it 40 Forms 2018

What is the IT-40 Form?

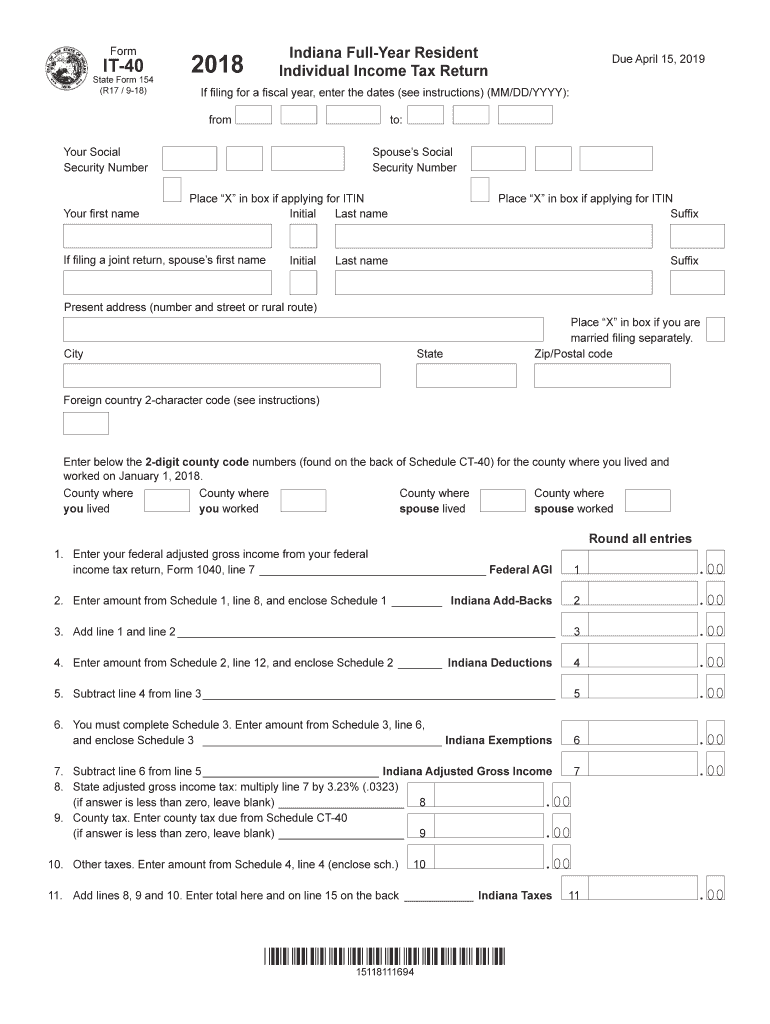

The IT-40 form is the Indiana state income tax return for residents. This form is used by individuals to report their income, calculate their tax liability, and determine any refunds or amounts owed to the state. It is essential for Indiana residents to accurately complete this form to comply with state tax laws. The IT-40 form includes sections for reporting various income types, deductions, and credits that may apply to the taxpayer's situation.

How to Use the IT-40 Form

Using the IT-40 form involves several steps to ensure accurate reporting of income and tax calculations. First, gather all necessary documents, such as W-2s, 1099s, and records of any deductions. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. After completing the form, review it carefully for accuracy. Finally, submit the form to the Indiana Department of Revenue either electronically or by mail, depending on your preference.

Steps to Complete the IT-40 Form

Completing the IT-40 form requires careful attention to detail. Follow these steps:

- Gather all income-related documents, including W-2 and 1099 forms.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources.

- Calculate your deductions, such as standard deductions or itemized deductions.

- Determine any tax credits you may qualify for.

- Calculate your total tax liability and compare it to any withholding or estimated payments made.

- Sign and date the form before submission.

Legal Use of the IT-40 Form

The IT-40 form is legally recognized as the official document for filing state income taxes in Indiana. It must be completed accurately to reflect the taxpayer's financial situation. Submitting false information on the form can result in penalties, including fines or legal action. Therefore, it is crucial to ensure that all information provided is truthful and complete, adhering to Indiana tax laws.

Required Documents for the IT-40 Form

To complete the IT-40 form, taxpayers need several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions, such as mortgage interest or medical expenses

- Proof of tax credits, if applicable

- Any prior year tax returns for reference

Filing Deadlines / Important Dates

Filing deadlines for the IT-40 form are crucial for compliance. Generally, the form is due on April 15 of each year for the previous tax year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of deadlines for making estimated tax payments to avoid penalties.

Quick guide on how to complete enter below the 2 digit county code numbers found on the back of schedule ct 40 for the county where you lived and

Your assistance manual on how to prepare your It 40 Forms

If you’re curious about how to generate and submit your It 40 Forms, here are a few concise guidelines on how to streamline your tax filing process.

To begin, you just need to create your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, draft, and finalize your tax forms with ease. Utilizing its editor, you can switch between text, checkboxes, and electronic signatures while returning to update information as needed. Simplify your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to finalize your It 40 Forms in just a few minutes:

- Establish your account and start working on PDFs within minutes.

- Browse our catalog to obtain any IRS tax form; review various versions and schedules.

- Click Get form to access your It 40 Forms in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any discrepancies.

- Save modifications, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please keep in mind that submitting in writing may lead to increased errors and delayed refunds. It’s essential to verify the IRS website for submission regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct enter below the 2 digit county code numbers found on the back of schedule ct 40 for the county where you lived and

Create this form in 5 minutes!

How to create an eSignature for the enter below the 2 digit county code numbers found on the back of schedule ct 40 for the county where you lived and

How to generate an electronic signature for your Enter Below The 2 Digit County Code Numbers Found On The Back Of Schedule Ct 40 For The County Where You Lived And online

How to make an eSignature for the Enter Below The 2 Digit County Code Numbers Found On The Back Of Schedule Ct 40 For The County Where You Lived And in Google Chrome

How to make an electronic signature for signing the Enter Below The 2 Digit County Code Numbers Found On The Back Of Schedule Ct 40 For The County Where You Lived And in Gmail

How to create an electronic signature for the Enter Below The 2 Digit County Code Numbers Found On The Back Of Schedule Ct 40 For The County Where You Lived And right from your smartphone

How to generate an eSignature for the Enter Below The 2 Digit County Code Numbers Found On The Back Of Schedule Ct 40 For The County Where You Lived And on iOS devices

How to generate an electronic signature for the Enter Below The 2 Digit County Code Numbers Found On The Back Of Schedule Ct 40 For The County Where You Lived And on Android

People also ask

-

What is the form it40 used for?

The form it40 is a crucial document required for filing your New York State income tax. It provides essential information about your income, deductions, and tax credits, helping to determine your tax liability.

-

How can airSlate SignNow help with the form it40?

airSlate SignNow simplifies the process of completing and signing the form it40. With our user-friendly platform, you can easily fill out, eSign, and send the document, ensuring compliance and accuracy in your tax filing.

-

What are the key features of using airSlate SignNow for form it40?

airSlate SignNow offers features like eSignature, document templates, and real-time collaboration to enhance your experience with the form it40. These tools enable you to streamline your workflow and eliminate paper-based processes.

-

Is airSlate SignNow a cost-effective solution for managing form it40?

Yes, airSlate SignNow provides a cost-effective solution for managing the form it40. By reducing printing and mailing costs, businesses can save money while ensuring a secure and efficient way to handle document signing.

-

Can I integrate airSlate SignNow with other software for form it40 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage. This allows users to manage the form it40 efficiently within their existing workflows.

-

How secure is submitting the form it40 through airSlate SignNow?

Submitting the form it40 through airSlate SignNow is highly secure. We implement industry-standard encryption and protection measures to ensure that your sensitive tax information remains confidential.

-

What are the benefits of using airSlate SignNow for the form it40?

Using airSlate SignNow for the form it40 offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced collaboration. These advantages streamline the tax filing process, making it easier for businesses and individuals alike.

Get more for It 40 Forms

- Oklahoma legal last will and testament form for divorced and remarried person with mine yours and ours children

- Speed credit pte ltd form

- Vps sample logic form

- Customer agreement form for new land line telephone connection

- Sea scout quartermaster form

- Fire safety regulations for productions amp events form

- This instrument prepared by name address form

- Magician contract template form

Find out other It 40 Forms

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself