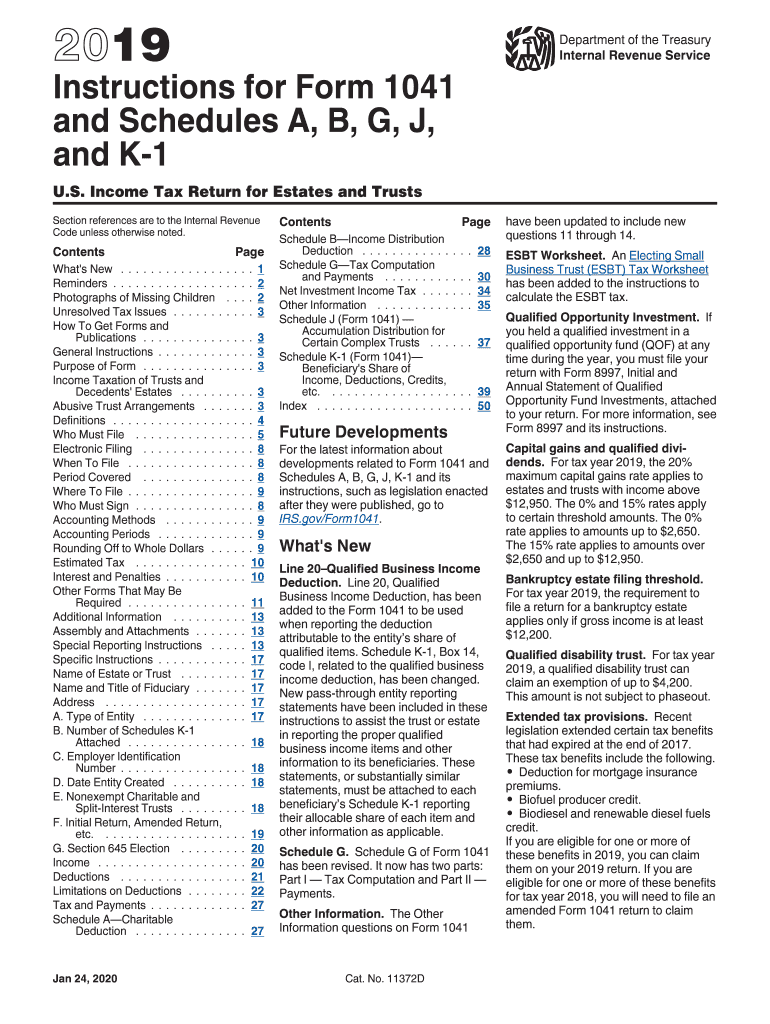

Irs Form 1041 Instructions 2019

What is the IRS Form 1041 Instructions

The IRS Form 1041 instructions provide detailed guidance for fiduciaries of estates and trusts on how to properly complete and file Form 1041, the U.S. Income Tax Return for Estates and Trusts. This form is essential for reporting income, deductions, gains, and losses of estates and trusts. The instructions outline the eligibility criteria, filing requirements, and necessary documentation needed for accurate submission. Understanding these instructions is crucial for compliance with federal tax obligations and to avoid potential penalties.

Steps to Complete the IRS Form 1041 Instructions

Completing the IRS Form 1041 involves several key steps to ensure accuracy and compliance:

- Gather Required Information: Collect all financial documents related to the estate or trust, including income statements, deduction records, and prior tax returns.

- Fill Out the Form: Follow the instructions carefully, entering information in the appropriate sections, such as income, deductions, and tax computation.

- Review for Accuracy: Double-check all entries for accuracy, ensuring that calculations are correct and all necessary information is included.

- Sign and Date the Form: The fiduciary must sign and date the form, certifying that the information provided is true and complete.

- Submit the Form: File the completed form by the due date, either electronically or by mail, depending on your preference and the requirements.

Legal Use of the IRS Form 1041 Instructions

The legal use of the IRS Form 1041 instructions is critical for ensuring that fiduciaries comply with federal tax laws. The instructions provide a framework for accurately reporting income and deductions, which is necessary for avoiding legal issues. Adhering to these guidelines helps in maintaining transparency and accountability in managing the financial affairs of an estate or trust. Failure to follow the instructions can lead to penalties, audits, or other legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for Form 1041 are essential to adhere to in order to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the form is typically due by April fifteenth. In cases where the due date falls on a weekend or holiday, the deadline is extended to the next business day. Understanding these important dates is crucial for timely compliance.

Required Documents

To complete the IRS Form 1041, several documents are necessary:

- Income Statements: Documentation of all income received by the estate or trust, including interest, dividends, and rental income.

- Deductions Records: Receipts and statements for any deductions claimed, such as administrative expenses, charitable contributions, and taxes paid.

- Prior Year Tax Returns: Copies of previous tax returns can provide useful information and context for the current filing.

Form Submission Methods (Online / Mail / In-Person)

Filing the IRS Form 1041 can be done through various methods to accommodate different preferences:

- Online Submission: Many fiduciaries opt to file electronically using approved tax software, which can streamline the process and ensure accuracy.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address, depending on the estate's or trust's location.

- In-Person Submission: While less common, some may choose to deliver the form in person at a local IRS office, although this may require an appointment.

Quick guide on how to complete 2019 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

Effortlessly Complete Irs Form 1041 Instructions on Any Device

Web-based document management has become favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, alter, and digitally sign your documents swiftly and without delays. Manage Irs Form 1041 Instructions on any device using the airSlate SignNow apps for Android or iOS and simplify your document-centric processes today.

How to Modify and Digitally Sign Irs Form 1041 Instructions With Ease

- Find Irs Form 1041 Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal standing as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the time-consuming search for forms, or corrections that require new copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 1041 Instructions and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

How to create an electronic signature for the 2019 Instructions For Form 1041 And Schedules A B G J And K 1 Instructions For Form 1041 And Schedules A B G J And K 1 Us online

How to make an eSignature for your 2019 Instructions For Form 1041 And Schedules A B G J And K 1 Instructions For Form 1041 And Schedules A B G J And K 1 Us in Google Chrome

How to create an electronic signature for putting it on the 2019 Instructions For Form 1041 And Schedules A B G J And K 1 Instructions For Form 1041 And Schedules A B G J And K 1 Us in Gmail

How to make an electronic signature for the 2019 Instructions For Form 1041 And Schedules A B G J And K 1 Instructions For Form 1041 And Schedules A B G J And K 1 Us straight from your mobile device

How to make an eSignature for the 2019 Instructions For Form 1041 And Schedules A B G J And K 1 Instructions For Form 1041 And Schedules A B G J And K 1 Us on iOS

How to make an eSignature for the 2019 Instructions For Form 1041 And Schedules A B G J And K 1 Instructions For Form 1041 And Schedules A B G J And K 1 Us on Android OS

People also ask

-

What are IRS forms 1041 instructions?

IRS forms 1041 instructions provide guidance on how to accurately prepare and file income tax returns for estates and trusts. These instructions cover various aspects, including filing requirements, due dates, and the necessary forms that need to be completed. Understanding these instructions is crucial for ensuring compliance with tax regulations.

-

How can airSlate SignNow help with IRS forms 1041 instructions?

AirSlate SignNow simplifies the document signing process, making it easy to complete and submit IRS forms 1041 instructions. With our platform, you can eSign and send forms securely and quickly, ensuring all tax-related documents are handled efficiently. This helps streamline the filing process for estates and trusts.

-

What features does airSlate SignNow offer for handling IRS forms 1041 instructions?

AirSlate SignNow offers features such as eSignature, document templates, collaboration tools, and secure cloud storage. These functionalities ensure that you can manage IRS forms 1041 instructions effortlessly. Our user-friendly interface allows for quick adaptations and easy access to necessary documents.

-

Is there a cost associated with using airSlate SignNow for IRS forms 1041 instructions?

Yes, airSlate SignNow offers various pricing plans, allowing users to choose one that fits their needs for handling IRS forms 1041 instructions. Our plans are cost-effective and designed to accommodate businesses of all sizes. You can find comprehensive details about our pricing on our website.

-

Are there any integrations available with airSlate SignNow for IRS forms 1041 instructions?

Absolutely! AirSlate SignNow integrates with numerous applications and platforms, facilitating a seamless experience when managing IRS forms 1041 instructions. You can connect with tools such as Google Drive, Salesforce, and Dropbox to enhance your workflow and document management.

-

How secure is the documentation process for IRS forms 1041 instructions with airSlate SignNow?

AirSlate SignNow prioritizes security, using industry-standard encryption to protect your documents, including those related to IRS forms 1041 instructions. We comply with legal and regulatory requirements to ensure that all data remains confidential and secure throughout the signing process.

-

Can I track the status of my IRS forms 1041 instructions with airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your documents, including IRS forms 1041 instructions. You can see when documents are opened, signed, and completed. This transparency keeps you informed and helps streamline your filing process.

Get more for Irs Form 1041 Instructions

Find out other Irs Form 1041 Instructions

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself