensure compliance with federal tax regulations. It includes various sections that require detailed financial information, including income from operations, deductions for business expenses, and credits that may apply.

How to use the 1120S Form

Using the 1120S Form involves several steps to ensure accurate reporting. First, gather all necessary financial records, including income statements and expense reports. Next, fill out the form by entering the corporation's income, deductions, and credits in the appropriate sections. It is crucial to follow the IRS instructions carefully to avoid errors. Once completed, the form must be signed by an authorized officer of the corporation. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail.

Steps to complete the 1120S Form

Completing the 1120S Form requires careful attention to detail. Here are the key steps:

- Gather financial documents, including income statements and expense records.

- Fill out the basic information section, including the corporation's name, address, and employer identification number (EIN).

- Report total income from all sources, including sales and any other revenue.

- List all allowable deductions, such as salaries, rent, and utilities.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the sections for credits, if applicable.

- Review the form for accuracy and ensure it is signed by an authorized officer.

- Submit the completed form to the IRS by the filing deadline.

Filing Deadlines / Important Dates

The filing deadline for the 1120S Form is typically March 15 for most S corporations. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Corporations can also request an automatic six-month extension, which pushes the deadline to September 15. It is essential to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal use of the 1120S Form

The 1120S Form is legally required for S corporations to report their income and deductions to the IRS. Failure to file this form can result in penalties, including fines and potential loss of S corporation status. Additionally, accurate reporting is crucial for shareholders, as the income reported on the 1120S will affect their personal tax returns. Thus, understanding the legal implications of this form is vital for compliance and proper tax management.

Required Documents

To complete the 1120S Form, several documents are necessary:

- Income statements detailing all revenue sources.

- Expense records, including receipts and invoices for business-related costs.

- Prior year tax returns for reference and consistency.

- Any relevant schedules or additional forms required by the IRS.

Having these documents organized and accessible will streamline the completion of the form and help ensure accurate reporting.

Quick guide on how to complete 2015 1120s form

Complete 1120s Form seamlessly on any device

Managing documents online has gained popularity among companies and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Handle 1120s Form on any platform with airSlate SignNow for Android or iOS and enhance any document-driven task today.

How to modify and electronically sign 1120s Form effortlessly

- Obtain 1120s Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or mask sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your device of choice. Modify and electronically sign 1120s Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1120s form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1120s form

The way to make an electronic signature for a PDF online

The way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

The way to generate an eSignature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 1120s Form and who needs to file it?

The 1120s Form is an IRS tax form used by S corporations to report their income, deductions, and credits. Businesses that elect S corporation status must file this form annually to inform the IRS about their financial activities. Understanding the 1120s Form is crucial for compliance and accurate tax reporting.

-

How can airSlate SignNow help with the 1120s Form?

airSlate SignNow simplifies the process of preparing and signing the 1120s Form by allowing users to easily upload, edit, and eSign documents online. With its user-friendly interface, businesses can streamline their tax filing process, ensuring that the 1120s Form is completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for small businesses needing to file the 1120s Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses. By using this service, you can reduce costs associated with paper documentation and signatures, making it a budget-friendly solution for managing the 1120s Form and other important documents.

-

What features does airSlate SignNow offer for handling the 1120s Form?

airSlate SignNow provides features such as document templates, electronic signatures, and secure cloud storage, all of which enhance the efficiency of handling the 1120s Form. These tools ensure that users can prepare and sign their forms quickly while maintaining compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software to manage my 1120s Form?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting and tax software, making it easier to manage the 1120s Form alongside your other financial documents. This integration helps streamline workflows and reduces the risk of errors during the filing process.

-

What are the benefits of using airSlate SignNow for the 1120s Form over traditional methods?

Using airSlate SignNow for the 1120s Form offers several advantages over traditional methods, including faster processing times, reduced paperwork, and enhanced security. The electronic signature capability ensures that your forms are signed quickly, while cloud storage keeps your documents safe and accessible.

-

Is it easy to track the status of my 1120s Form with airSlate SignNow?

Yes, airSlate SignNow allows users to track the status of their 1120s Form in real-time. You can easily see who has signed the document and when, ensuring a smooth and transparent filing process that keeps you informed every step of the way.

Get more for 1120s Form

Find out other 1120s Form

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free