it 40 09 12 Indd in Gov Forms in 2016

What is the IT-40-09-12 IN gov Forms In

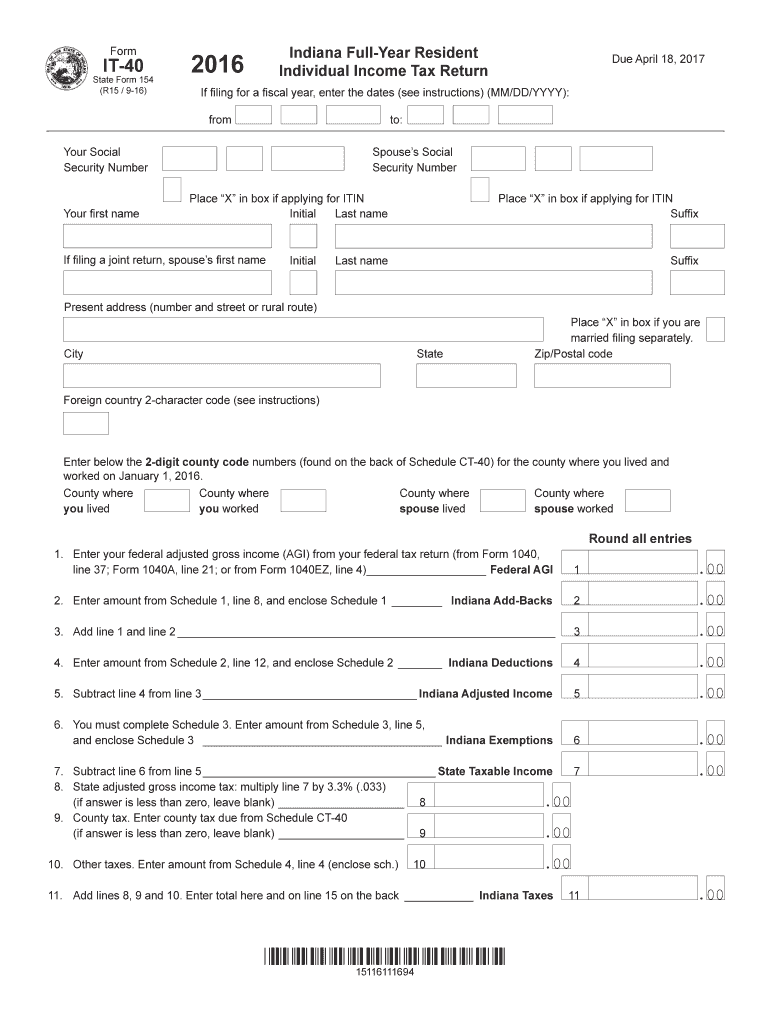

The IT-40-09-12 IN gov Forms In is a specific tax form utilized for reporting income and calculating tax liabilities in the state of Indiana. This form is essential for residents who need to file their state income tax returns. It includes sections for personal information, income details, deductions, and tax credits. Understanding the structure and purpose of this form is crucial for accurate tax reporting and compliance with state regulations.

How to obtain the IT-40-09-12 IN gov Forms In

To obtain the IT-40-09-12 IN gov Forms In, individuals can visit the official Indiana Department of Revenue website, where the form is available for download in PDF format. Alternatively, physical copies may be requested from local tax offices or public libraries. It is important to ensure that the most current version of the form is used to meet filing requirements.

Steps to complete the IT-40-09-12 IN gov Forms In

Completing the IT-40-09-12 IN gov Forms In involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as name, address, and Social Security number.

- Report total income and any applicable deductions or credits.

- Calculate the total tax owed or refund due based on the provided information.

- Review the completed form for accuracy before submission.

Legal use of the IT-40-09-12 IN gov Forms In

The IT-40-09-12 IN gov Forms In is legally recognized by the Indiana Department of Revenue for tax filing purposes. It must be completed accurately and submitted by the designated deadlines to avoid penalties. The form can be signed electronically, provided that the eSignature complies with federal and state regulations, ensuring that the submission is valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the IT-40-09-12 IN gov Forms In typically align with federal tax deadlines. For individual taxpayers, the due date is usually April 15 of each year, unless it falls on a weekend or holiday. It is essential to stay informed about any changes to these dates, especially during tax season, to ensure timely submission and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The IT-40-09-12 IN gov Forms In can be submitted through various methods:

- Online: Taxpayers can file electronically using approved e-filing software that supports Indiana tax forms.

- Mail: Completed forms can be printed and mailed to the Indiana Department of Revenue at the designated address.

- In-Person: Individuals may also choose to submit their forms in person at local tax offices for assistance and confirmation of receipt.

Quick guide on how to complete it 40 09 12indd ingov forms in

Your assistance manual on how to prepare your IT 40 09 12 indd IN gov Forms In

If you’re curious about how to generate and submit your IT 40 09 12 indd IN gov Forms In, here are some concise guidelines on how to ease tax declaration.

To start, you simply need to set up your airSlate SignNow account to alter how you handle documents online. airSlate SignNow is an incredibly intuitive and robust document solution that allows you to modify, generate, and finalize your income tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to adjust responses as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to complete your IT 40 09 12 indd IN gov Forms In in no time:

- Create your profile and start editing PDFs in just a few minutes.

- Browse our catalog to obtain any IRS tax document; explore different versions and schedules.

- Click Obtain form to access your IT 40 09 12 indd IN gov Forms In in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Please be aware that submitting on paper can increase return mistakes and delay refunds. It goes without saying, before e-filing your taxes, verify the IRS website for declaration regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 40 09 12indd ingov forms in

FAQs

-

I'm a 12 year old. I ran my mile in 6:38, and my 400m in 1:09. How good is that, and is it healthy for me to train at this age?

Those are average times for a serious runner at your age.Yes, it is fine to train at your age, and in fact I highly encourage it. Join a club if you can. However, take at least one day off per week, and vary your training mixing in easy, moderate, and hard workouts during the week. This is why joining a club with a coaching staff who can supervise your training is important. If you are entering high school, and you will join the school cross-country and track team, the distance coach will guide you in your training. Between seasons, take at about a 2-week break from training. Be sure that your parents invest in a proper pair of running shoes for you. Beg if necessary. It is cheaper to spend $150 on a good pair of shoes than repeated visits to an orthopedic surgeon or podiatrist.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

What percentage is needed in 12 class to apply for the NDA exam?

According to the latest notification ,there is no minimum percentage required in for joining NDA, but you should be pass in all the subjects , in terms of percentage you can take it as 33% . But aim to score a minimum of 80% so you can apply for other fields in the future also.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the it 40 09 12indd ingov forms in

How to generate an electronic signature for your It 40 09 12indd Ingov Forms In online

How to create an eSignature for your It 40 09 12indd Ingov Forms In in Google Chrome

How to generate an electronic signature for putting it on the It 40 09 12indd Ingov Forms In in Gmail

How to generate an eSignature for the It 40 09 12indd Ingov Forms In right from your smartphone

How to generate an eSignature for the It 40 09 12indd Ingov Forms In on iOS

How to make an electronic signature for the It 40 09 12indd Ingov Forms In on Android OS

People also ask

-

What is the IT 40 09 12 indd IN gov Forms In and how does it work?

The IT 40 09 12 indd IN gov Forms In is an official form used for filing state income tax returns in Indiana. With airSlate SignNow, you can easily fill out and eSign this form, streamlining your tax filing process. Our platform ensures you can access the form quickly and securely from anywhere.

-

How can airSlate SignNow help me with IT 40 09 12 indd IN gov Forms In?

airSlate SignNow simplifies your paperwork by allowing you to fill in and eSign the IT 40 09 12 indd IN gov Forms In digitally. This eliminates the need for printing, scanning, or mailing, making your filing process faster and more efficient. Plus, our secure platform guarantees your sensitive information remains protected.

-

What are the pricing options for using airSlate SignNow for IT 40 09 12 indd IN gov Forms In?

airSlate SignNow offers various pricing plans that cater to different business needs, whether you are an individual or a large enterprise. Our plans are cost-effective, starting at an affordable monthly fee, and include access to helpful features for completing IT 40 09 12 indd IN gov Forms In and more. Additionally, a free trial is available to explore all functionalities.

-

Are there any integrations available for airSlate SignNow and IT 40 09 12 indd IN gov Forms In?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms, enhancing your efficiency when handling IT 40 09 12 indd IN gov Forms In. Whether you use CRMs, document storage solutions, or email tools, you can easily connect them to streamline your document management process, making life easier.

-

Is it safe to eSign the IT 40 09 12 indd IN gov Forms In using airSlate SignNow?

Absolutely! airSlate SignNow employs top-notch security features to ensure your eSignatures and documents, including IT 40 09 12 indd IN gov Forms In, are protected. We use encryption and comply with industry standards to ensure your information is safe from unauthorized access.

-

What features does airSlate SignNow offer for completing IT 40 09 12 indd IN gov Forms In?

airSlate SignNow offers a range of features to assist you in completing the IT 40 09 12 indd IN gov Forms In, including customizable templates, form-filling tools, and collaboration options. You can also track document status and receive notifications when the form is signed. These features enhance your overall efficiency.

-

Can I access airSlate SignNow from any device while filling out IT 40 09 12 indd IN gov Forms In?

Yes, airSlate SignNow is compatible with various devices, allowing you to access and complete the IT 40 09 12 indd IN gov Forms In from anywhere at any time. Whether you are using a desktop, tablet, or smartphone, our platform is designed for accessibility and ease of use, ensuring you can manage your documents on-the-go.

Get more for IT 40 09 12 indd IN gov Forms In

Find out other IT 40 09 12 indd IN gov Forms In

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT