If Amending 2020

What is the If Amending

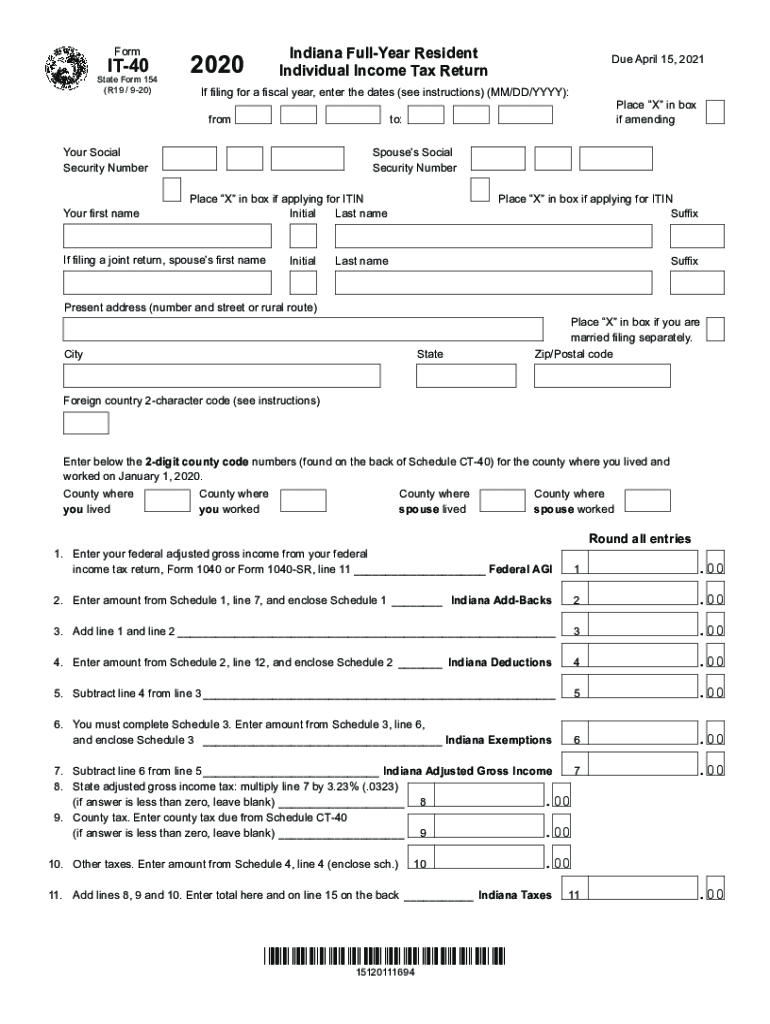

The If Amending refers to the process of modifying a previously filed form IT-40, which is the Indiana individual income tax return. This amendment is necessary when a taxpayer discovers errors or omissions in their original return, such as incorrect income reporting, missed deductions, or changes in filing status. The amended return allows taxpayers to correct these mistakes and ensure compliance with state tax laws.

Steps to complete the If Amending

To successfully complete the If Amending for the Indiana IT-40, follow these steps:

- Obtain the correct amended form, which is the IT-40X, specifically designed for amendments.

- Review your original IT-40 return to identify the necessary changes.

- Fill out the IT-40X form, clearly indicating the adjustments to your income, deductions, or credits.

- Attach any supporting documentation that verifies the changes, such as W-2 forms or receipts.

- Sign and date the amended return to validate it.

- Submit the IT-40X form to the Indiana Department of Revenue either electronically or via mail.

Legal use of the If Amending

The legal use of the If Amending is critical for maintaining compliance with Indiana tax regulations. An amended return must be filed within a specific timeframe, typically within three years from the original filing date or two years from the date the tax was paid, whichever is later. This ensures that taxpayers can correct any discrepancies without facing penalties for non-compliance. It is essential to provide accurate information and necessary documentation to support the amendments made.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the If Amending is crucial to avoid penalties. The general deadline for submitting an amended IT-40 return is three years from the original due date of the return. For example, if the original return was due on April 15, 2019, the amended return must be filed by April 15, 2022. Additionally, if you are expecting a refund from the amendment, it is advisable to file as soon as possible to expedite the processing of your return.

Required Documents

When preparing to file the If Amending, certain documents are necessary to support your changes. These typically include:

- The original IT-40 return that you are amending.

- The completed IT-40X form.

- Any W-2 forms, 1099s, or other income statements that reflect the changes.

- Receipts or documentation for any deductions or credits being claimed.

Form Submission Methods (Online / Mail / In-Person)

There are several methods available for submitting the If Amending to the Indiana Department of Revenue. Taxpayers can file the amended IT-40X form electronically through the state’s online tax portal, which offers a convenient and efficient way to submit. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submissions are generally not available for amended returns, so electronic or mail options are preferred.

Quick guide on how to complete if amending

Manage If Amending seamlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the right template and securely save it online. airSlate SignNow equips you with all the tools you need to draft, modify, and eSign your documents rapidly without setbacks. Handle If Amending on any system with the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign If Amending effortlessly

- Locate If Amending and click Get Form to begin.

- Utilize the tools we offer to fill out your template.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Modify and eSign If Amending and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct if amending

Create this form in 5 minutes!

How to create an eSignature for the if amending

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the form it40 and how does it work with airSlate SignNow?

The form it40 is a specialized document used for certain state tax filings. With airSlate SignNow, you can easily create, send, and eSign the form it40, streamlining your filing process. Our platform ensures that your sensitive information remains secure and accessible.

-

What features does airSlate SignNow offer for the form it40?

AirSlate SignNow provides comprehensive features for the form it40, including customizable templates, eSignature capabilities, and secure storage. These features allow you to efficiently fill out, sign, and manage your documents without the hassle of paper. Additionally, you can track the status of your form it40 in real-time.

-

Is there a cost associated with using airSlate SignNow for the form it40?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Our pricing plans vary, offering flexible options depending on your needs. The investment in airSlate SignNow will save you time and money when managing the form it40.

-

How can I integrate airSlate SignNow with other software for the form it40?

AirSlate SignNow offers seamless integrations with various software, enabling you to automate and enhance the workflow involving the form it40. You can easily connect your favorite tools such as CRMs, document management systems, and more. This integration helps streamline the process and improve efficiency.

-

What are the benefits of using airSlate SignNow for the form it40?

Using airSlate SignNow for the form it40 provides numerous benefits, including reduced processing time, increased accuracy, and improved compliance. Our platform simplifies the signing process, ensuring that your forms are completed quickly and correctly. This results in a more efficient filing experience for tax documents.

-

Can multiple users access and sign the form it40 using airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to access and eSign the form it40 simultaneously. This feature is particularly useful for organizations requiring input from several stakeholders, enabling collaborative document handling. You can manage access rights and ensure a smooth signing experience.

-

Is my data secure when using airSlate SignNow for the form it40?

Yes, your data is secure when you use airSlate SignNow for the form it40. We implement robust security measures, including encryption and secure data storage, to protect sensitive information. You can trust that your documents are safe while being sent, signed, and stored.

Get more for If Amending

Find out other If Amending

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple