Eres Form 101 2018

What is the Eres Form 101

The Eres Form 101 is a crucial document used primarily for tax purposes in the United States. It serves as a declaration for individuals and businesses to report specific information to the IRS. This form is essential for ensuring compliance with federal tax regulations and is often utilized by various taxpayer scenarios, including self-employed individuals and corporations. Understanding the purpose and requirements of the Eres Form 101 is vital for accurate tax reporting and avoiding potential penalties.

How to use the Eres Form 101

Using the Eres Form 101 involves several steps to ensure that all required information is accurately reported. First, gather all necessary documents and information, including income statements and deductions. Next, access the form through a reliable source, ensuring it is the most current version. Fill out the form carefully, paying close attention to each section to avoid errors. Once completed, review the information for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Eres Form 101

Completing the Eres Form 101 can be straightforward if you follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Download the latest version of the Eres Form 101 from a trusted source.

- Carefully fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections of the form.

- Include any applicable deductions and credits to ensure you maximize your tax benefits.

- Review the entire form for completeness and accuracy.

- Submit the completed form according to the guidelines provided, whether electronically or by mail.

Legal use of the Eres Form 101

The Eres Form 101 is legally recognized for tax reporting in the United States. To ensure its legal validity, it must be completed accurately and submitted within the specified deadlines. Compliance with IRS guidelines is essential, as inaccuracies or omissions can lead to penalties. The form also requires a signature, which can be done electronically, provided the eSignature meets legal standards under the ESIGN Act and UETA. This ensures that your submission is not only valid but also secure.

Filing Deadlines / Important Dates

Filing deadlines for the Eres Form 101 are critical to avoid penalties. Typically, the form must be submitted by April 15 of each year for individual taxpayers. However, if you are self-employed or filing for a business entity, the deadlines may vary. It's essential to stay informed about any changes to these dates, as the IRS may adjust deadlines based on specific circumstances, such as natural disasters or legislative changes. Mark your calendar to ensure timely submission.

Required Documents

To complete the Eres Form 101, you will need several documents to provide accurate information. Key documents include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

- Any relevant schedules or additional forms required by the IRS

Having these documents ready will streamline the process and help ensure accuracy in your filing.

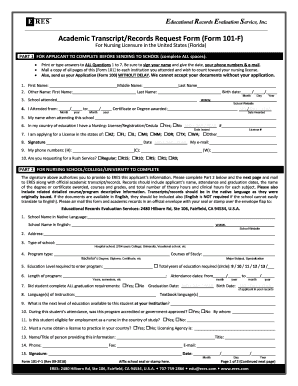

Quick guide on how to complete academic transcriptrecords request form form 101 f

The optimal method to locate and authenticate Eres Form 101

In the context of your whole enterprise, unproductive workflows related to document authorization can consume a signNow amount of working time. Executing documents such as Eres Form 101 is an inherent aspect of operations within any organization, which is why the productivity of each agreement's lifecycle impacts the overall productivity of the business. With airSlate SignNow, authorizing your Eres Form 101 is as straightforward and swift as possible. This platform provides you with the latest version of nearly any form. Even better, you can sign it instantly without the need to install external applications on your device or print anything as physical copies.

Steps to obtain and authenticate your Eres Form 101

- Explore our collection by category or utilize the search bar to locate the necessary form.

- View the form preview by selecting Learn more to ensure it meets your needs.

- Click Get form to start editing immediately.

- Fill out your form and include any mandatory details using the toolbar.

- Once finished, click the Sign tool to authorize your Eres Form 101.

- Select the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and proceed to sharing options as necessary.

With airSlate SignNow, you possess everything required to handle your documents effectively. You can discover, complete, adjust, and even dispatch your Eres Form 101 within a single tab without any complications. Enhance your workflows with a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct academic transcriptrecords request form form 101 f

FAQs

-

Is academic record request form required to be attached along with transcripts to WES?

Yes

-

What are the documents to be posted along with my transcripts for ECA evaluation? Does it include that academic record request form?

The degree completion certificate, transcript and the WES form. All of them attested and enclosed in a signed and sealed envelope.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

Create this form in 5 minutes!

How to create an eSignature for the academic transcriptrecords request form form 101 f

How to create an eSignature for your Academic Transcriptrecords Request Form Form 101 F online

How to generate an eSignature for the Academic Transcriptrecords Request Form Form 101 F in Chrome

How to create an electronic signature for signing the Academic Transcriptrecords Request Form Form 101 F in Gmail

How to make an eSignature for the Academic Transcriptrecords Request Form Form 101 F straight from your mobile device

How to generate an electronic signature for the Academic Transcriptrecords Request Form Form 101 F on iOS

How to generate an electronic signature for the Academic Transcriptrecords Request Form Form 101 F on Android devices

People also ask

-

What is the Eres Form 101 and how does it work with airSlate SignNow?

The Eres Form 101 is a crucial document used for various administrative processes. With airSlate SignNow, you can easily eSign and manage your Eres Form 101, ensuring that your documents are securely signed and stored. Our platform simplifies the workflow, allowing you to focus on what matters most.

-

Is there a cost associated with using airSlate SignNow for Eres Form 101?

Yes, airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can use our platform to manage your Eres Form 101 efficiently without breaking the bank. We provide a cost-effective solution that scales with your needs.

-

What features does airSlate SignNow offer for managing Eres Form 101?

airSlate SignNow includes a range of features for handling the Eres Form 101, such as customizable templates, secure eSigning, and real-time tracking. These tools help streamline your processes and ensure compliance while making it easy to collaborate with team members.

-

How can airSlate SignNow improve the efficiency of processing Eres Form 101?

By using airSlate SignNow, you can enhance the efficiency of processing your Eres Form 101 through automated workflows and instant notifications. This means that you can minimize delays in document processing and ensure that signatures are collected promptly.

-

Can I integrate airSlate SignNow with other software for handling Eres Form 101?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage the Eres Form 101. Whether you use CRMs, cloud storage, or project management tools, our platform can easily connect to streamline your operations.

-

What are the benefits of using airSlate SignNow for Eres Form 101?

Using airSlate SignNow for your Eres Form 101 offers numerous benefits, including increased document security, reduced turnaround time, and improved compliance. Our user-friendly interface makes it easy for anyone in your organization to adopt eSigning without extensive training.

-

Is airSlate SignNow secure for handling sensitive Eres Form 101 documents?

Yes, security is a top priority at airSlate SignNow. Our platform employs advanced encryption and security protocols to ensure that your Eres Form 101 documents are protected against unauthorized access and tampering.

Get more for Eres Form 101

- Vernon powell job application form

- Chief minsters education endowment fund scholarship uetpeshawar edu form

- Dodd camera form

- Ohio board of pharmacy and oxygen form

- Blank business deed form

- Loan insurance policy form

- Conditional probability worksheet 12 2 answers pdf form

- Commercial cannabis licensee bond form state of california

Find out other Eres Form 101

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple