Sdarcc Forms 2021-2026

What is the Sdarcc Forms

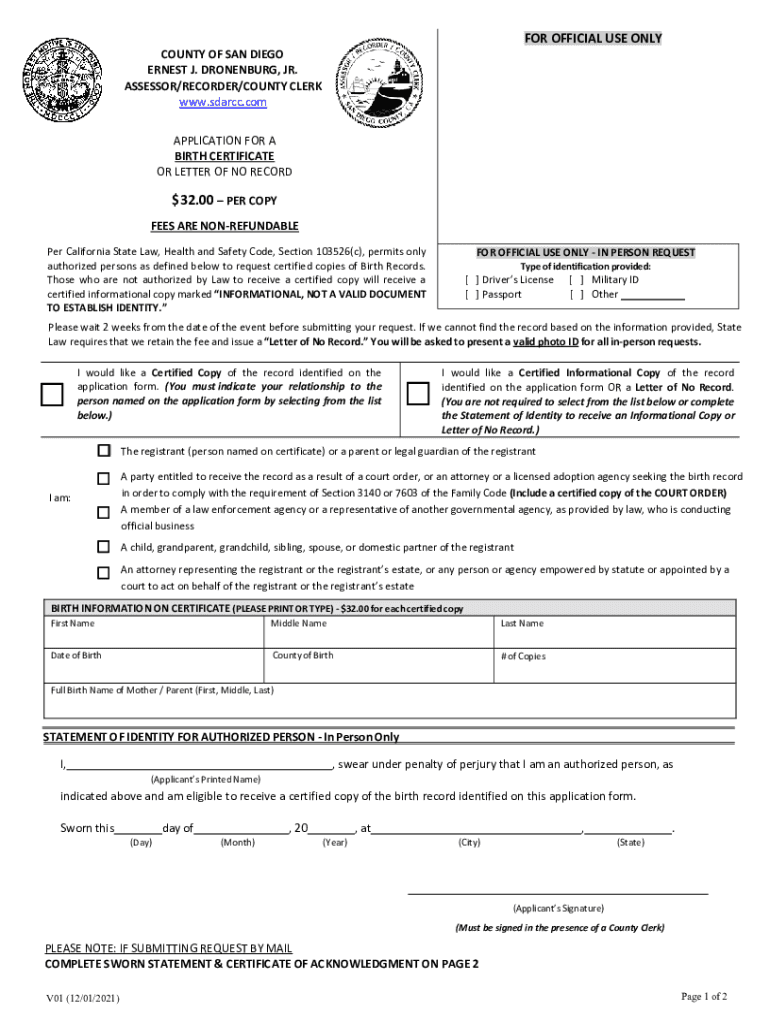

The Sdarcc Forms are essential documents used in the process of obtaining a county birth certificate record. These forms facilitate the request for vital records, ensuring that individuals can access their birth certificates in a structured manner. The forms are designed to comply with state regulations and provide necessary information to the issuing authority.

How to obtain the Sdarcc Forms

To obtain the Sdarcc Forms, individuals can visit their local county clerk's office or the official state vital records website. Many states provide downloadable versions of these forms online, allowing users to complete them at their convenience. It is important to ensure that the correct version of the form is used, as requirements may vary by state.

Steps to complete the Sdarcc Forms

Completing the Sdarcc Forms involves several key steps:

- Download the appropriate form from the official website or obtain a physical copy from the county clerk's office.

- Fill out the required information, such as the applicant's details, the individual's name on the birth certificate, and the date of birth.

- Provide identification as required, which may include a government-issued ID or other forms of verification.

- Review the completed form for accuracy before submission.

Required Documents

When submitting the Sdarcc Forms, applicants must include specific documents to verify their identity and relationship to the individual named on the birth certificate. Commonly required documents include:

- A valid government-issued photo ID.

- Proof of relationship, such as a marriage certificate or another birth certificate.

- Any additional documentation as specified by the state’s guidelines.

Form Submission Methods

The Sdarcc Forms can typically be submitted through various methods, depending on the county's regulations:

- Online submission via the state’s official website.

- Mailing the completed form and required documents to the appropriate county office.

- In-person delivery at the county clerk's office for immediate processing.

Legal use of the Sdarcc Forms

The Sdarcc Forms are legally recognized documents used to request vital records. They must be completed accurately and submitted according to state laws to ensure compliance. Misuse of these forms, such as providing false information, can lead to legal penalties, including fines or denial of the application.

Quick guide on how to complete sdarcc forms

Effortlessly Prepare Sdarcc Forms on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Sdarcc Forms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to Edit and Electronically Sign Sdarcc Forms with Ease

- Obtain Sdarcc Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sdarcc Forms, ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sdarcc forms

Create this form in 5 minutes!

How to create an eSignature for the sdarcc forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a county birth certificate record?

A county birth certificate record is an official document that provides details about a person's birth, including the date, place, and parentage. This record is essential for various legal purposes, such as obtaining identification or applying for government services.

-

How can airSlate SignNow help with county birth certificate records?

airSlate SignNow allows users to easily send and eSign documents related to county birth certificate records. Our platform streamlines the process, ensuring that you can manage and store these important documents securely and efficiently.

-

What are the pricing options for using airSlate SignNow for county birth certificate records?

airSlate SignNow offers flexible pricing plans that cater to different needs, whether you're an individual or a business. Our cost-effective solution ensures that you can manage your county birth certificate records without breaking the bank.

-

Are there any features specifically designed for managing county birth certificate records?

Yes, airSlate SignNow includes features such as document templates, secure storage, and easy sharing options that are perfect for managing county birth certificate records. These tools help you streamline the process and maintain compliance with legal requirements.

-

Can I integrate airSlate SignNow with other applications for county birth certificate records?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow for managing county birth certificate records seamlessly. This enhances productivity and ensures that all your documents are easily accessible.

-

What benefits does airSlate SignNow provide for handling county birth certificate records?

Using airSlate SignNow for county birth certificate records offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, making it easier to obtain necessary signatures quickly.

-

Is airSlate SignNow secure for storing county birth certificate records?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your county birth certificate records are stored safely. We utilize advanced encryption and security protocols to protect your sensitive information from unauthorized access.

Get more for Sdarcc Forms

- New zealand wholesale application form

- Loss history graph and discussion bvsdorg form

- Case 209 cv 11790 mob rsw document 1 jim edwardsamp39 nrx form

- Other equipment amp devices bsubmission formb usga usga

- Cg 20 12 05 09 form

- Ci cpt renewal application form the cooper institute cooperinst

- Wellness center membership application okbu form

- Deceased before july 2 2010 illinois state treasurer treasurer il form

Find out other Sdarcc Forms

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template