NYC DoF ATT S CORP Fill Out Tax Template 2021

What is the NYC DoF ATT S Corp Fill Out Tax Template

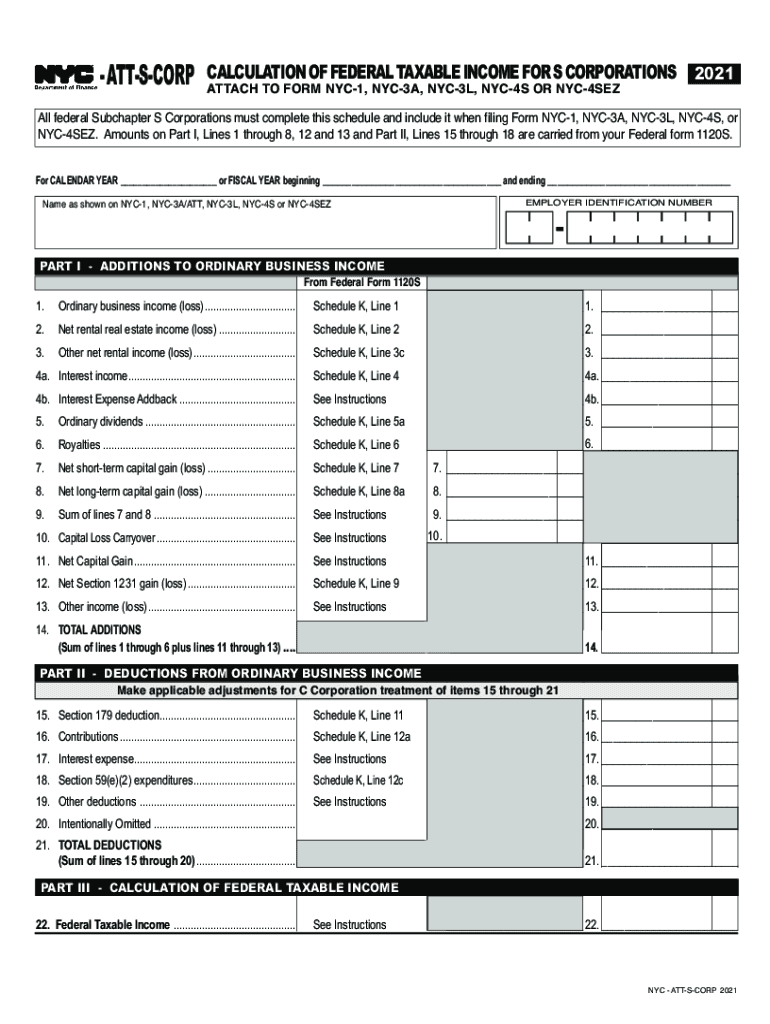

The NYC DoF ATT S Corp Fill Out Tax Template is a specific form used by S corporations operating in New York City to report their income and calculate the necessary taxes. This template is essential for compliance with local tax regulations and helps ensure that businesses accurately report their financial activities. The form captures various financial details, including revenue, expenses, and deductions, which are crucial for determining the corporation's tax liability.

Steps to complete the NYC DoF ATT S Corp Fill Out Tax Template

Completing the NYC DoF ATT S Corp Fill Out Tax Template involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill in the corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Report total income and allowable deductions on the form, ensuring accuracy in calculations.

- Complete any additional sections that may pertain to specific tax credits or adjustments.

- Review the completed form for accuracy and completeness before submission.

Legal use of the NYC DoF ATT S Corp Fill Out Tax Template

The NYC DoF ATT S Corp Fill Out Tax Template is legally binding when completed accurately and submitted in accordance with local regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the New York City Department of Finance. This includes providing truthful information and maintaining proper documentation to support the entries made on the form. Failure to comply with these legal requirements can result in penalties or audits.

Filing Deadlines / Important Dates

It is crucial for S corporations to be aware of the filing deadlines associated with the NYC DoF ATT S Corp Fill Out Tax Template. Generally, the form must be submitted by the due date of the corporation's federal tax return. For most S corporations, this is typically the fifteenth day of the third month following the end of the tax year. However, specific dates may vary, so it is advisable to verify the current year's deadlines with the New York City Department of Finance.

Form Submission Methods (Online / Mail / In-Person)

The NYC DoF ATT S Corp Fill Out Tax Template can be submitted through various methods, providing flexibility for businesses. Options include:

- Online: Submit the form electronically through the NYC Department of Finance website.

- Mail: Send a printed copy of the completed form to the appropriate address designated by the NYC Department of Finance.

- In-Person: Deliver the form directly to a local Department of Finance office for processing.

Required Documents

When completing the NYC DoF ATT S Corp Fill Out Tax Template, several supporting documents are required to ensure accurate reporting. These may include:

- Income statements detailing revenue generated by the corporation.

- Expense reports that outline all business-related costs.

- Prior year tax returns for reference and consistency.

- Any relevant documentation for tax credits or deductions claimed.

Quick guide on how to complete nyc dof att s corp 2020 2022 fill out tax template

Complete NYC DoF ATT S CORP Fill Out Tax Template effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed paperwork, as it allows you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents promptly without holdups. Manage NYC DoF ATT S CORP Fill Out Tax Template on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to modify and eSign NYC DoF ATT S CORP Fill Out Tax Template effortlessly

- Obtain NYC DoF ATT S CORP Fill Out Tax Template and click on Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Highlight pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Modify and eSign NYC DoF ATT S CORP Fill Out Tax Template and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc dof att s corp 2020 2022 fill out tax template

Create this form in 5 minutes!

How to create an eSignature for the nyc dof att s corp 2020 2022 fill out tax template

The best way to generate an e-signature for a PDF document in the online mode

The best way to generate an e-signature for a PDF document in Chrome

How to generate an e-signature for putting it on PDFs in Gmail

The best way to create an e-signature from your mobile device

How to create an e-signature for a PDF document on iOS devices

The best way to create an e-signature for a PDF file on Android devices

People also ask

-

What are the NYC ATT S Corp instructions 2021?

The NYC ATT S Corp instructions 2021 provide guidelines on how to properly file taxes as an S Corporation in New York City. These instructions include details on tax rates, eligibility, required forms, and specific compliance rules that businesses must follow. Familiarizing yourself with these instructions can help ensure your business remains compliant and avoids potential penalties.

-

How can airSlate SignNow assist with NYC ATT S Corp instructions 2021?

airSlate SignNow streamlines the process of managing documents related to your NYC ATT S Corp instructions 2021. With airSlate SignNow, you can easily send, receive, and eSign necessary forms and documents, enhancing your workflow efficiency. Our platform saves time and simplifies compliance management for your S Corporation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans to cater to various business needs. Our plans are designed to be cost-effective, ensuring that you have access to essential tools for managing documents while also addressing inquiries related to NYC ATT S Corp instructions 2021. Explore our pricing page to find a plan that suits your budget.

-

What features does airSlate SignNow offer for S Corporations?

airSlate SignNow provides a range of features tailored for S Corporations, including document templates, eSignature capabilities, and audit trails. These features help streamline processes outlined in the NYC ATT S Corp instructions 2021, making compliance easier. Additionally, our robust security measures ensure your documents are safe and secure.

-

Can airSlate SignNow integrate with other software for managing S Corp documents?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing the management of your S Corp documents. These integrations can assist you in following the NYC ATT S Corp instructions 2021 by ensuring that all your tools work together efficiently. Check out our integration options to find the best fit for your business needs.

-

What benefits does airSlate SignNow provide to businesses following NYC ATT S Corp instructions 2021?

By using airSlate SignNow, businesses can benefit from increased efficiency in eSigning and document management related to NYC ATT S Corp instructions 2021. Our intuitive platform simplifies the workflow, reduces processing time, and helps ensure compliance. These advantages can lead to overall cost savings and improved productivity.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone, regardless of tech-savviness, to use our eSigning features. This approach ensures that even those dealing with NYC ATT S Corp instructions 2021 can navigate the document signing process without difficulty. Access to support resources is also available for any questions.

Get more for NYC DoF ATT S CORP Fill Out Tax Template

Find out other NYC DoF ATT S CORP Fill Out Tax Template

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF