File & Pay Washington Department of Revenue 2019

Understanding the Form IT-40

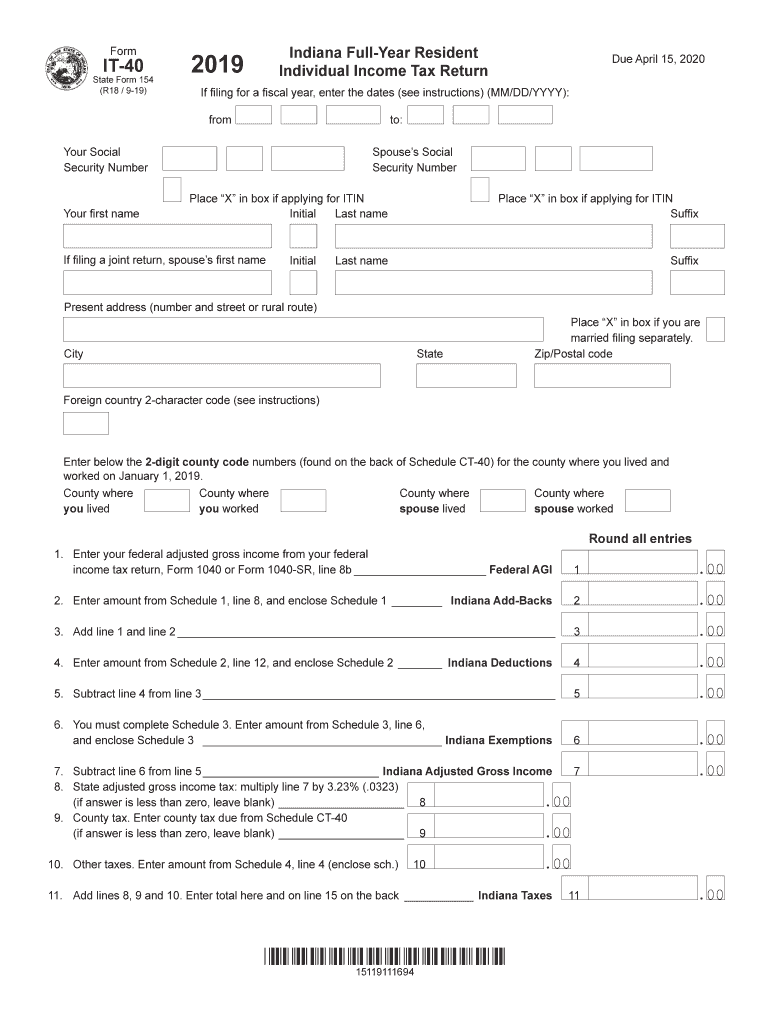

The Form IT-40 is the Indiana Individual Income Tax Return used by residents of Indiana to report their income and calculate their state tax obligations. This form is essential for individuals who earn income in Indiana and need to comply with state tax regulations. It includes sections for reporting various types of income, deductions, and credits available to taxpayers. Understanding the requirements and sections of the IT-40 can help ensure accurate filing and compliance with Indiana tax laws.

Steps to Complete the Form IT-40

Completing the Form IT-40 involves several key steps to ensure accurate reporting and compliance. First, gather all necessary documents, including W-2 forms, 1099 forms, and records of other income. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report your total income, including wages, interest, and dividends. After calculating your total income, apply any deductions or credits you may qualify for. Finally, review your completed form for accuracy before submitting it to the Indiana Department of Revenue.

Required Documents for Form IT-40

To complete the Form IT-40, you will need several documents to accurately report your income and deductions. Essential documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any tax deductions, such as mortgage interest statements

- Receipts for tax credits, such as education expenses

Having these documents ready will facilitate a smoother filing process and help ensure that you do not miss any important information.

Filing Deadlines for Form IT-40

The filing deadline for the Form IT-40 is typically April 15 of each year, coinciding with the federal tax filing deadline. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to file your return on time to avoid penalties and interest on any taxes owed. If you need additional time, you can request an extension, but be aware that this does not extend the time to pay any taxes owed.

Legal Use of Form IT-40

The Form IT-40 is legally binding and must be completed accurately to ensure compliance with Indiana tax laws. It is essential to provide truthful and complete information, as any discrepancies can lead to penalties or audits. The form is designed to meet the legal requirements set forth by the Indiana Department of Revenue, ensuring that taxpayers fulfill their obligations. Using a reliable electronic filing service can help maintain compliance and streamline the submission process.

Penalties for Non-Compliance with Form IT-40

Failure to file the Form IT-40 by the deadline or inaccuracies in reporting can result in significant penalties. Common penalties include:

- Late filing penalties, which can accumulate over time

- Interest on unpaid taxes, calculated from the due date

- Potential audits by the Indiana Department of Revenue

It is crucial to file on time and ensure accuracy to avoid these consequences and maintain good standing with state tax authorities.

Quick guide on how to complete file ampamp pay washington department of revenue

Complete File & Pay Washington Department Of Revenue seamlessly on any platform

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without any delays. Manage File & Pay Washington Department Of Revenue on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to modify and eSign File & Pay Washington Department Of Revenue effortlessly

- Locate File & Pay Washington Department Of Revenue and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to deliver your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to missing or lost files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets all your needs in document management in just a few clicks from your selected device. Alter and eSign File & Pay Washington Department Of Revenue and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct file ampamp pay washington department of revenue

Create this form in 5 minutes!

How to create an eSignature for the file ampamp pay washington department of revenue

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the form it40 used for?

The form it40 is specifically designed for taxpayers in certain states to report income, deductions, and tax credits. Using airSlate SignNow, you can easily fill out and eSign the form it40, streamlining your tax filing process and ensuring compliance with state regulations.

-

How can I prepare the form it40 using airSlate SignNow?

To prepare the form it40 using airSlate SignNow, simply upload the form to the platform, fill in the necessary fields, and add your electronic signature. The user-friendly interface makes it easy to manage your paperwork digitally without the hassle of printing and scanning.

-

Is airSlate SignNow cost-effective for handling the form it40?

Yes, airSlate SignNow offers a cost-effective solution for managing the form it40 compared to traditional methods. With various pricing plans available, businesses can choose the one that best fits their needs while enjoying unlimited eSigning and document management features.

-

What features does airSlate SignNow offer for the form it40?

airSlate SignNow provides several features for the form it40, including easy document editing, secure eSigning, and automatic storage. Additionally, it offers templates and advanced collaboration tools, making it straightforward to share and complete the form with multiple parties.

-

Can I integrate airSlate SignNow with other applications for handling the form it40?

Absolutely! airSlate SignNow integrates seamlessly with various applications like CRM systems, cloud storage platforms, and productivity tools. This integration simplifies the process of generating, sending, and managing the form it40 alongside your other workflows.

-

What benefits does airSlate SignNow provide for users completing the form it40?

By using airSlate SignNow for the form it40, users benefit from increased efficiency, reduced paperwork, and enhanced document security. The platform's electronic signing capabilities speed up the signing process and ensure that all parties can easily access and review the form.

-

Is my data secure when using airSlate SignNow for the form it40?

Yes, your data is secure when using airSlate SignNow for the form it40. The platform employs industry-standard encryption and complies with data protection regulations, ensuring that your sensitive tax information remains safe from unauthorized access.

Get more for File & Pay Washington Department Of Revenue

- Wpf cu 030350 visitation decree dc washington form

- Guardian ad litem minor form

- Wpf ps form

- Wpf ps 010155 010155 declaration of father parentage dclr washington form

- Wpf ps 010160 summons parentage sm washington form

- Washington wpf ps form

- Wpf drpscu 010260 motion declaration for service of summons by publication dclr washington form

- Wpf drpscu 010265 order for service of summons by publication orpub washington form

Find out other File & Pay Washington Department Of Revenue

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online