Nyc Att S Corp Form 2016

What is the Nyc Att S Corp Form

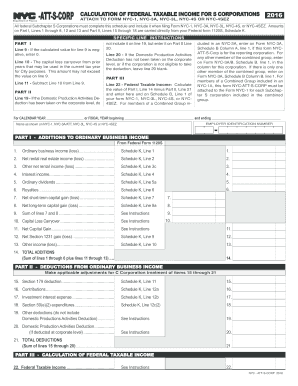

The Nyc Att S Corp Form is a tax document specifically designed for S corporations operating within New York City. This form is essential for businesses that have elected S corporation status under the Internal Revenue Code, allowing them to report income, deductions, and credits accurately. The form ensures compliance with local tax regulations and is a critical component in calculating any taxes owed to the city.

How to use the Nyc Att S Corp Form

To effectively use the Nyc Att S Corp Form, businesses must first gather all necessary financial information, including income statements, balance sheets, and any applicable deductions. The form should be filled out with precise figures and relevant details pertaining to the S corporation's financial activities within the tax year. After completing the form, it is important to review all entries for accuracy before submission to avoid potential penalties.

Steps to complete the Nyc Att S Corp Form

Completing the Nyc Att S Corp Form involves several key steps:

- Gather financial documents, including income and expense records.

- Fill out the form with accurate figures, ensuring all sections are completed.

- Review the completed form for any errors or omissions.

- Sign the form, either digitally or by hand, depending on the submission method.

- Submit the form by the designated deadline to avoid late fees.

Legal use of the Nyc Att S Corp Form

The Nyc Att S Corp Form is legally recognized for reporting purposes in New York City. It must be filed in accordance with local tax laws to ensure compliance. Failure to use this form correctly can result in penalties, including fines and interest on unpaid taxes. Therefore, it is crucial for S corporations to understand the legal implications of this form and to ensure its proper completion and timely submission.

Filing Deadlines / Important Dates

Filing deadlines for the Nyc Att S Corp Form typically align with the federal tax deadlines. S corporations must file their forms by the fifteenth day of the third month following the end of their fiscal year. For those on a calendar year, this means the form is due by March 15. It is essential to stay updated on any changes to these deadlines to avoid late penalties.

Form Submission Methods (Online / Mail / In-Person)

The Nyc Att S Corp Form can be submitted through various methods:

- Online: Many businesses opt to file electronically through approved platforms, which can streamline the process.

- Mail: The form can be printed and sent via postal service to the appropriate tax authority.

- In-Person: Some businesses may choose to deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete nyc att s corp 2016 form

Your assistance manual on how to prepare your Nyc Att S Corp Form

If you’re curious about how to finalize and submit your Nyc Att S Corp Form, here are a few straightforward tips on how to simplify tax declaration.

To begin, you need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly user-friendly and powerful document platform that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to make changes where necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing features.

Follow the instructions below to complete your Nyc Att S Corp Form in just minutes:

- Create your account and start managing PDFs within moments.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Get form to access your Nyc Att S Corp Form in our editor.

- Enter the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and rectify any errors.

- Preserve changes, print your copy, send it to the intended recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Keep in mind that submitting by mail may lead to increased errors and delays in refunds. As always, before e-filing your taxes, review the IRS website for filing regulations specific to your state.

Create this form in 5 minutes or less

Find and fill out the correct nyc att s corp 2016 form

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What is the guidance to fill out a W2 form for an S Corp?

You can fill in the W2 form here W-2 Form: Fillable & Printable IRS Template Online | signNowThe W-2 form is one of the most frequently used forms by taxpayers.

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the nyc att s corp 2016 form

How to create an electronic signature for the Nyc Att S Corp 2016 Form in the online mode

How to make an electronic signature for your Nyc Att S Corp 2016 Form in Chrome

How to make an electronic signature for signing the Nyc Att S Corp 2016 Form in Gmail

How to make an eSignature for the Nyc Att S Corp 2016 Form from your smart phone

How to generate an electronic signature for the Nyc Att S Corp 2016 Form on iOS devices

How to make an electronic signature for the Nyc Att S Corp 2016 Form on Android OS

People also ask

-

What is the NYC ATT S Corp Form and why do I need it?

The NYC ATT S Corp Form is a document required for S corporations operating in New York City to report their income and expenses for tax purposes. Completing this form ensures compliance with local tax regulations, helping your business avoid penalties and fines. It's essential to understand its requirements to avoid any issues with the NYC tax authorities.

-

How can airSlate SignNow assist with filing the NYC ATT S Corp Form?

airSlate SignNow simplifies the process of filling out and eSigning the NYC ATT S Corp Form. Our platform allows you to easily upload, complete, and securely eSign your documents, ensuring that you meet all filing deadlines. This convenient solution saves time and reduces the stress associated with paperwork.

-

What features does airSlate SignNow offer to streamline the NYC ATT S Corp Form process?

airSlate SignNow offers features such as customizable templates, seamless eSignature integration, and document tracking to enhance your experience with the NYC ATT S Corp Form. The platform allows multiple users to collaborate easily and ensures that all parties can eSign documents remotely. This makes the entire process of managing your S Corp documents efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for processing the NYC ATT S Corp Form?

Yes, airSlate SignNow provides a variety of pricing plans designed to meet different business needs. Depending on your usage requirements, you can choose a plan that suits your budget while accessing all necessary features for handling the NYC ATT S Corp Form. Additionally, the investment in our solution can save you time and potential legal costs associated with filing errors.

-

Can I integrate airSlate SignNow with other software to handle the NYC ATT S Corp Form?

Absolutely! airSlate SignNow offers seamless integrations with various business applications such as Google Drive, Dropbox, and CRM systems. This means you can easily manage your documents, including the NYC ATT S Corp Form, within your existing workflow without disrupting your processes.

-

What are the benefits of using airSlate SignNow for my NYC ATT S Corp Form?

Using airSlate SignNow for your NYC ATT S Corp Form provides numerous benefits, including increased efficiency, enhanced security, and compliance assurance. The user-friendly interface simplifies document management and eSigning, allowing you to focus on your business operations instead of paperwork. Our platform also ensures that your documents are safely stored and easily accessible.

-

How does airSlate SignNow ensure the security of my NYC ATT S Corp Form?

airSlate SignNow prioritizes the security of your documents, including the NYC ATT S Corp Form. Our platform uses advanced encryption protocols and secure cloud storage to protect your sensitive information. Additionally, authentication options are available to ensure that only authorized users can access or manage your documents.

Get more for Nyc Att S Corp Form

Find out other Nyc Att S Corp Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors