S Corporation Tax Forms Current Year Tax NY Gov 2022-2026

Understanding the S Corporation Tax Forms for the Current Year

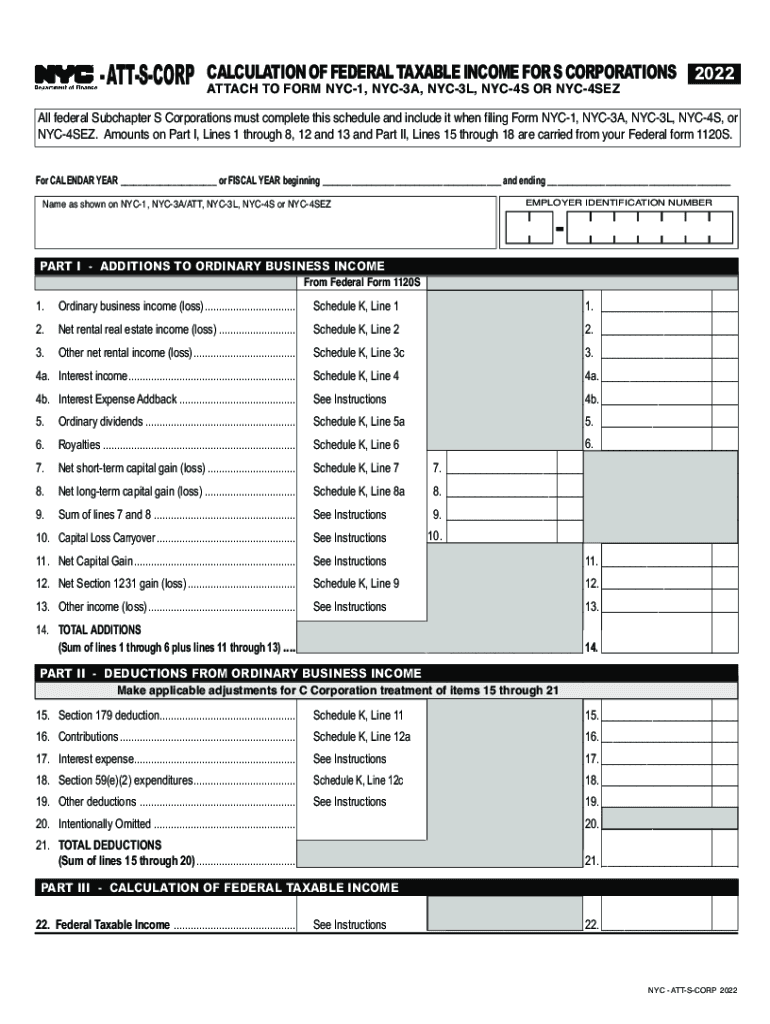

The S Corporation Tax Forms are essential for businesses operating as S corporations in New York City. These forms allow entities to report income, deductions, and credits to the Internal Revenue Service (IRS) and state tax authorities. For the current year, the primary form used is the NYC S Corporation Tax Form, which is tailored to meet specific local requirements. It is crucial for businesses to familiarize themselves with the form's structure, as it includes sections for detailing income, losses, and other financial activities pertinent to the S corporation.

Steps to Complete the S Corporation Tax Forms for the Current Year

Completing the S Corporation Tax Forms involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and previous tax returns. Next, carefully fill out the form, ensuring that all income sources are reported, including any federal income and losses. After completing the form, review it for any errors or omissions. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

Timely filing of the S Corporation Tax Forms is critical for compliance. For most S corporations, the deadline to file is the fifteenth day of the third month following the end of the tax year. For example, if your tax year ends on December thirty-first, the form is due by March fifteenth of the following year. It is advisable to mark these dates on your calendar to ensure that all necessary documentation is prepared and submitted on time.

Required Documents for Filing

When preparing to file the S Corporation Tax Forms, certain documents are essential. These include:

- Income statements reflecting all revenue generated.

- Balance sheets detailing assets and liabilities.

- Records of any distributions made to shareholders.

- Previous year’s tax returns for reference.

- Form W-2 for employees, if applicable.

Having these documents organized will facilitate a smoother filing process.

Legal Use of the S Corporation Tax Forms

The S Corporation Tax Forms must be filled out in accordance with federal and state regulations. Legal compliance ensures that the forms are accepted by tax authorities, which is crucial for maintaining the corporation's standing. Additionally, using electronic signature solutions can enhance the security and validity of the submitted documents, ensuring that they meet all legal requirements for e-signatures.

IRS Guidelines for S Corporations

The IRS provides specific guidelines for S corporations regarding tax filings. These guidelines cover eligibility criteria, income reporting, and the treatment of losses. It is essential for businesses to review these guidelines to ensure compliance and to take advantage of any available tax benefits. Understanding IRS requirements can help prevent costly mistakes during the filing process.

Quick guide on how to complete s corporation tax forms current year taxnygov

Effortlessly prepare S Corporation Tax Forms current Year Tax NY gov on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage S Corporation Tax Forms current Year Tax NY gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to easily edit and eSign S Corporation Tax Forms current Year Tax NY gov

- Find S Corporation Tax Forms current Year Tax NY gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, and mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign S Corporation Tax Forms current Year Tax NY gov and guarantee effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct s corporation tax forms current year taxnygov

Create this form in 5 minutes!

How to create an eSignature for the s corporation tax forms current year taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of NYC income federal tax for businesses using airSlate SignNow?

Understanding NYC income federal tax is crucial for businesses, as it affects their financial operations. With airSlate SignNow, companies can ensure that their document workflows, including tax-related paperwork, are compliant and efficiently handled. This helps businesses maintain accurate records while managing their NYC income federal obligations.

-

How can airSlate SignNow assist with filing NYC income federal tax documents?

airSlate SignNow streamlines the process of preparing and signing NYC income federal tax documents, making it easier for businesses to finalize their submissions. The platform allows users to quickly eSign required forms and send them securely. This increases efficiency and helps ensure all documents are submitted on time.

-

What pricing plans does airSlate SignNow offer for businesses concerned about NYC income federal tax?

airSlate SignNow provides flexible pricing plans tailored to fit the budget of any business, making it a cost-effective solution for handling NYC income federal tax documents. Each plan includes features that simplify document management and eSigning, allowing businesses to choose the level of service that meets their needs without overspending.

-

Are there integrations available with airSlate SignNow to help manage NYC income federal documentation?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software, enabling users to manage their NYC income federal documentation seamlessly. These integrations help simplify workflows, ensuring all necessary documents are stored and shared securely while reducing the risk of errors during filing.

-

What benefits does airSlate SignNow provide when dealing with NYC income federal tax forms?

Using airSlate SignNow for NYC income federal tax forms offers several benefits, such as increased efficiency and improved accuracy. The platform simplifies the eSigning process, which saves time and reduces the likelihood of errors on critical tax documents. This ultimately supports businesses in meeting their tax compliance requirements effortlessly.

-

Is airSlate SignNow secure for handling sensitive NYC income federal tax information?

Absolutely! airSlate SignNow employs the highest security standards to protect sensitive NYC income federal tax information. The platform features encryption, secure cloud storage, and strict access controls, ensuring that all documents remain confidential and safe from unauthorized access.

-

Can I use airSlate SignNow on mobile devices for my NYC income federal tax-related tasks?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to handle your NYC income federal tax tasks anywhere and anytime. The mobile app provides all the features needed to eSign documents, track statuses, and manage your document workflows effectively on the go.

Get more for S Corporation Tax Forms current Year Tax NY gov

Find out other S Corporation Tax Forms current Year Tax NY gov

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form