990 T 2019

What is the 990-T?

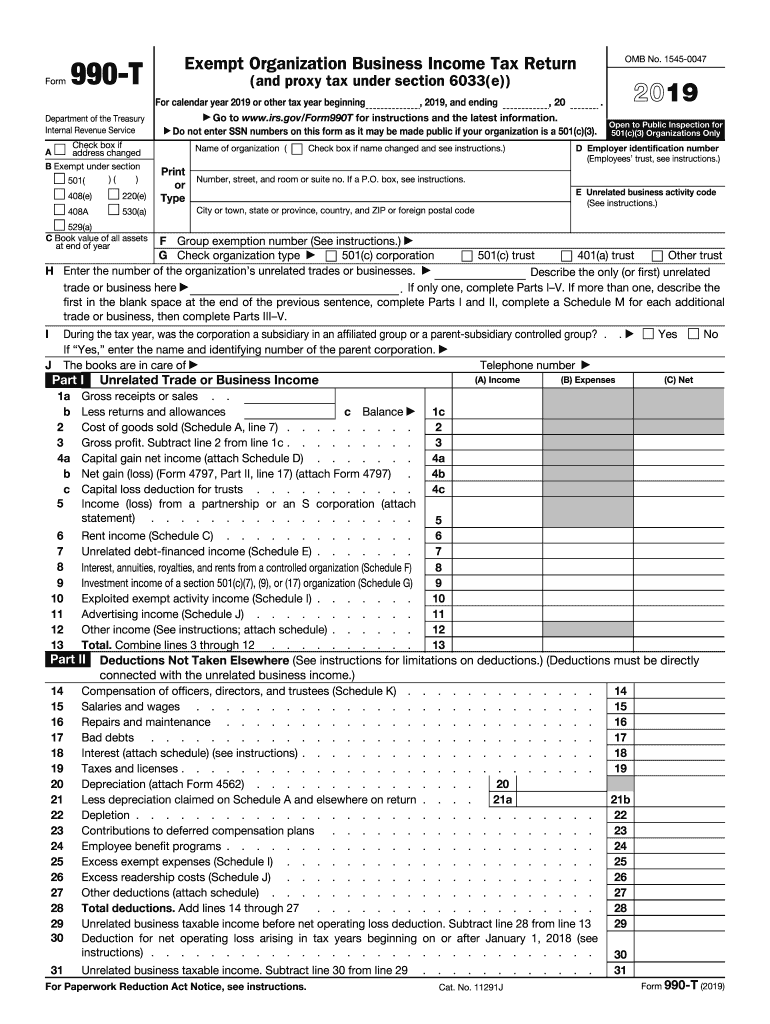

The IRS Form 990-T is a tax form used by tax-exempt organizations to report unrelated business income (UBI). Organizations that generate income through activities not directly related to their exempt purpose must file this form to determine the tax owed on that income. The 990-T is essential for maintaining compliance with IRS regulations while ensuring that tax-exempt entities fulfill their obligations regarding unrelated business activities.

Steps to Complete the 990-T

Completing the IRS Form 990-T involves several key steps:

- Gather Financial Information: Collect all relevant financial data related to your unrelated business activities, including revenue and expenses.

- Identify UBI: Determine which income qualifies as unrelated business income and ensure it meets the IRS criteria.

- Fill Out the Form: Complete the 990-T form accurately, detailing income, expenses, and any applicable deductions.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties.

- Submit the Form: File the completed form with the IRS by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for Form 990-T are crucial for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's tax year. For example, if your tax year ends on December 31, the form must be filed by May 15. Extensions may be available, but they must be requested properly to avoid penalties.

Required Documents

To complete Form 990-T, certain documents are necessary:

- Financial statements detailing income and expenses from unrelated business activities.

- Supporting documentation for any deductions claimed.

- Previous year's tax returns, if applicable, for reference.

Penalties for Non-Compliance

Failure to file Form 990-T or inaccuracies in the submission can result in significant penalties. The IRS may impose fines based on the amount of unpaid tax and the duration of non-compliance. Additionally, organizations risk losing their tax-exempt status if they consistently fail to meet filing requirements.

IRS Guidelines

The IRS provides specific guidelines for completing Form 990-T, including instructions on identifying unrelated business income, allowable deductions, and filing procedures. It is essential to refer to the latest IRS publications and instructions to ensure compliance and accuracy while preparing the form.

Quick guide on how to complete 2019 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Complete 990 T effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary template and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents promptly without any hold-ups. Manage 990 T on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign 990 T effortlessly

- Locate 990 T and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Modify and eSign 990 T ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 990 t exempt organization business income tax return and proxy tax under section 6033e

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 990 t exempt organization business income tax return and proxy tax under section 6033e

How to generate an eSignature for the 2019 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e in the online mode

How to create an eSignature for your 2019 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e in Chrome

How to create an electronic signature for putting it on the 2019 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e in Gmail

How to generate an electronic signature for the 2019 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e from your mobile device

How to generate an electronic signature for the 2019 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e on iOS

How to create an electronic signature for the 2019 Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e on Android

People also ask

-

What are the form 990 t filing requirements for organizations?

The form 990 t filing requirements apply to tax-exempt organizations that have unrelated business income. These organizations must file Form 990-T to report and pay tax on that income. Understanding these requirements is crucial to maintaining compliance and avoiding penalties.

-

How does airSlate SignNow help with form 990 t filing requirements?

airSlate SignNow streamlines the process of preparing and signing documents related to your form 990 T filing requirements. Our platform allows you to eSign forms quickly and securely, ensuring compliance with all necessary regulations. This efficiency saves time and reduces the risk of errors in your filings.

-

What features does airSlate SignNow offer for managing form 990 t filings?

airSlate SignNow offers features like document templates, automated workflows, and compliance tracking to help manage your form 990 T filings. These tools simplify document preparation and allow for easy collaboration with team members. With real-time updates, you’ll stay informed about your filing statuses.

-

Are there any pricing options for organizations needing assistance with form 990 t filing requirements?

Yes, airSlate SignNow offers flexible pricing plans tailored to meet the needs of various organizations, including those focused on form 990 T filing requirements. We understand that each organization has unique needs, so we provide a range of options to help you find the best fit. Additionally, our cost-effective solutions help manage budgets effectively.

-

What are the benefits of using airSlate SignNow for form 990 t filings?

Using airSlate SignNow for your form 990 T filings provides key benefits such as enhanced efficiency, security, and ease of use. Our platform ensures that documents are securely signed and stored, minimizing the risk of document loss. Furthermore, our user-friendly interface makes it easy for anyone to manage their filings without extensive training.

-

Can I integrate airSlate SignNow with other tools for form 990 t filing requirements?

Absolutely! airSlate SignNow can be integrated with various popular tools and software to help streamline your form 990 T filing requirements. These integrations enhance productivity by allowing seamless data transfer and collaboration across your existing workflows. You can connect with accounting software, project management tools, and more.

-

What customer support options are available for form 990 t filing requirements?

airSlate SignNow provides excellent customer support for all users, particularly those dealing with form 990 T filing requirements. Our knowledgeable support team is available to answer questions, provide guidance, and assist with any technical issues you may encounter. We offer multiple support channels, ensuring you're never alone in the process.

Get more for 990 T

- Horse bill of sale pdf form

- Bill of sale for horse form

- Bill of sale1doc form

- Contract for sale of puppy form

- Bill of sale for a manufactured home mobile home investing mobilehomeinvesting form

- School registration emergency card corona norco form

- Va form 27 2008 veterans benefits administration vba va

- Court order birth form

Find out other 990 T

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement