Form Individual Income Tax Return Indiana Full Year 2021

What is the Form Individual Income Tax Return Indiana Full Year

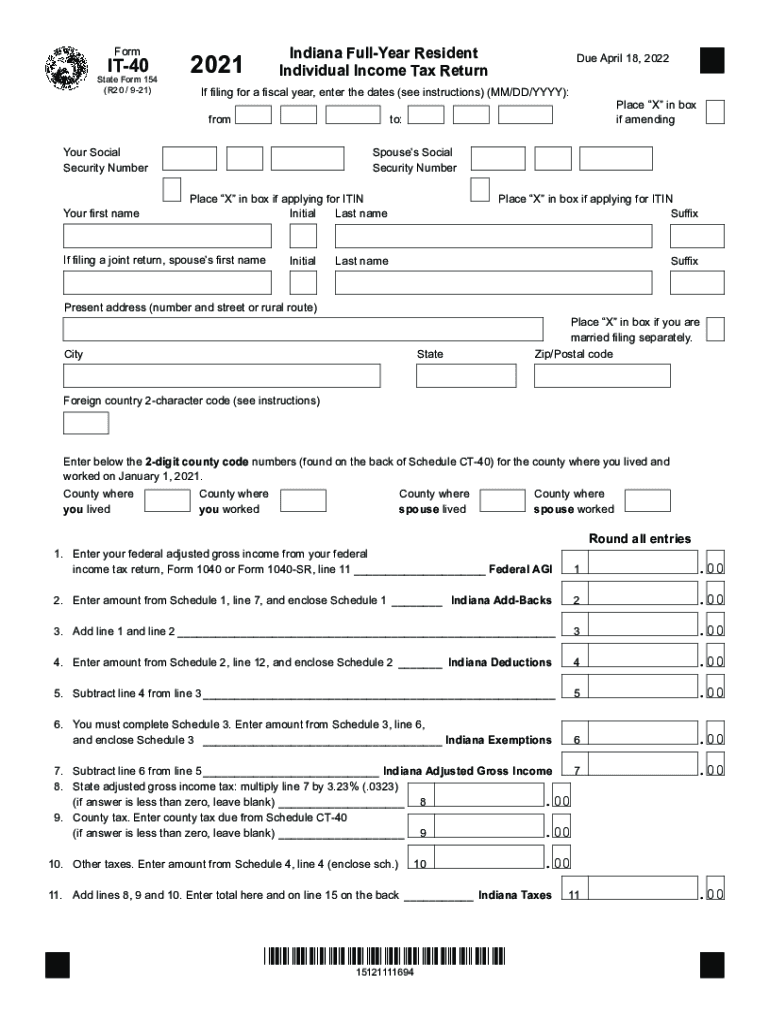

The Form Individual Income Tax Return Indiana Full Year, commonly referred to as the IT-40 form, is a tax document used by Indiana residents to report their annual income to the state. This form is essential for individuals who have earned income during the tax year and need to calculate their state tax liability. The IT-40 form allows taxpayers to claim various deductions and credits, ensuring they pay the correct amount of state income tax based on their earnings and applicable tax laws.

Steps to complete the Form Individual Income Tax Return Indiana Full Year

Completing the IT-40 form involves several key steps to ensure accurate reporting of income and tax obligations. Begin by gathering all necessary documents, such as W-2s, 1099s, and any other income statements. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income by entering amounts from your income statements.

- Claim deductions and credits applicable to your situation, such as standard deductions or specific tax credits.

- Calculate your total tax liability based on the income and deductions reported.

- Determine if you owe additional taxes or if you are due a refund.

- Sign and date the form, certifying that the information provided is accurate.

Legal use of the Form Individual Income Tax Return Indiana Full Year

The IT-40 form is legally recognized as a valid document for reporting income and calculating state tax obligations in Indiana. To ensure its legal standing, taxpayers must follow the guidelines set forth by the Indiana Department of Revenue. This includes accurately reporting income, claiming eligible deductions, and submitting the form by the designated filing deadline. Failure to comply with these legal requirements may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Timely filing of the IT-40 form is crucial to avoid penalties. The standard deadline for submitting the form is typically April 15 of the following year after the tax year ends. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they file any necessary forms to avoid late fees.

Required Documents

To complete the IT-40 form accurately, several documents are required. These include:

- W-2 forms from employers, detailing annual wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Documentation for any deductions or credits claimed, such as receipts for charitable contributions.

- Previous year’s tax return for reference, if applicable.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the IT-40 form. The form can be filed online through the Indiana Department of Revenue's e-filing system, which is a quick and efficient method. Alternatively, taxpayers can print the completed form and mail it to the appropriate address provided by the state. In-person submissions are also accepted at designated tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete form 2021 individual income tax return indiana full year

Complete Form Individual Income Tax Return Indiana Full Year easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents since you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without hindrances. Manage Form Individual Income Tax Return Indiana Full Year on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to adjust and eSign Form Individual Income Tax Return Indiana Full Year effortlessly

- Find Form Individual Income Tax Return Indiana Full Year and click Get Form to begin.

- Use the features we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal significance as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or sharing a link, or download it to your computer.

Eliminate the worry of lost or incorrectly stored files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your needs in document handling with just a few clicks from a device of your choice. Modify and eSign Form Individual Income Tax Return Indiana Full Year and ensure superior communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2021 individual income tax return indiana full year

Create this form in 5 minutes!

How to create an eSignature for the form 2021 individual income tax return indiana full year

The way to create an electronic signature for your PDF in the online mode

The way to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF document on Android OS

People also ask

-

What are IT 40 forms and how can they be used?

IT 40 forms are tax forms used for filing income taxes in various states. With airSlate SignNow, you can easily complete, sign, and send IT 40 forms digitally, ensuring a smooth filing process while maintaining compliance with all regulations.

-

How does airSlate SignNow help with filling out IT 40 forms?

airSlate SignNow simplifies the process of filling out IT 40 forms by providing an intuitive interface where users can easily input their information. Additionally, our platform allows you to save templates for IT 40 forms, making future submissions seamless and efficient.

-

What features make airSlate SignNow ideal for IT 40 forms?

Key features of airSlate SignNow that enhance the handling of IT 40 forms include eSigning, document tracking, and secure storage. These features ensure that your IT 40 forms are not only filled out correctly but also delivered on time with full accountability.

-

Is there a cost associated with using airSlate SignNow for IT 40 forms?

Yes, there is a subscription cost for using airSlate SignNow to manage IT 40 forms, but it is designed to be cost-effective for businesses of all sizes. Our pricing plans offer various levels of service, allowing you to choose the one that best fits your needs.

-

Can I integrate airSlate SignNow with other software for managing IT 40 forms?

Absolutely! airSlate SignNow offers robust integrations with popular software like CRM systems, ERP tools, and cloud storage services. This integration ensures that your IT 40 forms streamline seamlessly with your existing workflows.

-

What security measures does airSlate SignNow have for IT 40 forms?

airSlate SignNow prioritizes security, employing advanced encryption measures to protect your IT 40 forms and confidential information. Our platform is compliant with industry standards, ensuring that your documents are secure and accessible only to authorized users.

-

Are there templates available for IT 40 forms in airSlate SignNow?

Yes, airSlate SignNow provides templates for common IT 40 forms to simplify the process. Users can access, customize, and reuse these templates, making it much easier to manage their tax-related documents.

Get more for Form Individual Income Tax Return Indiana Full Year

Find out other Form Individual Income Tax Return Indiana Full Year

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation