Form 540 California Resident Income Tax Return 2019

What is the Form 540 California Resident Income Tax Return

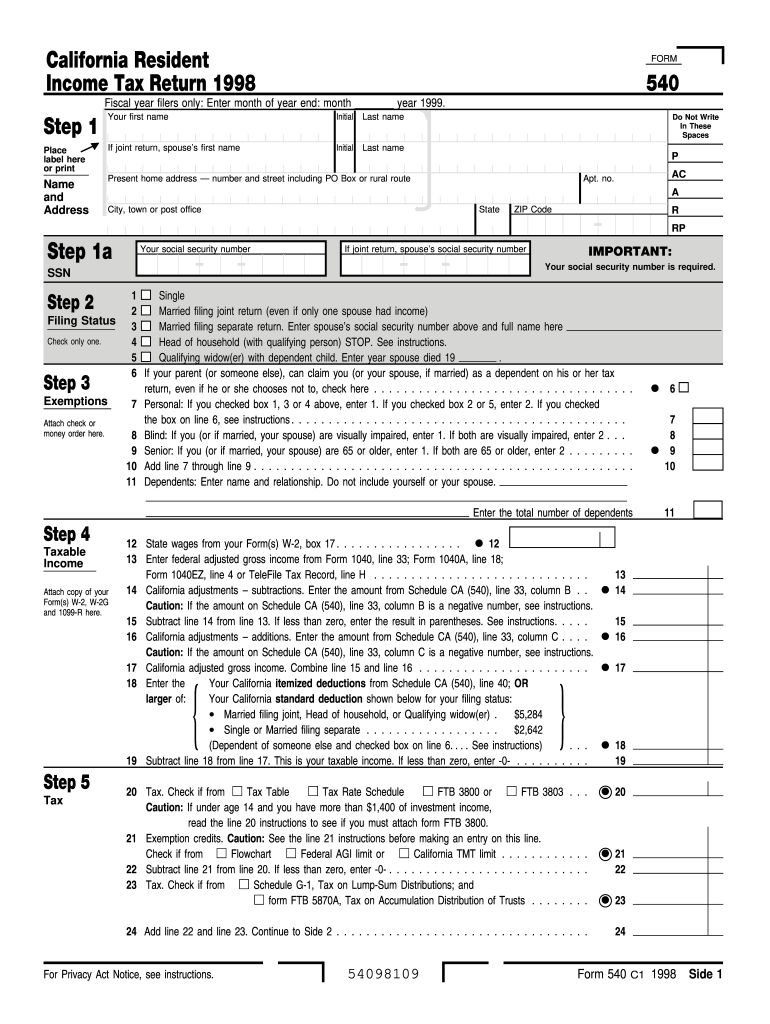

The Form 540 California Resident Income Tax Return is a state tax form used by residents of California to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to fulfill their tax obligations. It is designed to capture various types of income, deductions, and credits that may apply to California residents. Understanding this form is crucial for ensuring compliance with state tax laws and maximizing potential refunds.

Steps to complete the Form 540 California Resident Income Tax Return

Completing the Form 540 involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, determine your filing status, as this will affect your tax rates and deductions. After that, fill out the form by entering your income, deductions, and credits in the appropriate sections. It's important to double-check your entries for accuracy. Finally, review the completed form for any errors before submitting it to the California Franchise Tax Board.

How to obtain the Form 540 California Resident Income Tax Return

The Form 540 can be obtained through various channels. It is available for download on the California Franchise Tax Board's official website, where you can access the latest version of the form. Additionally, physical copies can be requested by mail or picked up at local tax offices or libraries. Many tax preparation software programs also include the Form 540, allowing users to fill it out electronically.

Legal use of the Form 540 California Resident Income Tax Return

The legal use of the Form 540 is governed by California tax laws and regulations. To be considered valid, the form must be completed accurately and submitted by the designated deadline. Electronic submissions are legally recognized, provided they comply with the requirements set forth by the California Franchise Tax Board. It is essential to retain copies of the submitted form and any supporting documents for future reference, especially in case of audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540 are critical for compliance. Generally, the deadline for submitting the form is April 15 of the following year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply if they need additional time to file. Keeping track of these important dates helps avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Form 540, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or medical expenses

- Proof of any tax credits claimed

- Identification information, such as Social Security numbers

Having these documents organized and readily available will streamline the process of filling out the form and ensure that all necessary information is included.

Key elements of the Form 540 California Resident Income Tax Return

The Form 540 includes several key elements that taxpayers must understand. These elements encompass personal information, income details, deductions, and tax credits. The form also features sections for calculating total tax liability and any payments made throughout the year. Additionally, it provides space for taxpayers to claim any applicable refunds. Familiarity with these components is essential for accurate completion and compliance with California tax regulations.

Quick guide on how to complete 1998 form 540 california resident income tax return

Prepare Form 540 California Resident Income Tax Return effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without complications. Manage Form 540 California Resident Income Tax Return on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Form 540 California Resident Income Tax Return with ease

- Obtain Form 540 California Resident Income Tax Return and then click Get Form to begin.

- Utilize the resources we provide to finish your form.

- Emphasize crucial sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your preferred device. Revise and eSign Form 540 California Resident Income Tax Return and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1998 form 540 california resident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 1998 form 540 california resident income tax return

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Form 540 California Resident Income Tax Return?

The Form 540 California Resident Income Tax Return is the official document used by California residents to report their income and calculate their state tax. This form is essential for filing your annual taxes and ensures compliance with California tax laws.

-

How can airSlate SignNow help with Form 540 California Resident Income Tax Return?

airSlate SignNow streamlines the process of completing and submitting the Form 540 California Resident Income Tax Return by providing easy eSigning and document management features. Our platform allows you to fill out, sign, and send your tax return securely and efficiently.

-

What are the pricing options for using airSlate SignNow for Form 540?

airSlate SignNow offers various pricing plans to suit different business needs, starting from a cost-effective monthly subscription. You can choose the plan that best fits your budget and utilize our platform for efficiently managing your Form 540 California Resident Income Tax Return.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features designed for tax document management, including customizable templates, document collaboration, secure cloud storage, and automated reminders. These features enhance your experience while preparing your Form 540 California Resident Income Tax Return.

-

Is airSlate SignNow compliant with California tax regulations?

Yes, airSlate SignNow complies with California tax regulations, ensuring that your Form 540 California Resident Income Tax Return is prepared and submitted in accordance with state laws. Our platform prioritizes data security and compliance, giving you peace of mind.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers seamless integrations with various accounting software programs, enhancing your workflow when preparing your Form 540 California Resident Income Tax Return. This allows for efficient data transfer and better overall tax management.

-

What are the benefits of using airSlate SignNow for eSigning tax documents?

Using airSlate SignNow for eSigning your tax documents, including the Form 540 California Resident Income Tax Return, offers numerous benefits such as increased efficiency, reduced turnaround time, and enhanced security. These advantages help you meet tax deadlines with ease.

Get more for Form 540 California Resident Income Tax Return

Find out other Form 540 California Resident Income Tax Return

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe